In 2012, a few short years after the financial crisis turned the American housing economy upside down, the legendary Warren Buffett told CNBC, “If I had a way of buying a couple hundred thousand single-family homes and if I had a way of managing them…, I would load up on them.”

Buffett’s opinion represented the mainstream view at the time. The multifamily industry had undergone widespread institutionalization during the 1980s and 1990s, but single-family homes represented a much more daunting investment and property management challenge: unlike apartments, it’s impossible to fit hundreds of houses in a single building, making maintenance, leasing, resident turnover and the like at best difficult, at worst prohibitively expensive.

But something else had also changed since the 1980s: new technology had disrupted every aspect of American life. Cloud computing altered every corner of corporate America and superpowered businesses’ ability to analyze and serve their customers. Smartphones put the internet in the pocket of millions of Americans. Social media networks changed the way we interact with each other and learn about the world.

“Technology…made significant advance ments over the prior five to 10 years to permit the substantial flow of information over the internet and the development of app-based consumer technology,” American Homes 4 Rent CEO Dave Singelyn said about technology’s impact on single-family rental’s growth. “We recognized this consumer technology would enable us to streamline our operations in ways that would benefit both our residents and our company.”

ments over the prior five to 10 years to permit the substantial flow of information over the internet and the development of app-based consumer technology,” American Homes 4 Rent CEO Dave Singelyn said about technology’s impact on single-family rental’s growth. “We recognized this consumer technology would enable us to streamline our operations in ways that would benefit both our residents and our company.”

Technology did not make single-family rentals themselves possible. On the contrary, the sector has been an ever-present part of the American housing economy, historically dominated by small investors who kept just a few additional properties as investments. Even today, less than 2% of all single-family rental homes are institutionally owned.

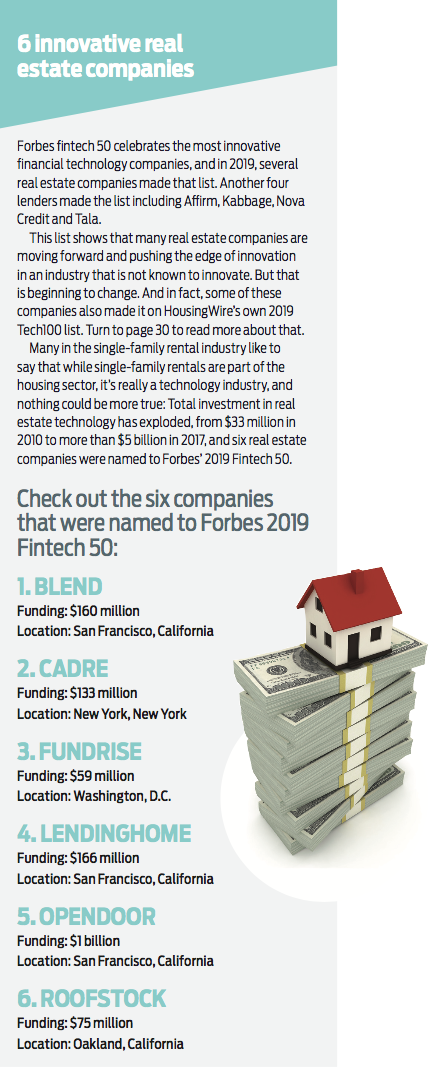

But many in the single-family rental industry like to say that while single-family rentals are part of the housing sector, it’s really a technology industry, and nothing could be more true: Total investment in real estate technology has exploded, from $33 million in 2010 to more than $5 billion in 2017, and six real estate companies were named to Forbes’ 2019 Fintech 50.

From owners of just one or two homes to large firms with hundreds or thousands of properties, disruptive technological innovations have shaped the growth of the industry and improved the renter experience for countless American families.

Unlocking the SFR business model

Just two decades ago, the core challenge of single-family rental — how to acquire and manage enough homes to turn a profit — was essentially unsolvable.

