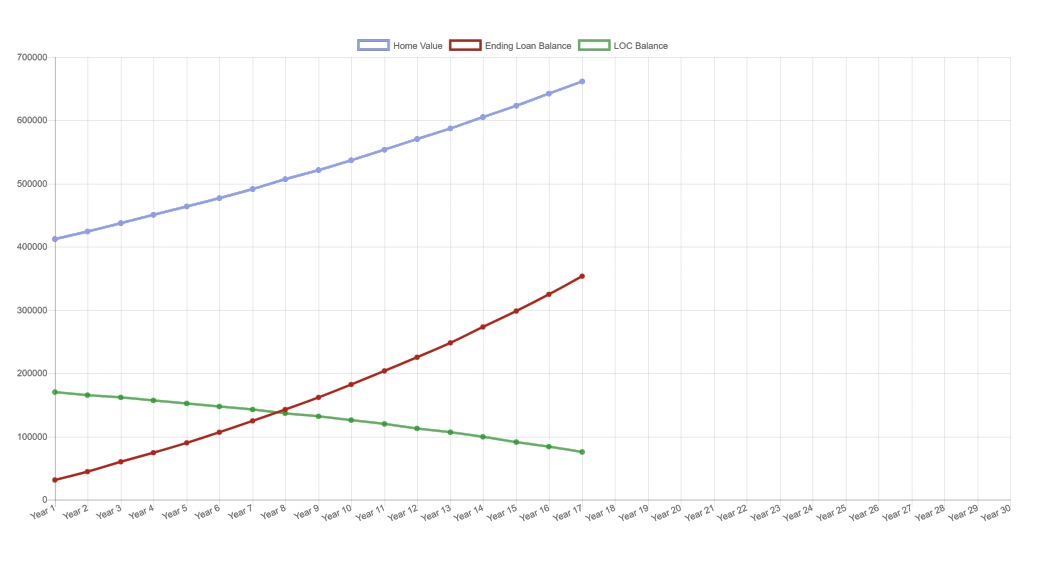

It’s one thing to tell someone how payments made on a reverse mortgage loan can grow their line of credit – but it’s another thing to show them.

That’s the approach Finance of America Reverse is taking with its HECM Illustrator. The reverse mortgage lender recently rolled out its new sales tool, which graphically illustrates the features of a reverse mortgage and its effect on a client’s wealth over a 30-year term.

The Illustrator allows users to enter information like home value and loan terms, tweaking the info as they like to see graphic illustrations of the loan’s impact in various interactive charts.

The program enables users to try out a number of scenarios to see how the loan could affect them, allowing them to play around with “what-if” scenarios like how a line of credit changes if payments are made, or what impact rising interest rates would have on the loan.

It also allows users to select from FAR’s three proprietary HomeSafe products to see what loan might best suit their needs.

It also allows users to select from FAR’s three proprietary HomeSafe products to see what loan might best suit their needs.

FAR introduced the Illustrator to its mortgage division three months ago, and just recently made it available to its wholesale partners.

Steve Resch, vice president of retirement strategies, designed the program.

A financial planner himself, Resch said the idea grew out of the realization that people are visual, and the ability to graphically demonstrate the loan’s potential would be much more effective than just talking numbers.

“I talk to financial advisors every week, and you can talk until your blue in the face about the line of credit and the growth and everything else, and they’ll nod and they’ll agree. But a when you put it up on the screen, their eyes get huge and they’ll say, ‘I didn’t know it could do that!’” Resch said. “This gives us the opportunity to bring the numbers to life.”

David Cook, a reverse mortgage consultant with FAR, said the tool has become a vital part of his education process when working with clients, their children and their advisors.

“The input of data is very simple and results are instant without a need to include the loan in my user software and pipeline,” Cook said. “I recently was able to send to a prospect multiple samples with graphs and amortization schedules for a variety of monthly term payment options to meet their specifications within 30 minutes of their request.”

Howard Frankel, a reverse mortgage loan officer with Resolute Bank, also uses the tool. He said it has greatly improved his ability to connect with advisors.

“When a financial advisor can graphically see the line of credit benefit relative to the cost of the loan, it creates that ah-ha moment. Without this visual, we’ve been stuck with amortization schedules that don’t tell a story and are hard to convey the power of the line of credit growth,” Frankel said.

“Advisor clients rely on their expertise and due diligence, and Illustrator becomes a toolset for that advisor to share his recommendation with their valued client,” Frankel continued. “I’ve seen this eliminate the here-say static of the old reverse mortgage, and it serves to expedite the next step in the process.”

Resch agreed that the ability to offer a visual demonstration of the loan's flexibility is huge.

“It’s simple, it’s easy to use, and it sends a very powerful message,” Resch said. “It turns a reverse mortgage into something that is real and alive and valuable, rather than just this numbers game. Now you have the ability to see how powerful this can be and what impact it can have down the road.”