In 2018, the principal-and-interest mortgage payment on the median-priced home climbed by more than 16%, according to the latest data from CoreLogic.

CoreLogic reports that although the median home price rose by less than 6% over the past year, prospective buyers are in for a rude awakening come 2019.

According to the company’s forecast, American home prices will rise by almost 5% year over year in September 2019. In fact, it claims that some mortgage rate forecasts point to mortgage payments climbing to more than 11%.

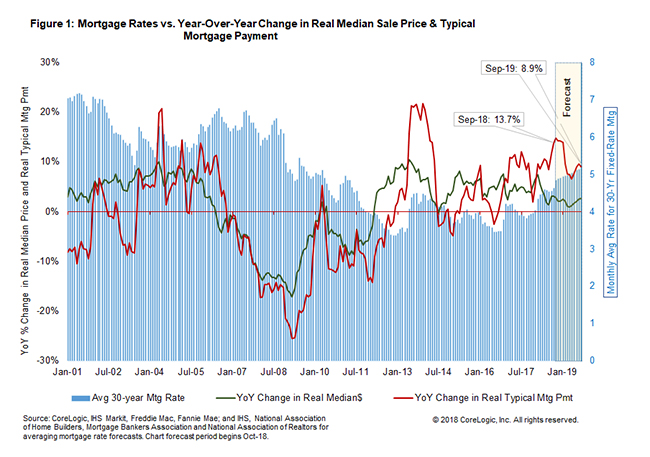

The image below shows the year-over-year change in median sale prices:

(Click to enlarge)

“A consensus forecast suggests mortgage rates will rise by about half of a percentage point between September 2018 and September 2019,” CoreLogic writes. “The CoreLogic HPI Forecast suggests the median sale price will rise 2.7% in real, or inflation-adjusted, terms over that same time period.”

CoreLogic says based on these projections, the real typical monthly mortgage payment would rise from $912 in September 2018 to $994 by September 2019. This is an 8.9% year-over-year gain, which equates to a nominal year-over-year gain of 11.3% in 2019.

That being said, the latest CoreLogic Case-Shiller report indicated that although home prices were slowly increasing, most cities across the country saw a boost from the prior year.

“The combination of higher mortgage rates and higher home prices rising faster than incomes and wages means fewer people can afford to buy a house. Fixed rate 30-year mortgages are currently 4.75%, up from 4% one year earlier,” S&P Dow Jones Indices Managing Director and Chairman of the Index Committee David Blitzer said. “Home prices are up 54%, or 40% excluding inflation, since they bottomed in 2012. Reduced affordability is slowing sales of both new and existing single-family homes.”