In 2018, American consumer debt reached a whopping $4 trillion, contributing to tightening affordability concerns in the housing sector.

In fact, according to the latest National Association of Home Builders/Wells Fargo Housing Opportunity Index, housing affordability sat at a 10-year low in the third quarter of 2018.

As the cost of living is often a significant factor in determining where people choose to live, homeowners often seek out more affordable markets.

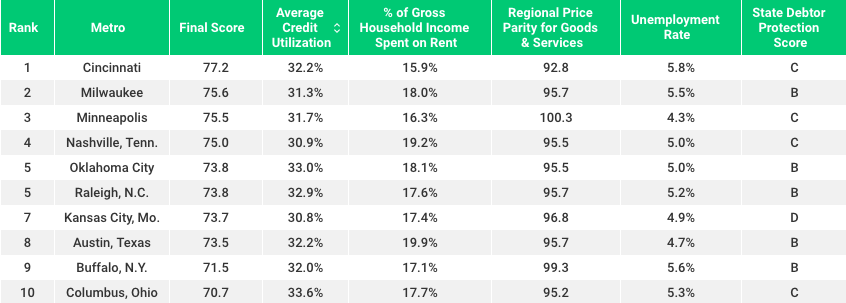

LendingTree recently released a report that highlighted the best U.S. metros for paying off debt.

According to the company's data, the top metros had a rent-to-income ratio below 20%, and all but one had a below-average price on goods and services.

LendingTree discovered that Cincinnati was the No. 1 metro in the country for paying down debt, with a score of 77.2.

The company calculated this total by comparing factors related to residents’ abilities to pay down debt in the 50 largest metros across the country.

Notably, Milwaukee and Minneapolis followed closely behind with scores of 75.6 and 75.5, respectively.

Not surprisingly, Californian metros were listed amongst the most difficult cities to pay off debt. In fact, Riverside, California, was named the toughest metro, with a score of 31.8. Residents living in Detroit and Los Angeles were also challenged, with scores totaling 40.8 and 42.3, respectively.

The image below shows which metros are the best for paying off debt:

(Click to enlarge)

(Source: LendingTree)

NOTE: LendingTree scored cities based on factors including credit rate, household income, unemployment rate, price parity for goods and services and more.