Aging housing stock tells the tale of a construction industry that continues to fall behind in the number of new homes built each year.

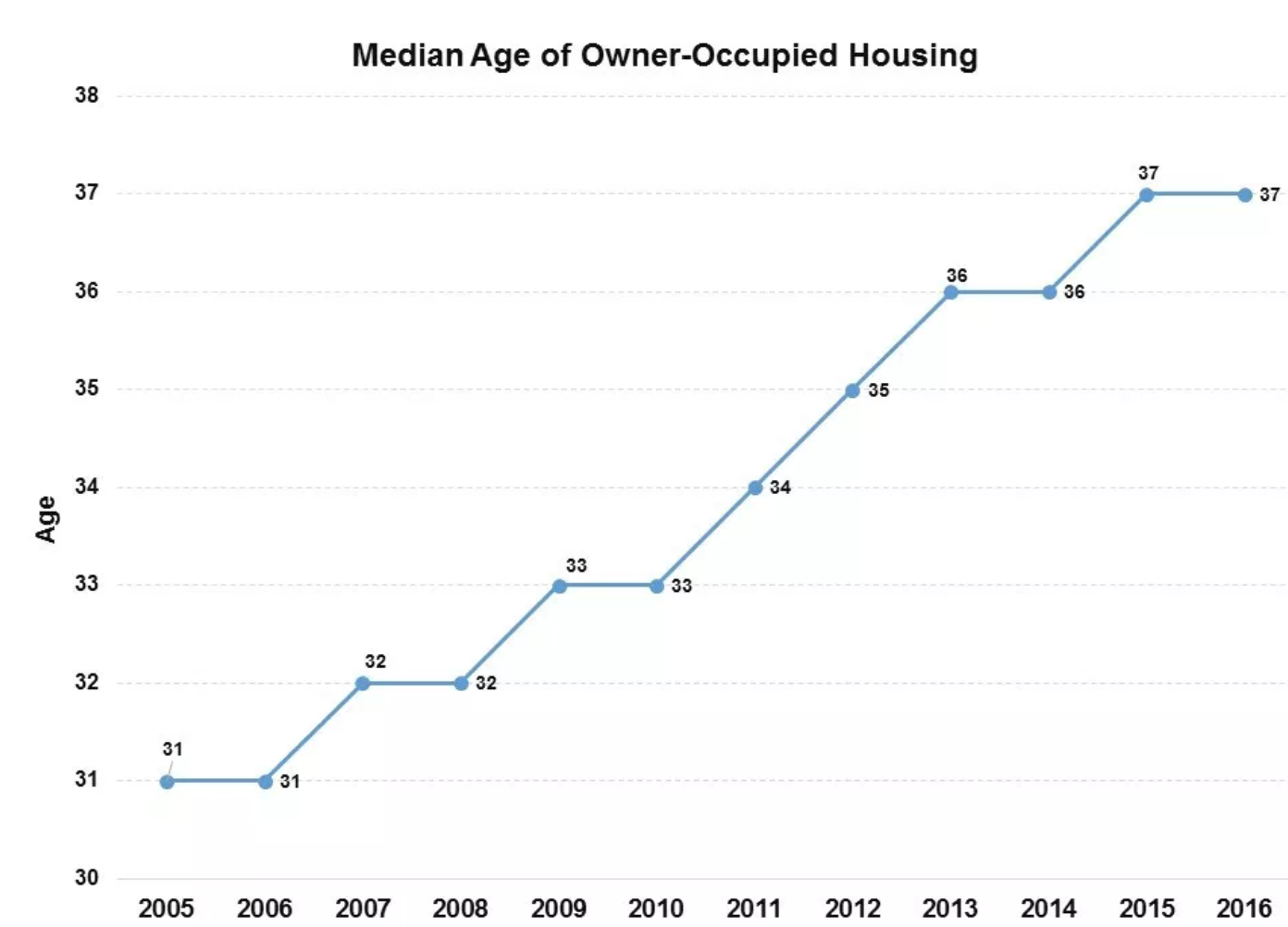

The median age of owner-occupied homes is currently 37 years, according to data from the 2016 American Community Survey from the National Association of Home Builders. This is the same age the association reported last year for 2015, however, it is up six years from 31 years in 2005.

NAHB explained the aging trend is due primarily to the slight increases in residential construction over the past decade.

The chart below shows that while the housing stock sometimes stays the same age from one year to the next, it has continued to follow an increasing trend over the past decade.

Click to Enlarge

(Source: NAHB)

Because many homes are growing older, and new construction is not keeping up with demand, it has caused a surge in the remodeling market, according to the report. And as home prices continue to rise, many homeowners also turn to home improvement as an alternative to moving.

