The lowest mortgage rates ever occurred around Thanksgiving 2012, when the interest rate for a 30-year fixed-rate mortgage fell to 3.31% (according to Freddie Mac data). However, rising panic over the coronavirus could drive rates to lows never seen before.

The signs of record lows for mortgage rates are already emerging, with the yield on the benchmark 10-year U.S. Treasury note falling to its lowest level ever during Tuesday’s trading.

In fact, several lenders told HousingWire Tuesday that they have never seen borrowers get mortgage rates as low as they are getting right now.

So, what’s behind the potential record lows for interest rates? Blame the coronavirus.

Federal Reserve Vice Chair Richard Clarida said Tuesday that it’s “still too soon to even speculate” about the economic impact of the coronavirus, but investors don’t seem to agree. And investors (and the rates of return they’re willing to accept) are the true determining factor for mortgage rates.

When investors get nervous about the state of the global economy, they tend to seek out U.S. bonds. That leads to increased competition for those bonds, which drives down yields. This is already happening with Treasury notes.

And that increased competition for bonds, including mortgage-backed securities, means that investors have to accept lower returns, which results in lower mortgage rates.

Case in point: the yield on the benchmark 10-year U.S. Treasury note fell to a record low during Tuesday’s trading, indicating that investors are already concerned about the impact of the coronavirus.

The 10-year Treasury tends to act as a loose benchmark for mortgage rates, and that means that mortgage rates could soon fall even lower than they already are.

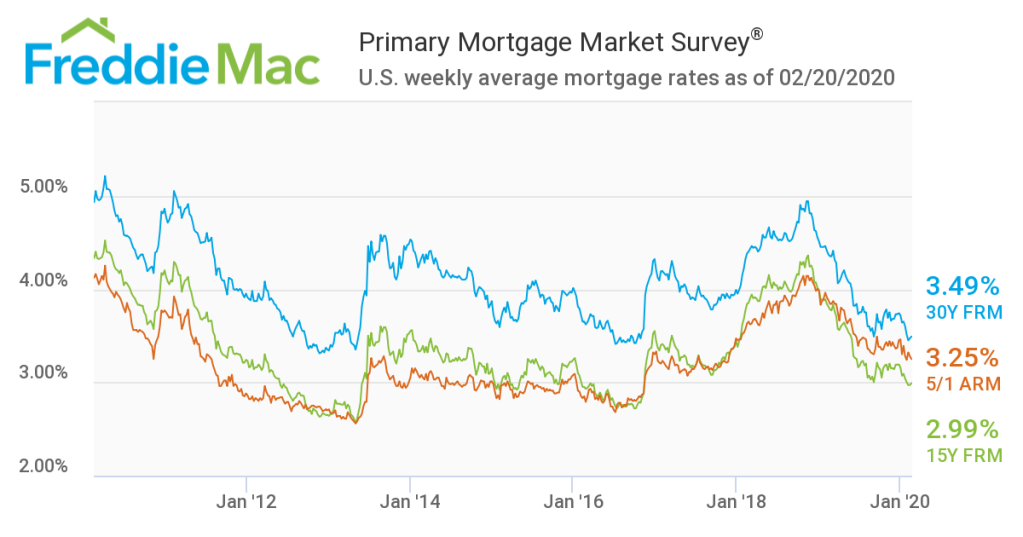

The latest data from Freddie Mac showed that the average U.S. fixed rate for a 30-year mortgage was 3.49% last week, up slightly from the previous week’s rate of 3.47%.

But both of those rates are only slightly higher than the all-time low, which happened in November 2012.

Freddie Mac’s interest rate data updates once a week on Thursdays, so we’ll get a good look at just how far rates have fallen industrywide on Thursday, but HousingWire’s mortgage rates center, which tracks actual rate lock transactions, shows that rates have fallen by more than 10 basis points in the last few days.

HousingWire’s mortgage rate center widget, which is based on rate locks for all borrowers of all credit scores in Optimal Blue’s loan origination software, typically displays rates that are roughly 20 basis points above the Freddie Mac data, as the Freddie Mac report provides the rates for borrowers with the best credit.

As of Tuesday afternoon, the Optimal Blue data places the average 30-year mortgage rate at 3.55%. Subtract the typical 20 basis point difference from the Freddie Mac data, and we’re likely to see the Freddie Mac report show mortgage rates in the 3.3% range on Thursday.

That would likely place rates very near the all-time low, perhaps even touching the all-time low.

But some observers suggest that interest rates may not actually fall much lower than they are right now.

In a note sent to clients Tuesday, analysts from Capital Economics suggested that mortgage rates are “unlikely to hit record lows” despite the falling Treasury yield.

“A flight to safety and belief that the Fed will cut rates have driven the 10-year Treasury yield to record lows. But we doubt the 30-year mortgage rate will follow suit,” Capital Economics stated. “Stretched lender capacity and increased caution will act to widen the spread against the 10-year yield.”

And that means that mortgage rates may fall into the 3.4% range, but not to the lows seen in 2012.

“Circumstances today are very different to the situation back then (in 2012), when the spread between the 10-year yield and 30-year mortgage rate was narrowing,” Capital Economics wrote. “By contrast, we suspect the mortgage interest spread will widen over the next couple of weeks. That would echo what happened in July 2016 and September last year, when a wider spread meant a drop in the Treasury yield failed to fully translate into lower mortgage rates.”

According to Capital Economics, the circumstances that prevented a historic drop in mortgage rates in September are still in place today, namely surging refinancing demand that is already stretching lenders’ capacity and reducing their incentive to cut rates.

Beyond that, Capital Economics states that “increasing lender caution” means that lenders may not be willing to “aggressively compete” for business.

“After all, Treasury yields are falling due to concerns that the coronavirus will hit the economic outlook. Alongside stretched home prices, that suggests lenders will demand a wider spread when making loans,” Capital Economics stated. “Indeed, even before the latest drop in yields, banks had been gradually tightening standards on the belief that the housing market was reaching a cyclical peak.”

Therefore, Capital Economics expects the spread between the 10-year Treasury and the prevailing mortgage rate to begin to widen over the next several weeks, meaning that rates may still fall but not to record lows.

Then again, multiple lenders told HousingWire Tuesday that the rates they’re able to give borrowers right now are lower than they’ve ever seen before.

Either way, mortgage rates are likely to touch levels not seen in eight years. And perhaps to lows we’ve never seen before.