Lately, I have become weary of hearing financial planner types say that reverse mortgages are terrible scams or interesting curiosities that may occasionally help the destitute (or worse, merely opportunities for them to sell more of their products). While reverse mortgages are far more valuable and versatile than these simplistic characterizations, I have not yet seen HECM fans make much of an effort to promote all of the ways that this loan can help seniors. Therefore, I’ve assembled a few arguments to make the case for a much greater use of HECMs in financial planning.

Reverse Mortgages as Part of a Portfolio

I used to think that having a reverse mortgage was, among other cool things, something seniors did to help protect their portfolios. That was until a financial planner friend, Eric (name changed to protect the guilty from his superiors—see sidebar below), who gave me a different slant that I had never even heard from anyone in the reverse industry.

Eric’s theory is that all assets can be divided into one of three buckets:

number one: Income/assets that will be taxed now, such as W-2 income, unsheltered investment accounts, savings accounts, certificates of deposit accounts, etc.

number two: Income/assets that will be taxed at some later date, such as traditional IRAs and 401(k)s

number three: Income/assets that will never be taxed, such as Roth IRA accounts, tax-free municipal bonds, cash value life insurance and [drum roll]… reverse mortgages!

Did you catch what I just did? I have put reverse mortgage in the portfolio and not off by itself somewhere. And even better, it’s in the coolest part of the portfolio—the “never taxed” part. How about that?

Did you catch what I just did? I have put reverse mortgage in the portfolio and not off by itself somewhere. And even better, it’s in the coolest part of the portfolio—the “never taxed” part. How about that?

Furthermore, Eric told me that his goal for all of his retired clients is to have their monthly incomes remain sufficiently high, but their taxes low. A reverse mortgage is a versatile tool that can help achieve this goal.

Optimizing Social Security

I’ve read numerous articles recommending the three most talked-about ages to begin taking Social Security benefits:

-At 62, when first eligible, even though one may have to repay some benefits if other income is too high

-At the age when the repayment of benefits is no longer required, regardless of the amount of outside income (66-67 these days, depending on birth year)

-At 70, when full benefits are available

Some articles suggest waiting until 70, when the monthly payment reaches the maximum, while others say you’re better off taking it earlier and investing it. Whatever choice is selected, the point is that we have an option for that. They are as follows:

-For those waiting until age 70, at 62, begin drawing from the reverse mortgage an amount equal to the (estimated) age 70 benefit. At age 70, begin taking Social Security benefits and discontinue reverse mortgage payments.

-For those beginning benefits at age 66-67, do the same as above at age 62, but reduce reverse mortgage payments at age 66-67 so that the total cash infusion from both sources equals the age 70 benefit.

-For those commencing benefits at age 62, begin taking reverse mortgage payments immediately in an amount equal to the difference between the age 62 Social Security benefit and the age 70 benefit.

Of course, there are numerous variations to the above based on an individual’s unique circumstances, and a trusted financial advisor would help select a plan that works best for a borrower’s particular situation. Our job as reverse professionals is to make sure we communicate these options to those advisors and provide them with the information they need to support their clients.

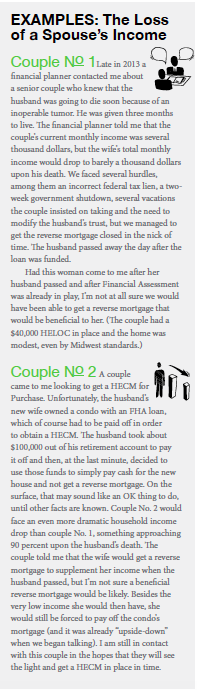

The loss of a spouse is overwhelming in many ways, often including financially. Even in the best scenario, in which both spouses receive their own Social Security checks, the surviving spouse will usually only receive one check, the larger of those amounts. When the deceased also had a pension that was supporting the household, the effect can be especially devastating. (See the sidebar on pg. 33.)

Couples might believe that if the spouse with the highest income passes first, the surviving partner could get a reverse mortgage. With Financial Assessment in play, that may no longer be true, so it is especially critical that financial planners know that taking a HECM before tragedy strikes is often best. Let’s tell them.

Asset Protection

I bet that, if we asked 100 random seniors, their adult children and their advisors, “Could a reverse mortgage improve a senior’s legacy?” 98 of them would say something like, “Are you kidding? Of course not!” This would be followed up with something about how the bank would own the house or that there would be no equity left.

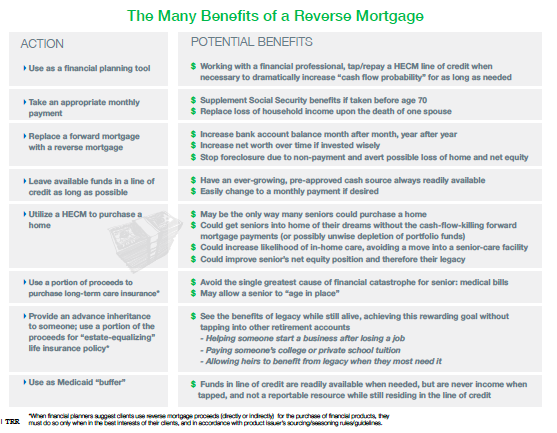

What few seem to realize is that for seniors securing reverse mortgages, there is always a financial benefit or they shouldn’t do it. The chart on the next page outlines many of these benefits (some discussed elsewhere herein), and I challenge other reverse mortgage professionals to add to this list.

