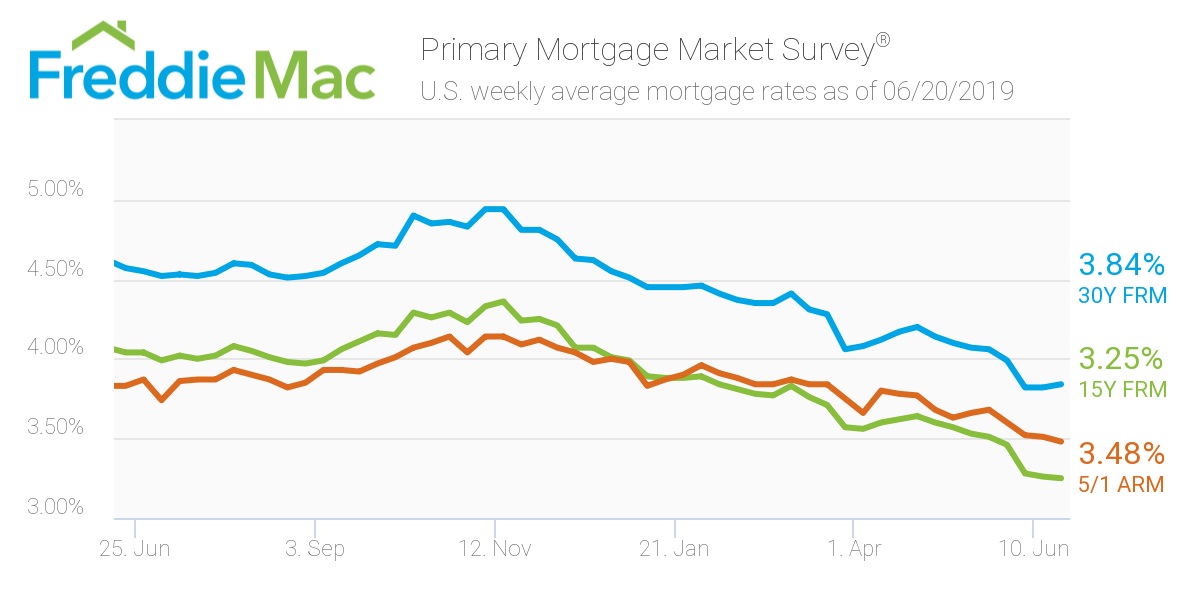

The average U.S. rate for a 30-year fixed mortgage rose two basis points this week from a two-year low, according to the latest Freddie Mac Primary Mortgage Market Survey.

The rate was 3.84%, compared with last week’s 3.82%. A year ago, the rate sat significantly higher at 4.57%.

“While the continued drop in mortgage rates has paused, homebuyer demand has not. This is evident in increased purchase activity and loan amounts, indicating that homebuyers still have the willingness and capacity to purchase homes,” Freddie Mac Chief Economist Sam Khater said. “Today’s low rates, strong job market, solid wage growth and consumer confidence are typically important drivers of home sales.”

The 15-year FRM averaged 3.25% this week, sliding from last week’s 3.26%. This time last year, the 15-year FRM came in at 4.04%.

Lastly, the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.48%, retreating from last week’s rate of 3.51%. Once again, this rate is much lower than the same time period in 2018 when it averaged 3.83%.

The image below highlights this week’s changes: