As a product shaped and insured by the federal government, reverse mortgages are subject to frequent regulatory change. In the past few years, the program has undergone massive alterations, with FHA’s policymakers working hard to secure the HECM’s long-term viability while making sure it can still meet the needs of consumers.

The industry has endured its fair share of ups and downs—product variations have come and gone, big banks have entered and exited, home prices have risen and fallen, investor interest has ebbed and flowed.

Despite such volatility, the demand for reverse mortgages remains—and to many the future looks promising. Some analysts predict sizable growth as home prices recover and a massive wave of baby boomers prepares to enter their retirement years with little savings in the bank.

But for professionals in the space, weathering the storms that shake the market can be stressful and challenging. Reverse specialists have endured quite a lot in a short amount of time. Still, many of those who have stuck it out hold firm to the belief that recent change will better the product. They are working hard to carry on in this new environment, continuing to help seniors and share their ardent belief in the HECM’s potential to help thousands of aging Americans.

ML Mayhem in 2013

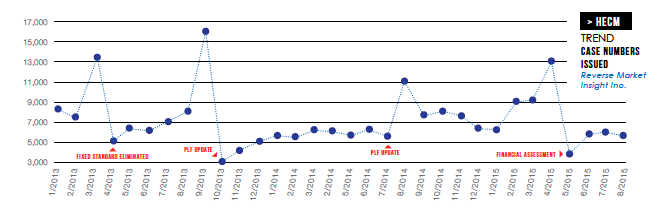

Each time a mortgagee letter mandates an impactful new guideline, a ripple effect is felt through the industry. And each time, the pattern repeats itself: First there’s a surge in endorsements as lenders usher borrowers through the loan process before new changes take effect; then there’s a lag as volume wanes and originators adjust.

But every time, there is a rebound. It may not be huge—endorsement numbers haven’t climbed back to the unprecedented highs of 2009—but they have come back after each change, even if the recovery is small.

The past three years have been particularly volatile for the reverse mortgage program. The first hit came with the release of ML 2013-01 in January 2013, which essentially announced the elimination of the Standard fixed-rate HECM.

The fixed-rate had become an increasingly popular product even as overall volume declined, and the industry was shaken over how this would impact business.

In the months ahead of the April 1 effective date, fixed-rate volume soared, following a predictable pattern as borrowers pushed to get approval before the product disappeared. Reverse Market Insight tallied the impact, noting that fixed-rate loans, which could be funded through June of that year, continued to inflate endorsements until August, when they finally cleared the pipeline. At that point, volume began to taper as the impact was felt. Originators had to rework their sales approach and focus on marketing the adjustable rate product.

RMI’s John Lunde explains the impact of the loss of the fixed rate on the market. “When the Standard fixed was eliminated, it shifted a lot of volume over to the Standard ARM, because it still had the highest principal limit factors, so [it offered] the most cash to the borrower. I wasn’t originally expecting there to be an overall volume decline because of that, but we actually did end up seeing some decline there,” he says. “It wasn’t a dramatic volume change, but it was there.”

While the impact might have thrown off business as usual, some still thought it was a positive step that would improve the future of the product. According to Mark Browning, CEO of New York-based lender HomeChex, the Standard fixed product wasn’t always a great choice for senior borrowers, and its loss benefited the program as a whole. “Frankly, I think it culled some of the players who were in the market for the wrong reasons, so I think that was good. And I would comment that industry volumes were at their highest before the fixed-rate, closed-end ever existed,” Browning says. “It was a good product that was perhaps used in the wrong ways, and I think most of the veterans in the industry quickly rebounded.”

Industry players had little time to focus on losing the fixed rate, as HUD moved forward with the release of ML 2013-27 just five months later. This monumental mortgagee letter left the industry bracing itself for a reduction in principal limit factors (effectively cutting a borrower’s available proceeds by about 15 percent) and the institution of an upfront utilization restriction (which capped the amount of money a borrower could take upon the loan’s closing).

The changes were drastic and a palpable sense of fear radiated from many HECM specialists who worried about the impact this would have on their business. How would potential borrowers respond? How would the market react?

