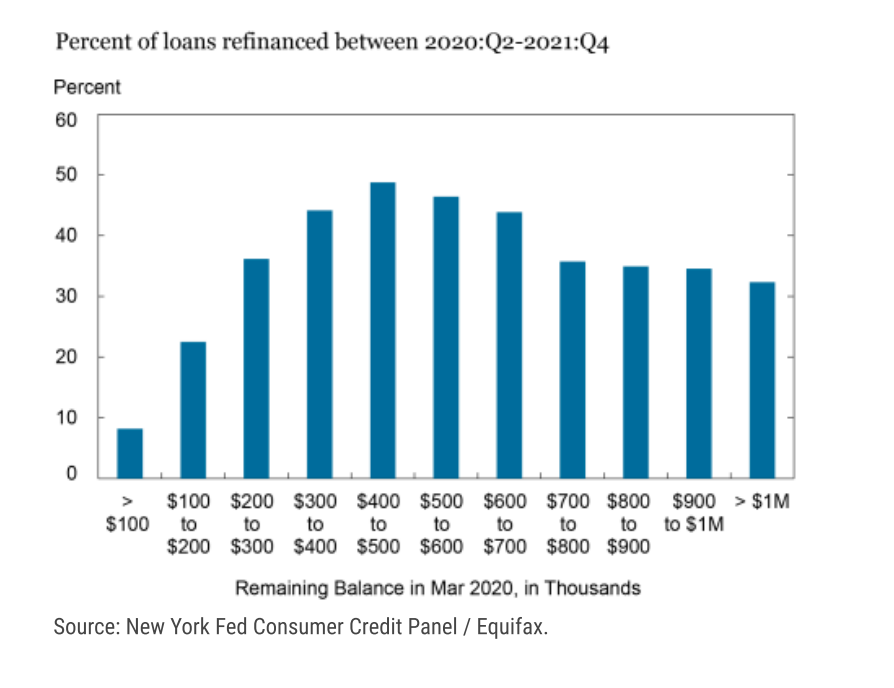

Incentivized by a 200 basis point decline in mortgage rates, 14 million homeowners in America refinanced their mortgages between the second quarter of 2020 and the fourth quarter of 2021, according to a recent research report by the New York Fed.

Approximately 5 million homeowners extracted $430 billion in home equity from their cash-out refinancings ($81,000 on average), while 9 million received a rate-term refi and shaved more than $200 on average from their monthly mortgage payments.

All told, approximately one-third of outstanding mortgage balances got refinanced during the refi boom, and an additional 17% of mortgages outstanding were refreshed through home sales, the New York Fed found.

In other words, 50% of homeowners with a mortgage in America have little financial incentive to sell. They’re actually disincentivized given that they’d face a housing market where home prices are 36% higher than they were pre-pandemic and the cost of financing is up significantly.

It seems increasingly likely that the COVID refi boom will prove to be the most consequential event in housing in modern American history. It reset the board. Mortgage lenders were so successful at refinancing their own customers that they have a hugely diminished customer base just two years later. Some lenders won’t survive. Real estate brokerages have a related problem — transaction volume is down. Way down. Their bread-and-butter move-up customers can’t make the math work and/or are reluctant to give up what they’ve got.

Take my wife’s cousin Christopher, for example. Christopher and his spouse bought a townhouse in Charlotte, North Carolina, in 2021 and scored a mortgage rate in the 2.8% range. They want to start a family soon and would like more space and yard, but feel stuck. They don’t want to give up that mortgage rate. Although they could rent out the townhouse and make a profit, it wouldn’t be enough to offset the cost of a new home in the suburbs.

At this point, Christopher is waiting until a major life event happens or the market becomes much more favorable.

A lot of households are in this sort of holding pattern. In a recent survey by Realtor.com, 82% of 1,200 potential sellers felt “locked in” by their currently low mortgage rate.

So where do housing pros turn? There’s always the first-time homebuyers who are ready to take the leap. And a proportion of people will move for new jobs, divorce, death of a spouse, etc. But the fact that most home sellers also need to buy at the same time complicates matters and will suppress transaction volume until affordability improves.

The medium-term answer may rest with the boomers (since they have all the money). In that aforementioned Realtor.com survey of potential sellers, more than half of those who identified themselves as boomers said they did not feel “locked in” by their current mortgage rate. (It’s worth noting that 87% of Gen Xers said they did feel locked in, but one-third said they planned to sell anyway, perhaps because they have lower debt levels.)

A related potential target is the roughly 40% of households that don’t have a mortgage and own their property “free and clear,” according to Census Bureau data. This group tends to be older and must plan out their final chapter in life. That might mean moving to be closer to family and downsizing, extracting equity from their home to pay for age-in-place upgrades (HELOCs and reverse mortgages), or finding a more affordable lifestyle in a cheaper area. If we’re going to see inventory unlocked, this is one segment it will have to come from.

Where do you think existing home inventory will come from? And when? Share your thoughts with me at [email protected].

In our weekly DataDigest newsletter, HW Media Managing Editor James Kleimann breaks down the biggest stories in housing through a data lens. Sign up here! Have a subject in mind? Email him at [email protected].