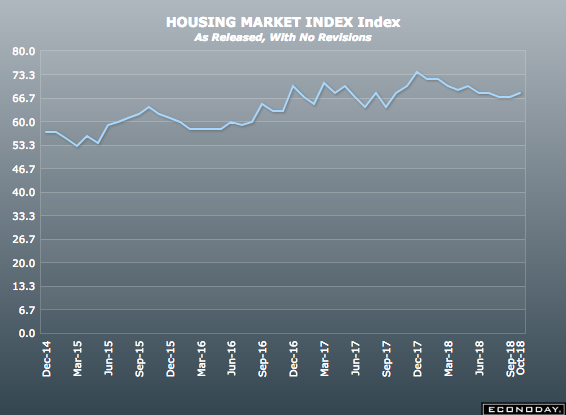

Affordability concerns contributed to homebuilder confidence falling eight points to 60 in November, according to the National Association of Home Builders/Wells Fargo Housing Market Index.

“Builders report that they continue to see signs of consumer demand for new homes but that customers are taking a pause due to concerns over rising interest rates and home prices,” NAHB Chairman Randy Noel said.

NAHB Chief Economist Robert Dietz said for the past several years, shortages of labor and lots along with rising regulatory costs have led to a slow recovery in single-family construction.

“While home price growth accommodated increasing construction costs during this period, rising mortgage interest rates in recent months coupled with the cumulative run-up in pricing has caused housing demand to stall,” Dietz said.

With the prospect of future interest rate hikes in store, Dietz said that builders have adopted a more cautious approach to market conditions and urged policymakers to take note.

“Recent policy statements on economic conditions have lacked commentary on housing, even as housing affordability has hit a 10-year low,” Dietz continued. “Given that housing leads the economy, policymakers need to focus more on residential market conditions.”

In November, the index measuring current sales conditions retreated from 74 to 67 points, while buyer traffic declined from 53 to 45. Lastly, expectations over the next six months fell from 75 to 65 points.

The three-month moving averages for regional HMI scores show the Northeast moved up two points from 56 to 58 points, the South decreased from 70 to 68, the West declined from 74 to 71 points and the Midwest fell one point from 58 to 57 points.

(Click to enlarge)

NOTE: The NAHB/Wells Fargo Housing Market Index gauges builder opinions of single-family home sales and expectations, asking for a rating of good, fair or poor. Builders are also asked to rate prospective buyer traffic from very low to very high. The scores are used to calculate a seasonally adjusted index with a rating of 50 or over indicating positive sentiment.