Industry veteran Jim Veale recalls the reaction. “People were talking about huge disaster. A number of people were talking about the end of the program,” he says. “It was a very bleak picture for a lot of people.”

Despite all the volatility, 2013 came to a close on a high note, with endorsements rising just over 15 percent year over year to a total of 61,122, according to RMI, which noted that the new guidelines would likely not impact endorsement figures for several months as loans funded ahead of the changes made their way through the pipeline. RMI attributed the year’s success to stabilizing home prices and the fact that leading lenders stayed put, unlike 2012 when a notable exodus caused volume to drop. Still, the industry braced itself for changes ahead.

Feeling the Effects in 2014

The following year took a hit as the new mandates took effect. Following the release of yet another PLF change in July—which made more money available to older borrowers in a lower interest rate environment, but also made less proceeds available to most borrowers in a higher rate environment—lenders were increasingly weary.

“I think many people were concerned about what impact [the reduced PLFs] would have in the marketplace,” 8 says Browning, adding that thus far the effect has turned out to be mostly nominal. “At the time they occurred, I think it was really manageable and a lower interest rate environment facilitated a relatively smooth transition. Obviously, it was packing up the pipeline that occurred before, but once that cleared, people found it wasn’t as a big a problem as they might have thought.”

The real concern, Browning says, is for the future. “If interest rates normalize, then it will have a very, very significant and adverse effect… I think everybody is worried about that. There’s a real potential future problem.”

Lunde agrees. “There are pretty significant changes on the higher expected interest rate PLF curves. If and when we get to the point where we have higher expected rates, there’s definitely going to be some impact there,” he says.

Veale says the push to sell the product through financial planners could create further complications. “Here’s where the rubber meets the road: If the interest rates increase substantially, we’re going to have to go back to the financial advisors who have been our referrals and say. ‘Hey, [PLFs] are a little bit worse now,’ and they will remember what it was like before. They may go back and tell their clients, ‘Wait a bit, the interest rates could go back down,’” Veale says. “We now have an interference layer between us and the potential client. This is a whole new way of doing business.”

RMI analysis pointed out the market’s steep nosedive from June through September of that year, which it primarily attributed to FHA’s new limit on borrower cash withdrawals. The reduction in cash upfront changed the way consumers could use the product—making it more of a retirement planning tool and less of a product for those who needed access to immediate cash. That meant lenders needed to remarket in order to find a way to redefine the HECM’s appeal, a move that would likely mean they would need to attract a new customer base—and find a way to connect with financial planners who had access to a more sophisticated clientele.

As lenders struggled with remarketing the product, the year took a hit, finishing with a total of 52,949 loans (down 13 percent). The market was beginning to climb out of the abyss, but the recovery was just so slow.

To Lunde, this was worrisome. “I would call it the most significant volume impact event that we’ve had in the industry. Not just because it had a dramatic shift right away, in terms of the volume, but because there was a muted recovery,” Lunde says. “We basically bumped along at a similar level for almost a year after that event, so that was new. That was more concerning to me than the initial volume decline. It brought us to the lowest level that we’ve been for probably a decade, but even more concerning than that was the lack of recovery for quite a while.”

Perhaps the problem was that the final shoe had yet to drop—FHA had not yet released the full details of Financial Assessment, which it promised in September 2013’s mortgagee letter.

Financial Assessment Takes Its Toll in 2015

While 2014 was behind them, industry participants had yet to take a deep breath. Financial Assessment had been finalized and was set to take effect in March, and several were concerned about how many potential borrowers would effectively be locked out of the program, unable to meet the new criteria. Lenders would need to assess a borrower’s “ability and willingness” to meet the obligations of the loan, requiring significant underwriting, including a credit history analysis.

True to form, volume soared ahead of FA’s implementation as originators rushed to get loans endorsed before the new rules complicated the process. August closed with 5,570 loans, the highest monthly total in two years. But the hit finally came as the gap between funding and endorsement narrowed and the FA took hold. Endorsements dropped to 4,671 in September, signaling the end of a strong three-month surge.

