The European Commission (EC) approved the legal and capital restructuring plan of UK mortgage lender Northern Rock, a move already praised by Her Majesty’s Treasury as a way to strengthen the firm’s standing in the mortgage market. Northern Rock, once the fifth-largest UK lender, ran into capital woes when the UK securitization market dried up, depriving the bank of its main funding source, according to the EC. The bank came into UK government control in February 2008. The bank will be split under terms of the restructuring into a ‘good bank’ that will continue economic activities and a ‘bad bank’ that will run down the remaining assets. Ultimately, the EC intends the restructuring to restore long-term viability to the ‘good bank,’ which will eventually be sold to a third party, and allow for the orderly liquidation of the ‘bad bank.’ The UK government’s financial support to Northern Rock includes recapitalization measures of up to £3bn (US$4.9bn), liquidity measures of up to £27bn and guarantees covering several billions of pounds in liabilities. “The failure of Northern Rock would have had major detrimental effects on the UK mortgage market and the overall financial stability of the UK economy,” said European Commissioner for Competition Neelie Kroes in a statement Wednesday. “Important structural changes, including the split of the bank into two entities and a significant reduction of its market presence will allow the bank to become viable in the long-term and limit distortions of competition.” Kroes added: “This decision demonstrates once again that the EU’s state aid rules provide an appropriate framework to allow state support for a sustainable restructuring of banks without giving individual banks an unfair competitive advantage.” HM Treasury said Northern Rock’s restructuring will bolster its capital position and support its return to the UK mortgage market. The back book of mortgages will be managed separately from Northern Rock’s other business segments under the terms of the restructuring. “The Government has made clear that it wants to see a well functioning mortgage market with responsible lending and access to a wide range of affordable mortgages,” HM Treasury said in a statement Wednesday. “The approach towards Northern Rock is part of meeting these aims.” Write to Diana Golobay.

EC Bails Out UK Mortgage Lender Northern Rock

Most Popular Articles

Latest Articles

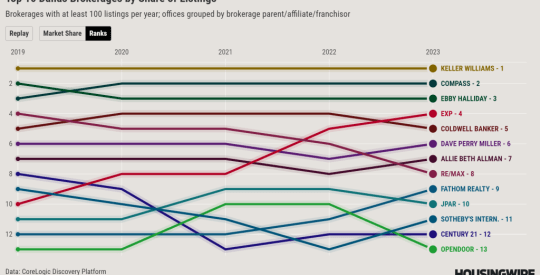

Special report: The brokerages gaining or losing market share in Dallas

Few cities have benefited as much from the trend of Americans moving south as Dallas, which added 170,000 residents in 2021 and 2022.

-

Technology’s role in rental property investment market

-

Best real estate continuing education schools for quick and easy license renewal in 2024

-

CoStar Group finds success through the sale of Homes.com memberships

-

Kevin Sears pulls back the curtain on NAR’s commission lawsuit settlement

-

A look back at HousingWire’s 2023 Marketing Leaders