The Ontario Teachers’ Pension Plan is announcing a definitive agreement to acquire American International Group‘s, (AIG) Canadian mortgage insurance business, known as AIG United Guaranty Mortgage Insurance Company Canada (d.b.a United Guaranty Canada). The Teachers’ Private Capital group, the investment arm of the Ontario Teachers, makes up the lead sponsor of the deal, though exact terms are not disclosed. The Ontario-based private equity firm’s investment muscle has grown substantially since 1992 and all through the recession. “We believe the mortgage insurance industry in Canada to be an attractive market, and that United Guaranty Canada is well positioned to grow its market position,” said Erol Uzumeri, Senior Vice-President, Teachers’ Private Capital in a statement. “The company has a strong management team, and Teachers’ is prepared to support the growth of the business.” United Guaranty Canada is headquartered in Toronto, and is the second largest private mortgage insurance provider in Canada with assets of C$274m ($263.5m) and total equity of C$127m as of September 30, 2009. The Ontario Teachers’ Pension Plan is an independent corporation responsible for investing the fund and administering the pensions of Ontario’s 284,000 active and retired teachers. The company holds investments with other insurers, such as Alexander Forbes Limited, South Africa’s leading insurance broker, asset multi-manager and financial services company and Glenstone Capital is one of the most successful commercial insurance companies in Canada. The company offers commercial and industrial insurance in Canada through its wholly owned subsidiary, GCAN Insurance. AIG recently re-branded its asset management and investment advisory business as PineBridge Investments as part of a transition into an independent operations. AIG currently owes the government $85bn in loans it began to receive from the US government in September 2008. It continues to wind down its assets in order to make good on the debt. Write to Jacob Gaffney. Disclosure: the author holds no relevant investments.

AIG Sells Mortgage Insurance Arm to Canadian Teacher’s Fund

Most Popular Articles

Latest Articles

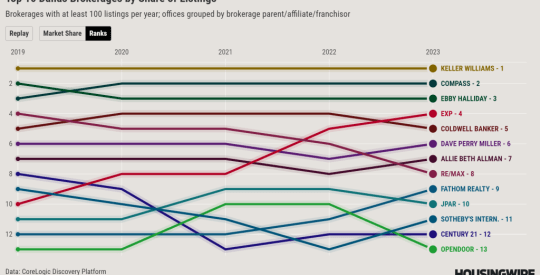

Special report: The brokerages gaining or losing market share in Dallas

Few cities have benefited as much from the trend of Americans moving south as Dallas, which added 170,000 residents in 2021 and 2022.

-

Technology’s role in rental property investment market

-

Best real estate continuing education schools for quick and easy license renewal in 2024

-

CoStar Group finds success through the sale of Homes.com memberships

-

Kevin Sears pulls back the curtain on NAR’s commission lawsuit settlement

-

A look back at HousingWire’s 2023 Marketing Leaders