Multifamily lenders are required by the Home Mortgage Disclosures Act to report data to regulators on the number of units in a property, including the number if rent-restricted units.

But the Consumer Financial Protection Bureau doesn’t share all of this data with the public, disclosing only vague ranges of unit totals and representing income-restriction units as a percentage of the total.

The Urban Institute said the vague reporting of HDMA data is a roadblock that prevents analysts from understanding how well a lender is serving its community.

The problem is particularly poignant in multifamily lending, the institute asserts, because these lenders are more concentrated in individual communities, with one lender making a disproportionate amount of loans in a single area.

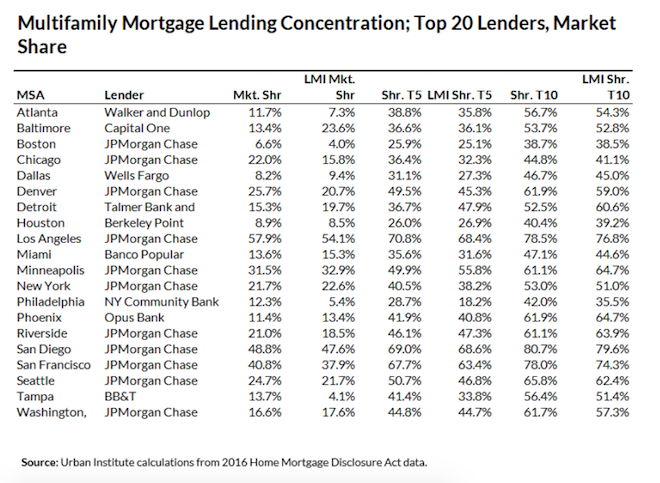

The researchers point out that JPMorgan Chase is the largest multifamily lender with 18.8% total market share nationwide, including 20.3% market share of low- to moderate-income lending. But otherwise, the rest of the market is relatively dispersed, with various lenders dominating specific MSAs (see chart below).

It is this concentration, which is far more distinct in the multifamily sector, that makes the need for expanded reporting so crucial, the researchers say.

Without a clear picture of how, exactly, these lenders are contributing to providing opportunities for low- and moderate-income borrowers, it’s hard to assess what can be done to help community reinvestment in areas that need it most.

“It is critical that these lenders play as important a role in LMI lending as they do in overall lending,” the Urban institute states. “The new HMDA data can give the market better information on the number of units – particularly income-restricted units – being created in LMI areas.”

“Making bank activities more transparent without imposing incremental regulatory burden isn’t easy, but publicly disseminating the new HMDA multifamily data would do just that,” it concludes. “Why not use this information fully to promote transparency on multifamily [Community Reinvestment Act] activity?”