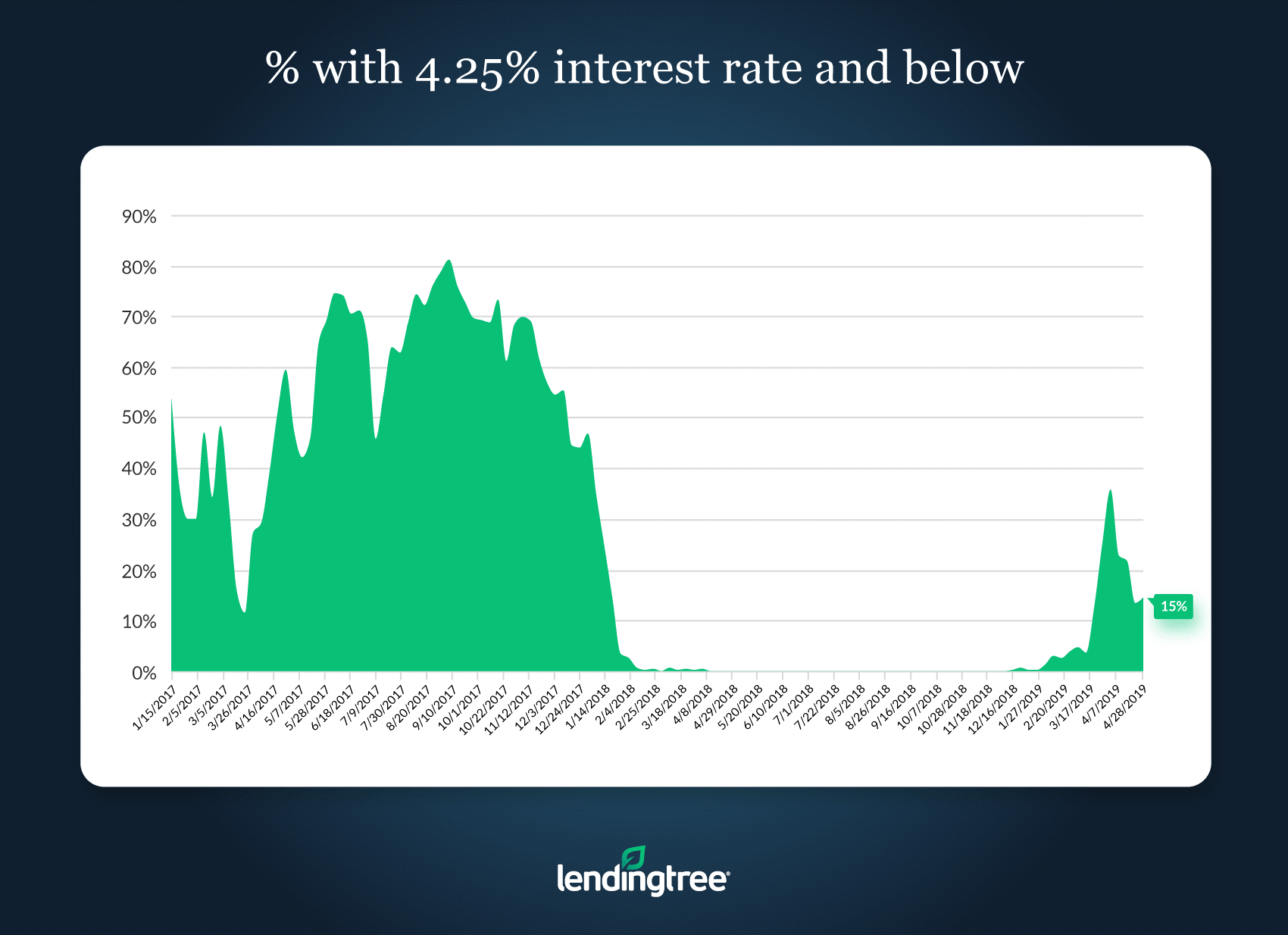

According to LendingTree's Mortgage Rate Competition Index, borrowers with rates under 5% nearly reached 15% for the week ending April 28, 2019.

The report states that for 30-year fixed-rate mortgages, only 14.95% of purchase borrowers received offers under 4.25%, rising from 13.8% last week. Notably, at this time last year no purchase offers were under 4.25%.

(Click to enlarge; Source: LendingTree)

Additionally, across all 30-year, fixed-rate mortgage purchase applications made on LendingTree’s website, 16.28% of borrowers were offered an interest rate of 4.625%, making it the most common interest rate.

When it came to 30-year fixed-rate mortgage refinance borrowers, 19.8% received offers under 4.25%, holding steady from the previous week. Once again, no purchase offers were listed under 4.25% at this time last year.

Across all 30-year, fixed-rate mortgage refinance applications, the most common interest rate was 4.5%. This rate was offered to 20.6% of borrowers, according to the report.

LendingTree also reports that across all 30-year fixed-rate mortgage purchase applications on its site, the index edged up 2 basis points from the previous week, coming in at 0.89. This means that over 30 years, the average borrower could have saved $41,842 on a $300,000 loan.

Lastly, with a wider refinance market index of 0.94, the typical refinance borrowers could have saved $44,353 by shopping for the lowest rate.

NOTE: The LendingTree Mortgage Rate Competition Index measures the spread in the APR of the best offers available on its website.