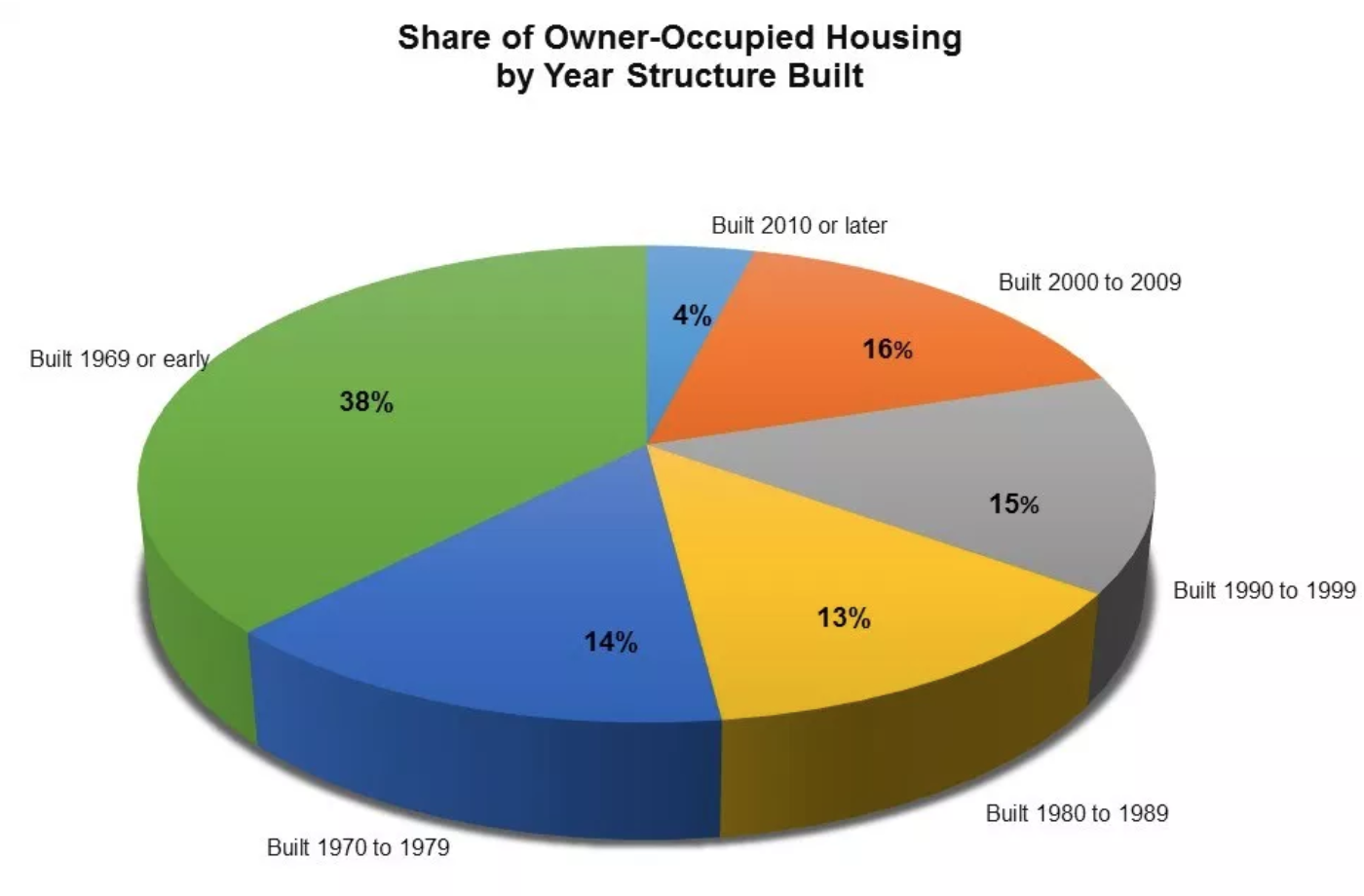

As the chart below shows, new construction added just 3 million units to owner-occupied housing stock from 2010 to 2016. That’s just 4% of the total housing stock as of 2016. Before that, homes constructed from 2000 to 2009 make up 16% of housing stock.

But the majority of housing stock is much older. In fact, about 38% of the current housing stock was built before 1970. The share of new construction dropped considerably even in the last decade – from 11% in 2006 to just 4% in 2016.

Click to Enlarge

(Source: NAHB)

And the growing market for renovations is allowing many older generations to age in place, as it is not Millennials or Gen Xers that are living in the homes built before 1970, but Baby Boomers. About 56% of homes built before 1970 are occupied by homeowners ages 55 and older.

On the reverse side, about 70% of homes built after 2010 are owned by Gen Xers and Millennials.

But even as the U.S. struggles to build enough homes to meet the rising demand, some markets are booming. The Dallas/Fort Worth area, in fact, continues to be the No. 1 market for new home starts, and even just became more affordable as new homes saw a drop in price due to builders concentrating on the start home market.