In the appraisal world, it’s no secret that the industry is facing a drastic decline in its workforce, and as the number of certified residential appraisers continues to dwindle, HECM lenders are feeling the pressure. Already lenders are seeing higher fees and longer turnaround times, and some are complaining about a lack of quality as stressed appraisers struggle to meet increasing demand.

A closer look at the issues currently facing the appraisal sector reveals a slew of deep-seated problems that are seriously stressing its workforce. For reverse mortgage lenders that rely on quality appraisals to close their loans, these issues are complicating business as they must grapple with the consequences of this appraisal problem.

While some may disagree about what needs to be done to solve the problem, everyone seems to agree that, with all signs pointing toward decline, something has to change.

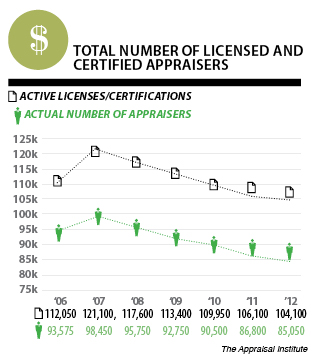

A Shrinking Workforce The appraiser workforce is notably shrinking, specifically among certified appraisers, whose advanced designation qualifies them to work on FHA-insured loans. At the same time, refinances in the real estate sector are booming and loan applications are on the rise, meaning that there is a lot of business out there, but few people to do the work.

A Shrinking Workforce The appraiser workforce is notably shrinking, specifically among certified appraisers, whose advanced designation qualifies them to work on FHA-insured loans. At the same time, refinances in the real estate sector are booming and loan applications are on the rise, meaning that there is a lot of business out there, but few people to do the work.

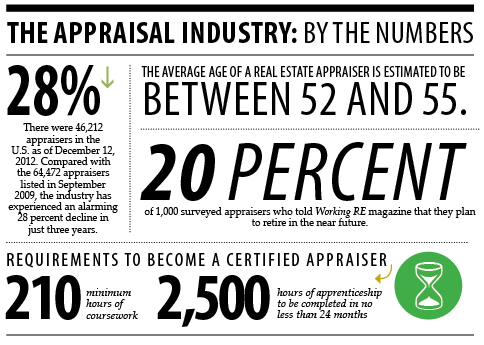

An FHA-published roster of certified appraisers lists 46,212 appraisers in the U.S. as of December 12, 2012. Compared with the 64,472 appraisers listed in September 2009, this number illustrates an alarming 28 percent decline in just three years. Also, keep in mind that just because these appraisers are listed on the roster, doesn’t mean they are necessarily active. Some could still have their licenses, but may have retired or moved on to another position in a related field.

Len Fishman is one such example; he is a certified appraiser but works as operations manager at Genworth Financial Home Equity Access. In an August webinar hosted by NRMLA 8 titled “Managing Appraisal Expectations,” Fishman said that the appraiser shortage is the No. 1 issue facing the industry right now. “Right now the roster is losing about 200 appraisers a month,” said Fishman, who oversees Genworth’s appraisal department. “We’re really kind of circling around this perfect storm [with] the lack of trainees coming into this industry and people getting out.” Fishman said this shortage will have an impact on the lending process. “It’s going to make it difficult to locate appraisers in rural communities,” he said during the webinar. “Appraisers are going to be busy and will cherry-pick the assignments they want, so locating appraisers for difficult projects is going to be a challenge over the next couple of years.”

A Multitude of Concerns Industry experts point to myriad factors that have contributed to this decline in the appraiser workforce. Some assert that it all began when a number of longtime appraisers left the industry after the housing bubble burst. The business, once booming and lucrative, saw volume tank with the collapse of the housing market, prompting the departure of industry veterans who never returned.

Of those who did stay, a sizable number are getting ready to retire. A recent survey by appraisal industry publication Working RE magazine revealed that 20 percent of respondents indicated plans to retire in the near future. In fact, trade associations and industry experts estimate the average age of a real estate appraiser to be between 52 and 55.

At the same time, there is a distinct lack of new appraisers entering the market, so while the current workforce is aging, few newbies are taking their place. Some say there is simply no incentive for young people to enter the industry, as the profit margin is slim and licensure requires extensive education and training.

David Brauner, publisher of Working RE, said this lack of new recruits is a result of a combination of lower fees and increased training and education requirements. “I think there are fewer appraisers entering the profession because being an appraiser these days is much less attractive than it used to be, given the lower fees and raised bar,” he said. “It just doesn’t make as much sense to enter this profession as it used to.”

Indeed, the process of becoming a professional appraiser is extensive. In many states, it can take between two and five years, depending on the type of license. Basically, there are two main types of real estate appraisers: licensed and certified. A licensed designation requires a minimum 150 hours of coursework and 2,000 hours of apprenticeship in no less than 12 months, but it does not require any sort of college degree. Licensed appraisers, though, can only work on noncomplex jobs in which the real estate is valued at $1 million or less.

Indeed, the process of becoming a professional appraiser is extensive. In many states, it can take between two and five years, depending on the type of license. Basically, there are two main types of real estate appraisers: licensed and certified. A licensed designation requires a minimum 150 hours of coursework and 2,000 hours of apprenticeship in no less than 12 months, but it does not require any sort of college degree. Licensed appraisers, though, can only work on noncomplex jobs in which the real estate is valued at $1 million or less.

