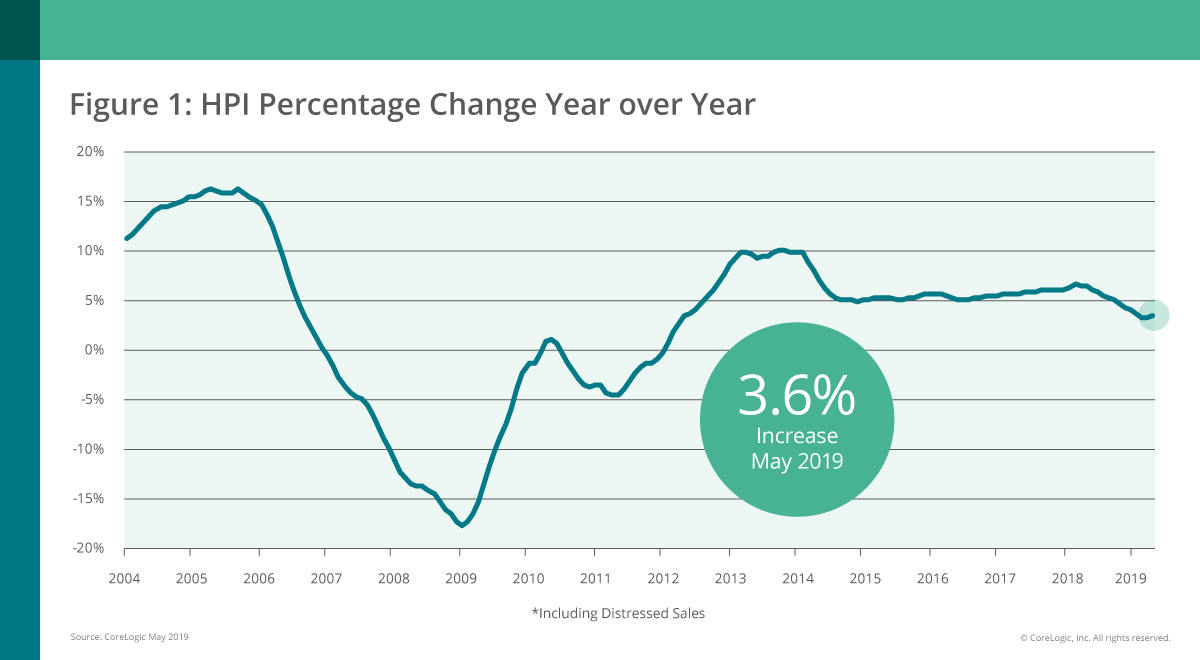

After 14 months of slowing home-price gains, the pace of growth finally picked up speed in May, increasing by 3.6% on an annual basis, according to the latest from CoreLogic.

And, it seems things may pick up steam, with CoreLogic’s forecast predicting home prices will rise 5.6% by May next year.

On a month-over-month basis, home prices rose 0.9% in May, with the forecast predicting a 0.8% increase in June. That would bring single-family home prices to an all-time high, CoreLogic said.

On a month-over-month basis, home prices rose 0.9% in May, with the forecast predicting a 0.8% increase in June. That would bring single-family home prices to an all-time high, CoreLogic said.

Around the country, home-price growth varied, with Idaho showing the greatest jump at 10.7%, while North Dakota came in last with a 1.7% decline. (See CoreLogic’s chart of home-price growth by state; click to enlarge.)

“Interest rates on fixed-rate mortgages fell by nearly one percentage point between November 2018 and this May,” said Dr. Frank Nothaft, chief economist at CoreLogic. “This has been a shot-in-the-arm for home sales. Sales gained momentum in May and annual home-price growth accelerated for the first time since March 2018.”

A recent CoreLogic survey revealed the dual nature of rising home prices, as it can be both a benefit and a drawback.

According to the homeowners surveyed, 28% said they were concerned they would be unable to afford the purchase of a new home. And, 40% of homeowners who are thinking of selling said they’d have to move outside of their current market to afford another home.

“The recent and forecasted acceleration in home prices is a good and bad thing at the same time,” said Frank Martell, president and CEO of CoreLogic. “Higher prices and a lack of affordable homes are two of the most challenging issues in housing today, and every buyer, seller and industry participant is being impacted. The long-term solution lies in expanding supply, which will require aggressive and effective collaboration between policy makers, state and local government entities and home builders.”