The Federal Housing Administration announced its new loan limits for 2019, and it looks like most of the country will see an increase.

In high-cost areas, the new FHA loan limit ceiling increased to $726,525, up from $679,650 in 2018. The FHA will also increase its floor to $314,827, up from 2018’s $294,515.

These new loan limits will be effective for FHA loans assigned on or after January 1, 2019.

FHA is required by the National Housing Act, as amended by the Housing and Economic Recovery Act of 2008, to set single-family forward loan limits at 115% of median house prices, subject to a floor and a ceiling on the limits. FHA calculates forward mortgage limits by Metropolitan Statistical Area and county.

FHA’s 2019 minimum national loan limit, or floor, of $314,827 is set at 65% of the national conforming loan limit of $484,350. This floor applies to those areas where 115% of the median home price is less than the floor limit.

Any areas where the loan limit exceeds this floor is considered a high-cost area, and HERA requires FHA to set its maximum loan limit "ceiling" for high-cost areas at 150% of the national conforming limit.

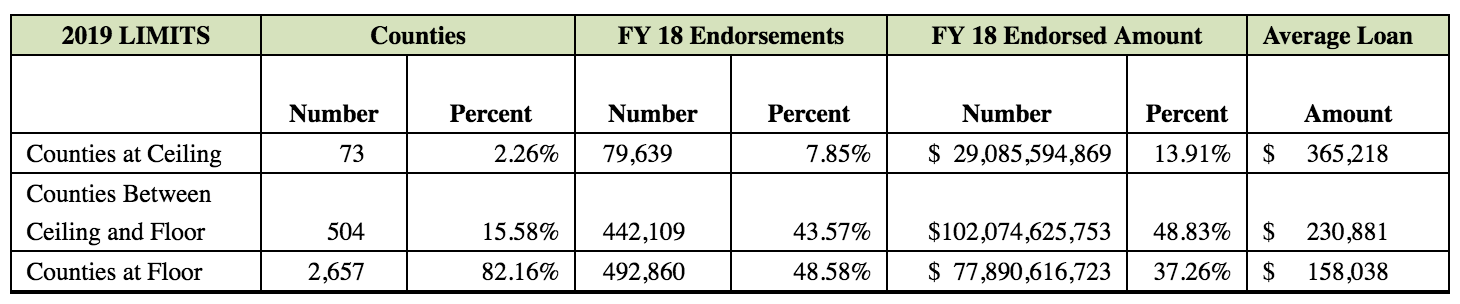

The chart below shows the number and share of counties where FHA loan limits are at the ceiling, floor and somewhere in between.

Each year, the FHA continues to increase how many counties see an increase in the FHA loan limits. Back in 2016, the FHA increased loan limits for just 188 counties; in 2017, this number jumped to 2,948 counties, then to 3,011 counties for 2018. In 2019, the U.S. Department of Housing and Urban Development will raise FHA loan limits in 3,053 counties.

Click here to read the FHA’s letter on 2019 forward mortgage limits.