The Elimination of a Forward Mortgage

A substantial number of retired seniors still have a traditional, forward mortgage against their home. Reverse mortgages provide an attractive solution to this unexpected problem. When a forward mortgage is replaced by a reverse mortgage, the elimination of required monthly mortgage payment frees up a significant amount of money. At least one study suggests that, despite negative amortization, such a move can be financially beneficial to seniors. Financial planners need to know and explore this.

Selling and Buying a House

While the number of real estate professionals who are aware of the H4P product is small, the number of financial planners who are informed of this loan is likely even smaller. And that’s too bad, because there are many ways that such a transaction can be a significant financial benefit to seniors.

For instance, if selling and moving is necessary or desired, reverse mortgages may be the only type of loan many seniors could qualify for (which most will, even in light of the new Financial Assessment challenge). Without this option, many seniors could not even think about selling and moving unless they were to use all the sales proceeds from the house sold and those proceeds were sufficient to get them into something better than their current “ill-suited quarters.” Furthermore, downsizing or even “upsizing” using a reverse mortgage as a purchase loan has its own unique financial benefits.

Finally, here is one financial consideration I’ll bet very few have thought of: If Ralph and Agnes are living in the house they bought 43 years ago, which Ralph has maintained, expanded and upgraded with skill and TLC, but only until the last five or six years, when his health has prevented him from doing so, this couple is now residing in a depreciating asset. It is not far-fetched to think that, if they sell the current home now before it gets much worse and buy something more suitable requiring little or no maintenance, after a few years they would own more net equity than if they stayed put. In other words, selling and buying could actually be a solid financial investment. Spread the word about this exciting possibility!

The Versatile Line of Credit

With recent limits on the fixed-rate HECM discouraging many borrowers from selecting this option, its “competitor,” the adjustable-rate HECM, is the predominant choice these days. (It always has been with my customers.) This is great because the line of credit grows over time at the same rate as the loan balance does, and money taken out can be repaid with the line-of-credit balance increasing dollar-for-dollar by the exact amount as the loan balance simultaneously shrinks: the amount of the repayment check.

We all know why a HECM credit line grows over time: Seniors get older without taking it, even though they could, and thereby reduce the likelihood that the loan will “go upside down.” And we also know that the increase is nothing more than a dollar figure in the computer; it is not interest and it is not taxable.

Although the initial proceeds and the related line-of-credit balance are based on the initial appraised value of the home, the growth rate of the line of credit has nothing to do with the subsequent actual appreciation of the home value over time. The line of credit is guaranteed to grow by the loan rate (which will at least be equal to the chosen margin), even if the home value plummets over time (which we now believe can actually happen).

Particularly for those seniors who have a small initial loan balance and an associated large initial line of credit, this could be a huge improvement to the senior’s legacy if, during the life of the loan, home values do not increase as expected and after some years the line-of-credit amount actually exceeds the value of the house. Some time between when that happens and when the last borrower permanently leaves the home, that senior should request the full line of credit then available. Although this action would put the house “under water,” that would be of no consequence because the heirs or the seniors themselves can simply walk away from the house and the loan and be flush. I often tell my senior customers to take this step without fail 15-30 days before they die. (This always gets a good laugh.)

Now, while this strategy may seem somehow sneaky or illegitimate, it is not. In fact, a few years ago, one lender actually included a disclosure advising borrowers to employ it if this situation ever occurs. Does anybody else remember this?

The other noted benefit of the line of credit, the in-out capability, combined with the growth feature, allows a financial planner to optimize seniors’ portfolios in a way described in the next and final section of this treatise.

Optimizing a Portfolio

I have just begun speaking with the children of a senior who told me, “Mom’s retirement account value is down to about $X and we are thinking it’s time to explore getting a reverse mortgage to supplement her cash flow.” Well, I had news for them: It’s way past time to do this.

A number of academic studies have concluded that if a senior follows an “active strategy,” funds can be drawn from the HECM’s line of credit when cash is needed rather than drawing down an underperforming portfolio. When the portfolio rebounds, it can repay the line of credit. The probability that this strategy would create sufficient cash flow for 30 years is greater than 90 percent, compared with about 50-55 percent if the portfolio is nearly exhausted before a reverse mortgage is secured.

And think of this: In addition to being able to serve their senior customers better, those financial planners who are paid as a percentage of their clients’ assets will be assured that those assets will actually survive through the years.

So there you have it: my reasons why financial planners need to consider the value HECMs can offer their clients. I do not claim that every suggestion I make is applicable to every senior, but I do believe every one applies to at least a few. And, since I know I am not brilliant enough to have thought of every possible benefit, I encourage readers to pick up where I have left off and share their own ideas. It is critical that we all spread the good word wherever we are, because doing so will help the entire industry grow.