Providing a continuously improving customer experience and loan affordability are two paramount objectives for all service providers focused on helping seniors age in place. At American Advisors Group (AAG) this is our principal focus, and we are always looking for transformative capabilities to better serve our customers. More and more often we are locating the seeds of those capabilities nestled securely within our data assets. Additionally, emerging “big data”-related technologies, techniques and standards are providing avenues for maximizing the utility of our people and for simplifying channels of interaction with our clients.

A key avenue for transformation is the efficiency of those people working toward completing the origination of loans for our seniors. This is a key focus area of AAG’s Enterprise Data Management initiatives—namely, the transformation of how our people work through progressively sophisticated analytical approaches and the optimization of their time and efforts.

Transformation of Effort

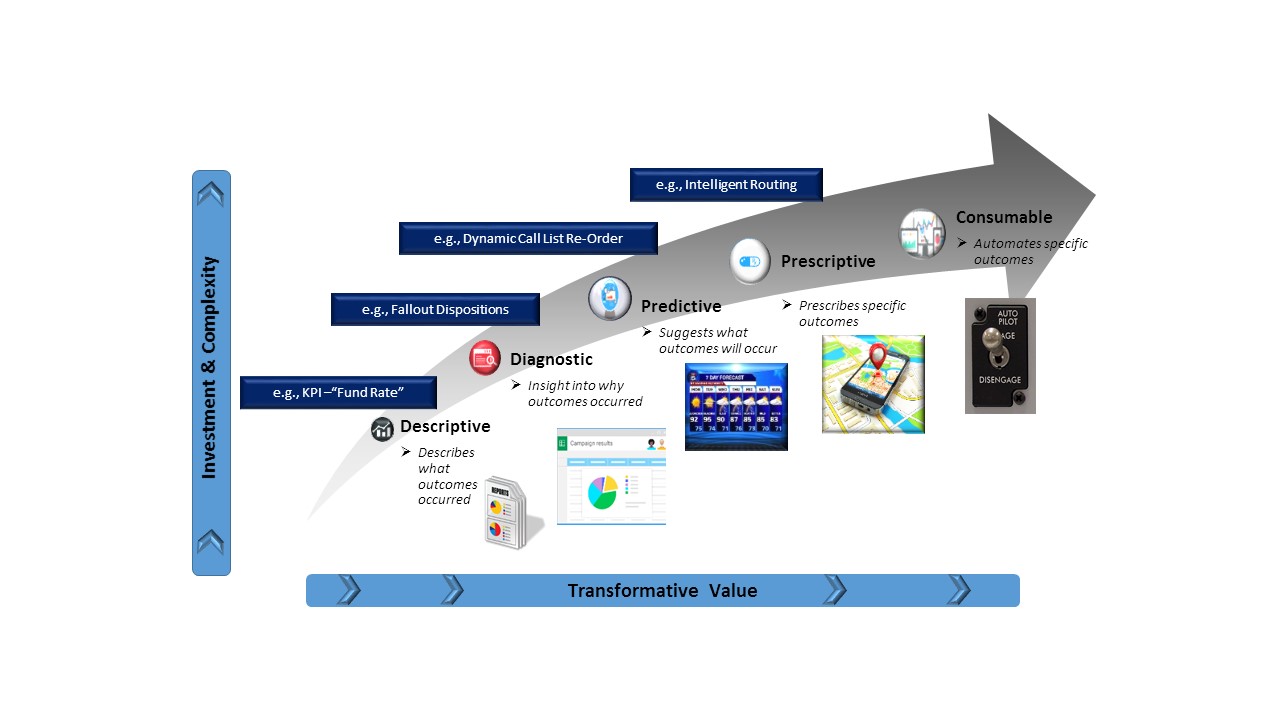

Most business reports fall in to the general class of analytical products called “Descriptive Analytics.” These are reports that merely recount what has actually happened, offering few or difficult-to-locate queues to exceptions and causality. For example, while monitoring the funding rate for reverse mortgages, we want to know how many of the loans we originate get funded (or the KPI “Fund Rate”). We can easily construct tabular or graphical depictions of Fund Rate performance over time, however, it is left to analysts or management to sift through the detail to identify the actionable insights hiding within those results.

