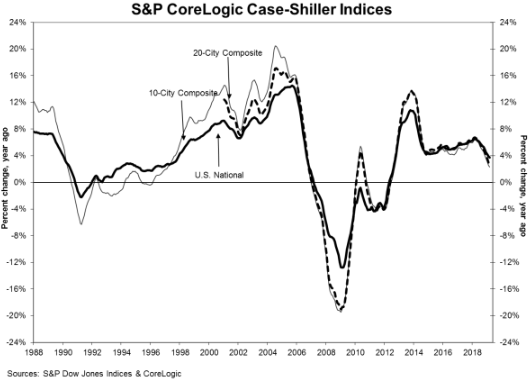

In March, annual home-price gains continued to slow across the nation, according to the latest Case-Shiller Home Price Index from S&P Dow Jones Indices and CoreLogic.

Home prices in March increased 3.7% nationwide from a year ago, sliding from the 4% annualized gain in the previous month's report.

The graph below highlights the average home prices within the 10-City and 20-City Composites.

(Click to enlarge)

Before seasonal adjustment, the National Index decreased 0.6% month over month in March. The 10-City Composite and the 20-City Composite both posted 0.7% month-over-month increases.

After seasonal adjustment, the National Index recorded a month-over-month gain of 0.3% in March. Additionally, the 10-City Composite and the 20-City Composite posted also posted 0.1% month-over-month increases.

The 10-City and 20-City composites reported a 2.3% and 2.7% year-over-year increase for the month, respectively. Before seasonal adjustment, 19 of 20 cities reported increases, while 14 of 20 cities reported increases after the seasonal adjustment.

S&P Dow Jones Indices Managing Director and Chairman of the Index Committee David Blitzer said given the broader economic picture, housing should be doing better.

“Mortgage rates are at 4% for a 30-year fixed rate loan, unemployment is close to a 50-year low, low inflation and moderate increases in real incomes would be expected to support a strong housing market,” Blitzer said. “Measures of household debt service do not reveal any problems and consumer sentiment surveys are upbeat.”

So, what could be responsible for the housing market’s cool down? Blitzer said he suspects the difficulty facing housing may be home prices that are too high.

“At the currently lower pace of home price increases, prices are rising almost twice as fast as inflation: in the last 12 months, the S&P Corelogic Case-Shiller National Index is up 3.7%, double the 1.9% inflation rate,” Blitzer continued. “Measured in real, inflation-adjusted terms, home prices today are rising at a 1.8% annual rate. This compares to a 1.2% real annual price increases in housing since 1975.”

Additionally, Blitzer notes that regional housing trends are changing, especially as previously thriving housing markets depreciate.

“The shift to smaller price increases is broad-based and not limited to one or two cities where large price increases collapsed,” Blitzer said. “Other housing statistics tell a similar story.”

According to the report, Las Vegas, Phoenix and Tampa continue to report the highest year-over-year gains among all of the 20 cities.

In March, Las Vegas led with a 8.2% year-over-year price increase, followed by Phoenix with a 6.1% increase and Tampa with a 5.3% increase. Only four of the 20 cities reported larger price increases in the year ending March 2019 versus the year ending February 2019.

“The patterns seen in the last year or more continue: year-over-year price gains in most cities are consistently shrinking. Double-digit annual gains have vanished. The largest annual gain was 8.2% in Las Vegas; one year ago, Seattle had a 13% gain,” Blitzer said. “In this report, Seattle prices are up only 1.6%. The 20-City Composite dropped from 6.7% to 2.7% annual gains over the last year as well.”