Take property management, for example. There is perhaps nothing more important to an owner-operator of a rental property than ensuring a positive renter experience. Without it, occupancy rates fall and the company must undergo the much more expensive and laborious process of finding a new resident.

In an apartment building, a single property manager or staff can manage a single building with hundreds of units, or even a few buildings in the same neighborhood. It’s nearly impossible to do the same for a collection of homes spread out across an entire metropolitan area.

For single-family rental, necessity became the mother of invention. Today’s most innovative single-family rental owner-operators have redefined the system from top to bottom, establishing what is essentially a mobile maintenance shop, deploying a fleet of vans across an entire market using a digital inventory management system and route optimization software. From the moment a maintenance request — which can now be made online thanks to new platforms and the omnipresence of internet-connected devices — comes in, it is slotted seamlessly into this network.

On the acquisitions side, independent investment platforms, like Roofstock, have significantly lowered the barrier to entry for small and large investors alike. Mom-and-pop investors remain the vast majority of the single-family rental industry, and many of these technological advances, from greater access to data to  modern property management solutions, have benefitted them as much as anyone. In a sign of SFR’s close ties to the tech sector, Roofstock, which is headquartered in Silicon Valley, recently hired a former Tesla executive to serve in a senior operations role.

modern property management solutions, have benefitted them as much as anyone. In a sign of SFR’s close ties to the tech sector, Roofstock, which is headquartered in Silicon Valley, recently hired a former Tesla executive to serve in a senior operations role.

What’s more, investors now have a wealth of data at their fingertips when evaluating a home for purchase: whether other homes in similarly situated neighborhoods have historically increased in value; how long residents in that neighborhood typically stay in their homes; the desirability of the local schools and parks, and countless other pieces of information that shape the home-buying calculus. Rather than poring through public records or having to decide based on instinct, today’s investor can look at a home listing and, with the snap of a finger, determine whether it is likely to be a financially viable rental property. And when they make the decision to buy, today’s owner-operators can make an offer within hours of a home hitting the multiple listing service.

Disrupting the renter experience – for the better

From showing to move-out, every part of the experience of renting a single-family home has been reshaped by the innovations of the past two decades. Even better, many of these disruptive changes are “win-win” improvements that make managing the property more financially viable while also offering a best-in-class experience to the renter.

Self-showing lockboxes make it so that a property manager no longer has to be present for a prospective renter to evaluate a home. This frees up the property manager to work on higher-value tasks, while rather than taking a scripted tour, the prospective renter can take their time and look closely at the parts of the home that interest them the most. The renter can then apply to live in the home, pay a security deposit and sign their lease, all using their smartphone.

“Last year, like many of our SFR peers, Progress Residential implemented self-showing technology, allowing prospective residents to view a home without  having to be accompanied by a leasing associate,” said Dana Hamilton, Pretium Partners head of real estate. “Today, Progress is building out a suite of tools to improve that self-showing experience, integrating video, QR codes and voice recognition technology in order to deliver customers the information they need where and when they need it most.”

having to be accompanied by a leasing associate,” said Dana Hamilton, Pretium Partners head of real estate. “Today, Progress is building out a suite of tools to improve that self-showing experience, integrating video, QR codes and voice recognition technology in order to deliver customers the information they need where and when they need it most.”

Once the renter has moved in, smart home technology like Amazon’s Alexa or Nest thermostats have revolutionized how Americans interact with their homes, and many of today’s SFR owner-operators offer these and others to their residents. And rather than having to chase down a far-flung landlord, online maintenance requests make it simple for residents to get any issues fixed in a timely fashion.

In yet another “win-win,” increased connectedness and the Internet of Things allow property managers to solve problems before the resident even knows about them. Using connected devices like water leak sensors or open door sensors, owner-operators can deploy their staff proactively, increasing efficiency and the satisfaction of a resident who is not inconvenienced by an issue with the home.