The true impact of FA remains to be seen, but according to a poll conducted in June by Reverse Mortgage Daily, many are feeling the heat. Of the poll’s 190 respondents, more than half said their volume had declined more than 15 percent, with some claiming to have experienced a drop as sharp as 50 percent.

Veale points to the numbers to highlight FA’s toll. “Right now, we are at a conversion rate of less than 60 percent,” he says. “June, July and August—not one saw more than 6,400 case numbers assigned. The conversion rate is the lowest it’s ever been since the early 2000s… It is sliding downward and it doesn’t want to come back up.”

Browning says that while he thinks some kind of financial assessment was needed, he fears the current policy is overkill. “Financial Assessment is prudent and it needs to be in place; the insurance fund needs to be protected. But the current guidelines have turned the HECM into a cumbersome, clunky product compared with alternatives like the HELOC. To reach its potential, the HECM has to reach middle and upper-middle class households.”

“I think that Financial Assessment as it’s currently constructed fundamentally changes the equation and I think the implications will take a long time to unfold,” Browning says. “I’m hoping there will be some room to adjust the program guidelines to better reflect the reality of the retirement picture for baby boomers.”

Veale agrees, saying succinctly, “We need FA, but I don’t know if this is the right FA.”

For now, the industry will just have to keep the faith and weather the storm. “We just need to get through the transition period, which can always be a little rough,” says Lunde, who calls FA a good thing for the long term. “I think so far the industry has done a pretty good job coming through it.”

Hopes for 2016 and Beyond

The past few years have been tumultuous for the industry, but many HECM specialists have stayed put, committed to the product and convinced of its importance.

Browning says that many who are part of smaller organizations like his are bound to their work by a sense of responsibility. “We are deeply embedded in our communities and we really believe the product can make a difference. The need and the demographics are compelling, and considering the retirement situation of baby boomers, clearly they are going to need housing equity as part of their solution.”

Veale says that while the road ahead may be tough, he predicts a slow but positive recovery. “We’re dealing with the unknown, because our client base is changing… We’re going to the referral source rather than the individuals,” he says. “I think we’re a mature industry that is going to see very solid growth, but it’s not going to be as speedy as we would like.”

Lunde also predicts some growth down the line, even if 2016 doesn’t turn into a banner year. “Even if we end up flat [in 2016] from where we are now, we’d still be somewhere in the 50,000-60,000 loans per year range. I do tend to think that we’ll see a little bit of growth barring any additional changes,” he says. “Hopefully we’re on the path toward recovery and we’ll get back to showing sustained growth… I think we’ve also seen quite a bit of recovery from the home price perspective, so we’ve got a decent wind on our backs there and that certainly helps.”

Browning says stability will be key to the program’s future growth. “If the HECM is going to find its place in the mainstream financial planning arena, it needs to have a sustained, stable period where financial, legal and other advisors to families can get their arms around what the product is. We’ve had this process of continual change and it has really driven a lot of folks away from the product. When it stabilizes, I think it will certainly help the landscape because people will be able to invest the time to understand the product.”

Lunde says more distribution channels will also go a long way to propelling the product forward. “We’ve got some good companies that have weathered the storm and have come through and found ways to make it through a very challenging period. I think that we’ll have some champions in that group, and I think it would be beneficial to them and everybody else in the industry if we had some additional large brand names with good distribution platforms and networks come back into or enter the industry. I think that’s more realistic these days than it’s been for the past several years because I think the product changes have made it more attractive; they’ve put more protections in place.”

Whatever the future holds in this post-FA world, there is something to be said about the product’s resilience.

“We layered on these changes sequentially and in a very short timeline. Nothing was ever given a change to see how it affects the risk profile of the book of business,” Browning says. “We just kind of threw everything but the kitchen sink at the product, and I think the fact that it’s still standing is a testament.”

Lunde echoes this idea. “I think we’ve shown ourselves to be a very resilient industry, which speaks to the product being one that borrowers like and proves that we have a customer base that needs the product and is well-served by the product,” he says. “As long as we continue to achieve that, I think the future is bright for us.”