More useful are the interpretive results associated with “Diagnostic Analytics,” which serve to answer “why,” not just “what.” Insights into the cause of change (positive or negative) can accelerate the opportunity for corrective action or expansion. Using the Fund Rate example, insights can be gained into Fund Rate by reviewing the “Fallout Rate,” or the exit disposition segments. In this way, we have a clear diagnostic view into Fund Rate. The progression from descriptive to diagnostic analytical products positively transforms the utility of the data and impact of those seeking to take action from it.

Analytical tools that provide a view into likely future outcomes are commonly called “predictive analytics” and offer the possibility of taking action before the negative impact of an event, or the increased investment into something likely to have positive results. For example, suppose a preferred wholesaler is offering a certain promotional credit for all files submitted in the next 30 days. Predictive analysis can combine awareness of this with awareness of all files with a Loan to Value (LTV) sensitivity less than or equal to the amount of the promotional credit, thus allowing for the reordering of call lists according to real-time sensitivity.

Analytics aimed at achieving specific outcomes based on existing conditions are often called “prescriptive analytics,” as they fundamentally prescribe actions for obtaining specific results. An example of this would be services that monitor each incremental change to the state of a loan file, setting the next steps in the file’s task flow based on the rules evaluated (developed in alignment with enterprise metrics) and thus optimizing the file’s path to completion. Clearly, this is the most sophisticated of the four types of analytics described, and the most expensive to develop and maintain. It requires not only data awareness but also the translation of experience into smart algorithms.

As these analytical approaches become more complex, they become more costly, either in terms of the tools or skills of the practitioners necessary to leverage them; however, each level of sophistication increases the value of the workforce leveraging their results, offering the opportunity to deliver solutions and service quicker, with a more optimal utilization of human assets.

Emerging solutions based upon principles of machine learning and adaptive reasoning provide a fifth level of data-driven utility, which can obviate the need for human assets all together. “Consumable analytics” is essentially prescriptive analytics without the need for human intervention, and delivers its directive results to another component of automaton for taking action.

Progression of Analytical Maturity

Consumable analytics solutions have long been employed in medical applications (e.g., insulin regulators, cardio defibrillators) and in aeronautics (e.g., autopilot functionality to maintain or change the trajectory of a plane without human intervention). However, it is somewhat more difficult to locate examples of prescriptive analytics in business applications. That is all changing now.

Transformation of Engagement

By adding an “Internet of Things (IoT) layer,” a broad suite of possibilities can be realized for transformation within business operations and customer engagement. “Digital Engagement,” as it’s now being popularly called, is providing more than just a means for your customer to interact via a prebuilt channel. IoT enables your customer to engage with you on their own terms.

In order to most efficiently utilize IoT, it will likely be necessary for the enterprise to adopt what is called a Micro Service architecture. Instead of the traditional means of interaction via a single platform, be it a Web portal or origination system, the platform is broken down into small, consumable parts. These parts (or services) can then be consumed by the user application in a way that makes sense for them. “Hey Siri, turn on the lights and play some music.” The consumer isn’t concerned with opening a smart home app or interacting with their sound system. The enterprise isn’t concerned with the necessary integration with every possible combination of smart home product. The micro service is simply developed and the creative minds of the end users engage with it in a manner that benefits them.

The smart home example is a very easy-to-understand model for IoT. Applying this model to your business takes a bit of ingenuity. For example, take a very traditional notification system. Something happens in your Loan Origination Platform (LOS) and you want to send out a notification to impacted stakeholders (maybe perspective borrowers) who subscribe to it. These stakeholders can only “know” what you have programmed for them to be alerted about, restricting flexibility.

Take this process and turn it into an IoT micro service that provides hundreds of key data points, and your stakeholders are now free to consume a broad range of events as they see fit.

Savvy users can even employ conditional rules for further customization of their engagement. Suppose you complete the funding of a loan for your borrower who has integrated your service, such that when notified of the funding, it automatically sends a dinner reservation to Open Table, a text alert to their spouse and an Uber to pick them up for a celebratory dinner at 8:00 p.m. They are consuming your enterprise service for their own level of engagement. Compare this to traditional methods of notifying customers of origination status and we see improved utilization of origination resources and a dramatically improved customer experience.

Better leverage of emerging data analysis and notification models can substantively improve the leverage of your most critical (and expensive) assets: your people. The result is an improved customer experience in terms of the length, transparency and cost of the reverse mortgage origination process.