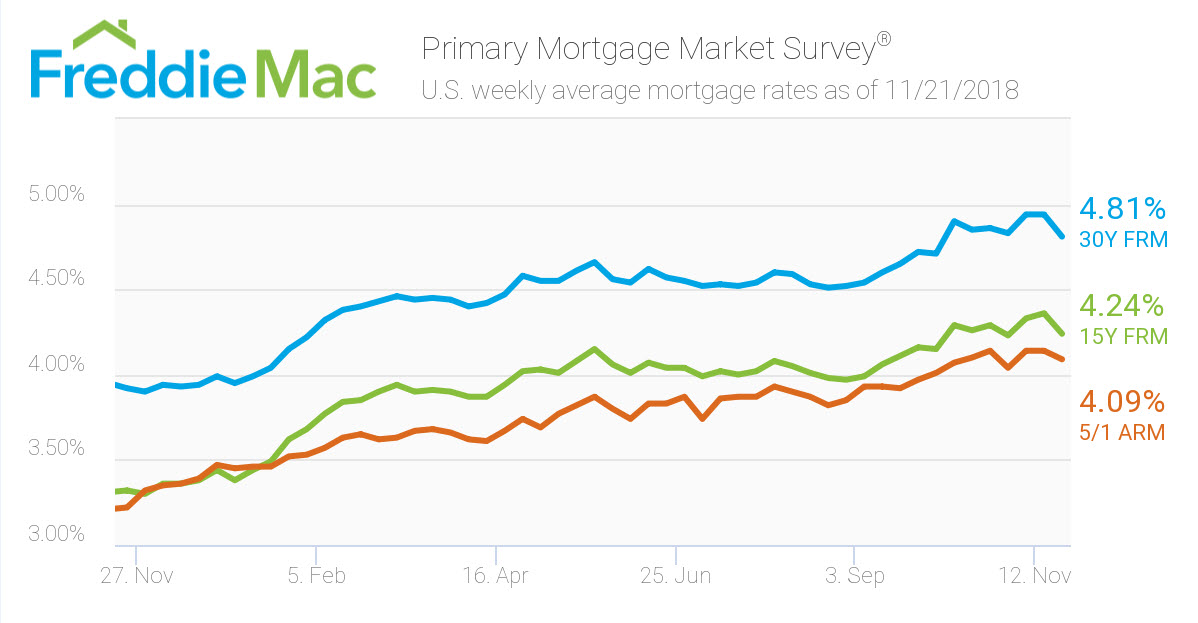

Mortgage rates declined this week, falling across the board, according to Freddie Mac’s latest Primary Mortgage Market Survey.

According to the survey, the 30-year fixed-rate mortgage dropped from 4.94% last week, averaging 4.81% for the week ending Nov. 21, 2018. However, this is still an increase from last year’s rate of 3.92%.

“The downward spiral in oil prices and a volatile equities market caused mortgage rates to decline 13 basis points to 4.81%, the largest weekly drop since January 2015,” Freddie Mac Chief Economist Sam Khater said. “Mortgage rates are the lowest since early October and the dip offers a window of opportunity for would be buyers that have been on the fence waiting for a drop in mortgage rates.”

(Click to enlarge)

The 15-year FRM averaged 4.24% this week, down from last week's 4.36%. This time last year, the 15-year FRM was 3.32%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage came in at 4.09% this week, retreating from 4.14% the week before. Notably, it also remains much higher than this time last year when it averaged 3.22%.