“At the end of the day, I firmly believe there is an intersection between serving our residents and meeting our business goals – both can be done,” Tricon American Homes President Kevin Baldridge said. “Doing good is good for business and I’d love our industry to be known for that.”

Finally, during worst-case scenarios like natural disasters, it is invaluable for owner-operators to be able to tap their technology networks to mobilize their staff and vendors in response and reliably contact their residents. In the face of 2017’s unprecedented hurricane season, which hit states like Texas and Florida where single-family rental has a significant presence, the industry came together to support each other and their residents.

“During the aftermath of Harvey and Irma, all of the large operators were able to use their multi-regional resources and relationships with national vendors to very quickly respond to the damage left behind by the massive storms,” Baldridge said.

“In addition to the swift response, we decided early on to accommodate our impacted residents by giving them the option to move to other unaffected homes, hotels or let them out of lease if they desired,” he said. “Late fees were waived, and we worked with residents on lease payment timing.”

Changing housing for a changing world

Lastly, the ways in which technology shapes the world around us — the way we work, live and play — have fundamentally altered American society, with massive implications for many of today’s pressing questions of housing affordability.

Telework, which is increasingly prevalent thanks to widespread internet access and video conferencing technology, may enable more Americans to relocate to less tight housing markets while retaining their desirable job. Home-sharing platforms like Airbnb and VRBO are shifting perceptions of rentership and rental income. Technology companies like Microsoft have pledged resources toward housing affordability, in recognition of the fact that the tech sector is inextricably linked with these challenges.

Critics have argued that not every problem is one of technology, and they’re right about that. The fundamental challenge of housing affordability in the U.S. is one of too little supply and too much demand, and only policy changes to allow more building can bring costs down in a sustainable way.

But by embracing the latest innovations, from homebuilding to the renter experience, we can put many of the country’s — and the world’s — smartest minds to work building a housing economy that works for all Americans.

SFR’s tech-driven future

Even as technology has already dramatically revolutionized single-family rental, disruptive new technologies are coming on line every day that continue to improve the experience for both the renter and the owner-operator of the home.

What’s most exciting about the current era of SFR, then, is how much more is left to be disrupted. Perhaps one day a prospective resident will be able to tour their dream rental home using a virtual reality headset, or artificial intelligence will enable property managers to predict and fix maintenance problems before they even happen.

“I am most excited to see how technology can continue to help the SFR sector mature, both for institutional and individual investors. The advent of cloud and mobile computing, as well as the emergence of AI and machine learning, provide potential to improve service, drive down costs, and increase accessibility to the sector for investors of all shapes and sizes,” Roofstock CEO Gary Beasley said. “I fundamentally believe in the attractiveness of U.S. housing as an investment, and over the next four years am confident we will see more investors getting exposure to SFR, whether through REITs, private funds, direct ownership or fractionalized interests.”

Another exciting recent trend in SFR is build-to-rent. With housing prices having risen significantly from their post-crisis lows, many owner-operators today are partnering with home builders to develop new rental housing from the ground up, diversifying the industry and providing the market with desperately needed units of new supply. And even this new segment of the industry is being reshaped by technology, as innovations from drones to 3D printers change homebuilding, and easy accessibility of data allows owner-operators to decide where they can build rental homes to best meet rising demand. With less than 2% of the $3.1 trillion single-family rental asset class institutionally-owned, compared to 55% of multifamily, there’s plenty of room to innovate and grow.

“Most of today’s challenges are really future opportunities,” Singelyn said. “Over the past five years, the processes by which this industry has historically been managed have significantly changed. As a result, our customer service to prospective and current residents has not only improved but also created efficiency for landlords. While much has changed and improved over the past five years, much more needs to be done to continue these improvements and enhance the consistency of our execution.”

The way Americans work, live and play is changing, and the rental housing industry will change with it. But the skepticism of SFR’s early days has given way to widespread perceptions of a healthy and growing asset class, with the tech-driven property management model at the forefront. If SFR has proven anything over the past few years, it’s that a little disruption can go a long way.