Since 2011, the number of existing single-family homes for sale has declined more than 30%. At the same time, we’ve seen an unprecedented increase in home prices.

This is why when we think about affordability, we focus on how to expand the supply of homes. By supplying more homes that are affordable, the housing industry can increase homeownership rates for everyone.

To explore how America can create the right kind of supply for today’s market, we first examined the attitudes and preferences of prospective homebuyers. Putting aside the yet unknown long-term effects of COVID-19, a healthy housing market needs to grow by providing opportunities for all generations, from Gen Z to seniors.

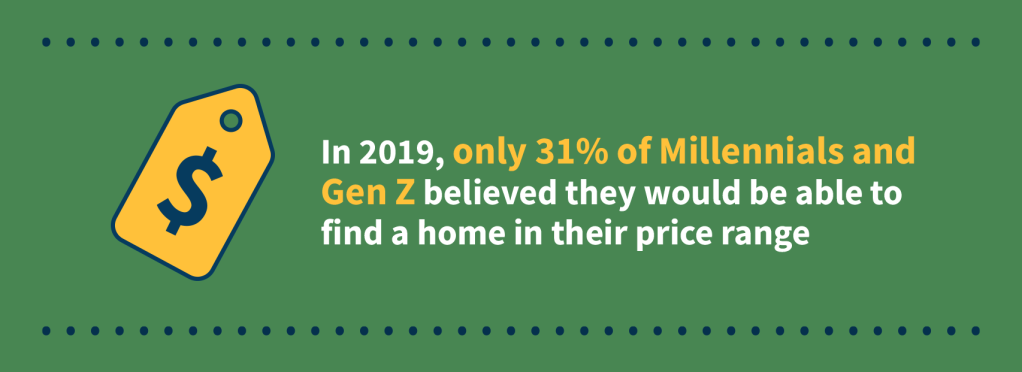

We focused our recent research on two younger generations—Millennials and Gen Z—that have reached or are approaching prime first-time homebuying age. According to our research, 88% of survey respondents in these generations are both excited and confident they will one day be homeowners. And according to MetroStudy, in 2018, 70% of Millennial survey participants planned to purchase a home in the next 12 months.

As Candace Taylor writes in The Wall Street Journal, “These days, buyers eschew the large, ornate houses built in [previous] years in favor of smaller, more-modern looking alternatives.” Recent Fannie Mae research found that 69% say they are open to a smaller home as long as it meets their needs. However, new construction trends do not reflect this changing preference. According to Habitat for Humanity, only 22% of homes built in 2018 were less than 1,800 square feet, down from an average of 32% from 1999-2011.

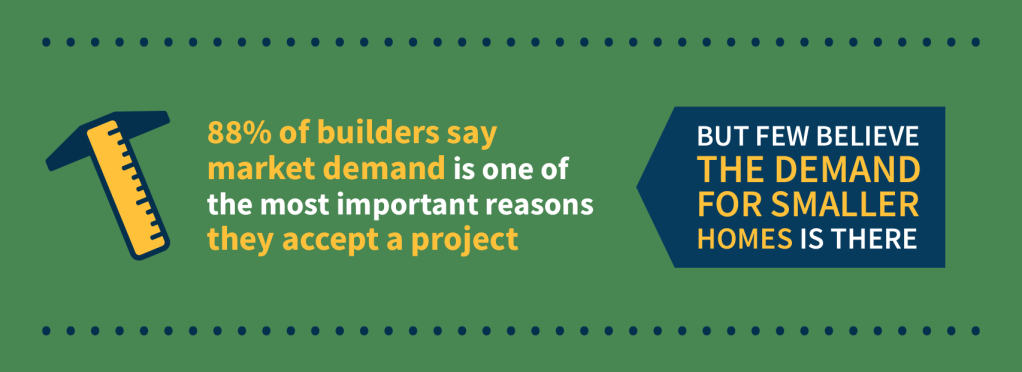

Of builders surveyed, 88% say market demand is one of the most important reasons to accept or begin a project, but there is no consensus about where the demand truly lies. Only 44% of builders believe there is a strong demand for smaller homes, while nearly the same amount (43%) say demand is average, and 12% say it’s weak.

The reasons for this gap in perception need to be better understood if the market is to keep up with changing demand.

That’s why we believe data and insights are the keys to alleviating misperceptions and creating better alignment. With a more comprehensive picture, the entire industry can work together to meet the housing needs of every generation while sustainably increasing the supply of affordable homes.

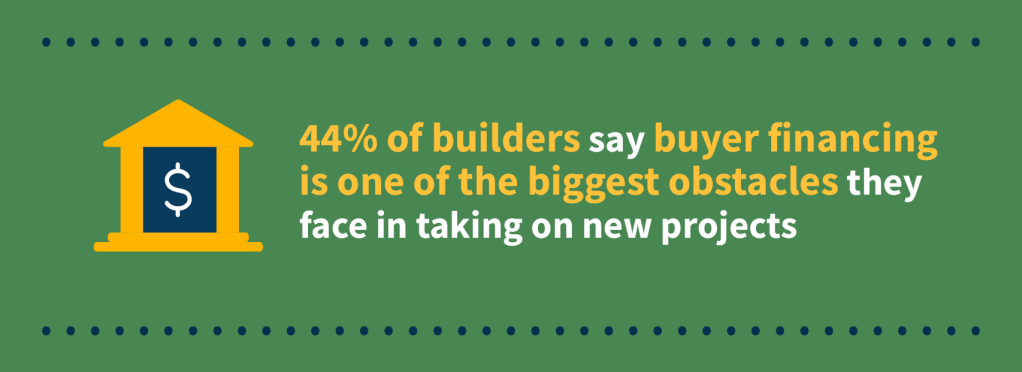

Another major factor affecting the creation of affordable homes is access to credit for prospective homebuyers. Of builders surveyed, 44% say that buyers’ ability to qualify for a loan is one of the biggest obstacles for taking on a new project. And 71% say that interested buyers are often unable to secure financing.

Fannie Mae, in collaboration with industry partners, is working to not only bridge the gap between demand and supply but create and test new solutions to increase access to financing for qualified homebuyers at every life stage.

For low-income and rural homebuyers, Fannie Mae is exploring and implementing various strategic initiatives as part of their Duty to Serve plan. Through this program, Fannie Mae is increasing loan purchases in high-needs rural regions, including purchases from small financial institutions, which provides more liquidity and can lower mortgage costs in underserved areas. And through MH Advantage, conventional mortgage financing is available for manufactured homes with features similar to those of site-built homes.

Visit FannieMae.com/Affordable and read more about our approach for making housing more affordable. See our infographic to learn more about bridging the affordable supply gap.

Sources: Fannie Mae, “Future Homebuyers,” Single-Family Strategy & Insights unpublished research (November 2019). | Fannie Mae, “Builders,” Single-Family Strategy & Insights unpublished research (December 2019). | Hayward, “Affordable Housing Crisis Demands Renewed Focus on Housing Supply,” Fannie Mae Perspectives (March 2019). | MetroStudy, “Activating the Millennial New-Home Buyer,” (January 2016). | Taylor, “A Growing Problem in Real Estate: Too Many Too Big Houses,” The Wall Street Journal (March 21, 2019). | Evangelou, “Wage Versus Home Price Growth,” National Association of Realtors (March 2019). | Hickey, “2019 State of the Nation’s Housing Report: Lack of Affordable Housing,” Habitat For Humanity (2019).