After taking out market-related losses due to interest rate and spread volatility, Freddie Mac reported an income of $1.5 billion in the fourth quarter of 2018 and $8.6 billion for the full year.

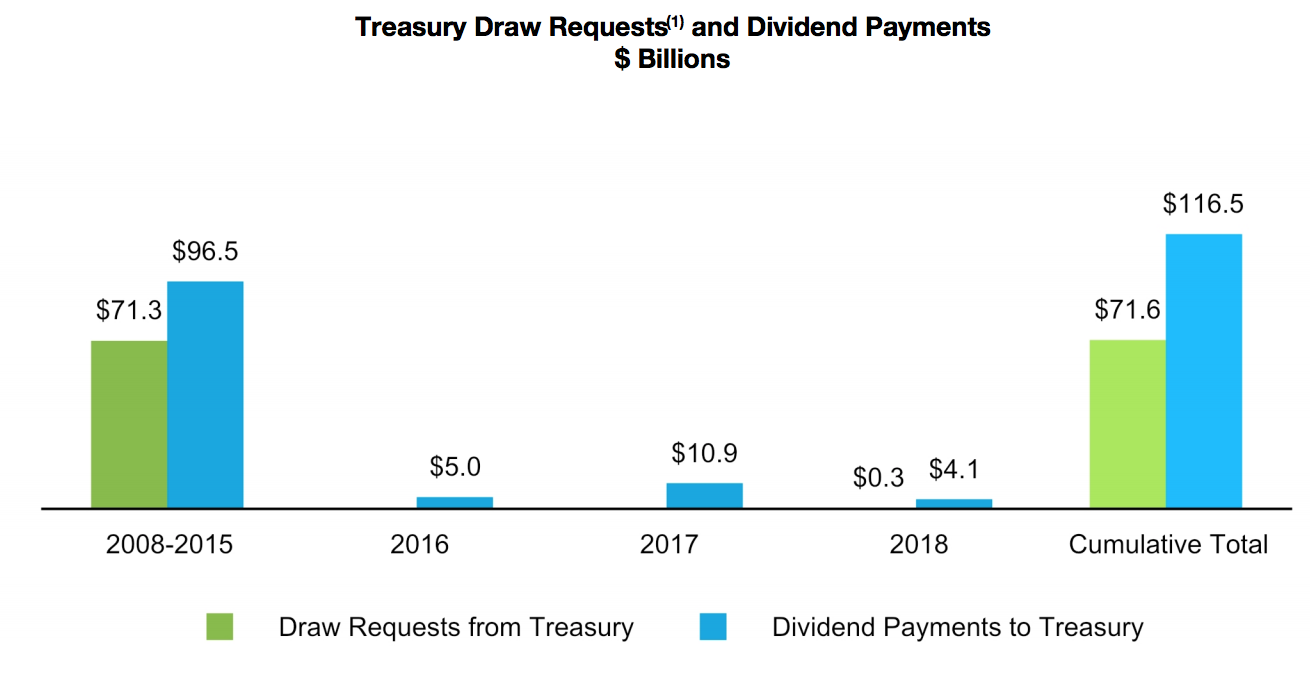

The government-sponsored enterprise expects to pay the $1.5 billion to the U.S. Department of the Treasury in March 2019, bringing its total payments to $116.5 billion. As the chart below shows, this is now up about $44.9 billion from the original withdraw of $71.6 billion.

Click to Enlarge

(Source: Freddie Mac)

For the full year, Freddie Mac reported $8.6 billion of comprehensive income, an increase of 55% from the year before. However, excluding significant items, 2018’s full-year income was $8.4 billion – an increase of about 4% from 2017.

Freddie Mac explained the improved results in 2018 primarily reflect two significant items in 2017, a $5.4 billion write-down of the company's net deferred tax asset resulting from tax reform legislation, partially offset by a $4.5 billion, or $2.9 billion after-tax, benefit from a litigation settlement related to non-agency mortgage-related securities, combined with lower income tax expense due to the reduction in the statutory corporate income tax rate in 2018.

“Ten years after the financial crisis, Freddie Mac’s transformed business model continues to produce solid financial and business performance, with $8.6 billion of profits this year,” Freddie Mac CEO Donald Layton said. “We delivered almost $400 billion of liquidity to the U.S. mortgage markets – with a very strong focus on first-time homebuyers and affordable rentals.”

“And we did it while transferring ever greater amounts of credit risk to the private capital markets and away from taxpayers,” Layton said. “We’re serving our customers better every year and delivering good value to the taxpayers who support us during conservatorship. It’s a true success story.”

The company reported market related losses of about $0.5 billion for the full year of 2018, after tax, but explained this was almost entirely from interest rate impacts. The fourth quarter saw market-related losses of $0.6 billion, of which about half was due to rising interest rates and the other half from market spread impacts.

The fourth quarter’s $1.5 billion income was down from $2.6 billion in the third quarter, but up from the loss of $3.3 billion in the fourth quarter of 2017.

But last year’s loss was due in part to the recently passed tax reform, which was expected to create a lower net income from the GSEs as a reduction in corporate tax rate would impact GSEs’ deferred tax assets.

Because of this possibility, Fannie Mae and Freddie Mac regained their capital reserves, each withholding $3 billion from the Department of the Treasury.

Freddie Mac reported a net interest income of $12 billion for the full year, down from $14.2 billion in 2017. For the fourth quarter, the GSE reported net interest income of $2.7 billion, down from $3.3 billion in the third quarter of 2018.

The company’s guarantee fee income increased from $662 million in 2017 to $811 million in 2018. Quarterly, g-fee income slipped slightly from $209 million in the third quarter to $208 million in the fourth quarter.