Certified appraisers are the only professionals approved to work on FHA-insured HECM loans. As a specialized product designed for members of a protected class, more experience is needed to handle HECM loans, and the pool of qualified appraisers to draw from is significantly smaller as the process to obtain this designation is far more intense. Certified appraisers must complete a minimum of 210 hours of coursework, and they must have an associate’s degree or 21 college semester credits in related coursework. Most importantly, they must also complete a 2,500-hour apprenticeship in no less than two years under a supervising appraiser. For many, it’s this mandatory mentorship that is a large part of the industry’s problem.

A two-year apprenticeship is certainly stringent, but it was designed to ensure that aspiring appraisers get the education and real-world experience needed to do the job properly. The reality, though, is that there are few certified appraisers out there who are willing to take on a trainee. This is especially true for independent appraisers, who some say comprise as much as 80 percent of the workforce, but it’s also true for AMCs. Even though AMCs are more likely to take on trainees to beef up their office staff, a 2012 study conducted by the Appraisal Institute determined that even they have dramatically decreased their number of trainees over the past two to three years.

The problem is that under the current structure, there’s no real benefit to playing the role of supervisor. Supervising appraisers are not compensated and they are often unwilling to take on trainees because doing so would mean sharing their clients and splitting their profits. On top of that, many find it economically unfeasible to set aside time to inspect a trainee’s work while managing their own workload. Compounding these issues is the fact that, in a post-Dodd-Frank world, some banks and other institutions will not accept work from an appraiser in training, or will only do so in limited situations. Fishman acknowledged that the trainee situation is a problem for the industry. “We haven’t had a good mechanism to bring trainees on and to develop an actual internship program,” Fishman said during the NRMLA webinar, calling the current system “short-sighted.”

Aside from the mentorship issue, there are other factors that have contributed to the decline of this workforce. Some say that the heightened regulations that arose in part from the Home Valuation Code of Conduct (HVCC) and a significant updating of investor and GSE underwriting requirements pushed industry veterans out of the business. HVCC was instituted in 2009 to preserve an appraiser’s independence, but some say that the regulation it set forth had a negative effect on the industry. Many appraisers chose to leave the business all together as opposed to retooling their operations to accommodate the endless changes and establish new AMC relationships. Brauner agreed that HVCC played a role in the drop-off. “I think the changes wrought by HVCC were a major reason why a lot of appraisers left the business,” he said.

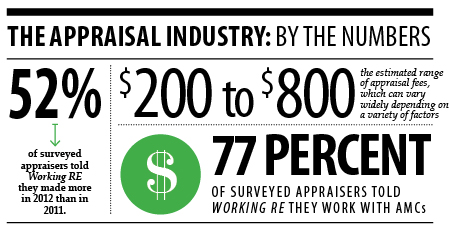

Industry players have noted a growing impatience with the regulatory scrutiny, saying that many are weary from constant concerns about compliance, and in light of minimal profits, they’re not finding the payout to be worth the trouble. In some cases, HECM-certified appraisers have opted to scale back the amount of FHA work they accept in order to focus on more conventional work on the forward side, where the refinance boom has generated a higher volume of simplified assignments and where regulations are less severe.

The Impact on HECM Lenders The problems imploding in the appraisal sector have had a palpable impact on HECM lending. Already, some lenders have noted that fees are rising, and that will likely continue as the demand for a limited number of appraisers remains high.

The cost of an appraisal can vary widely depending on a variety of influencing factors, including the location, the AMC and the lender. Currently, the average cost of a full-fee residential appraisal starts at about $300 to $350 in most metropolitan markets. But as a result of this appraiser shortage, many expect to see these fees rise. It’s a simple case of supply and demand.

While they are not perhaps immediately palatable for reverse mortgage lenders, higher appraisal fees do have an upside: They could help jumpstart this stalling industry.

While they are not perhaps immediately palatable for reverse mortgage lenders, higher appraisal fees do have an upside: They could help jumpstart this stalling industry.

With the promise of greater profits, more people could be enticed to enter the workforce. Higher fees would also elevate appraiser satisfaction, which is notably low, and help the industry in its recruitment efforts. And of course, higher fees would help ensure quality. Busy and underpaid appraisers are not going to churn out acceptable work. A higher fee might provide that extra incentive to complete the job properly and with care.

The bottom line is that the appraisal sector has undergone a drastic decline and as a result, lenders are not going to get the same service for the same price anymore… perhaps instead of being reactive to what is clearly at the end of this path, both industries should work together and be proactive about instituting change.

Can the Problem Be Solved? Many familiar with the appraiser situation and its impact on HECM lending admit that it’s not an easy problem to solve. But if lenders collectively decide to do nothing, the problem will likely get worse. Consider the situation in Montana, for example. There, six-week turnaround times and $800 fees are the standard, simply because there are more transactions than certified appraisers and the closest appraiser might be 100 miles away. If we continue to witness this decline without attempting to change the narrative, we may very well see Montana’s standard become the norm in other parts of the country.

Perhaps instead of being reactive to what is clearly at the end of this path, both industries should work together and be proactive about instituting change. This means that HECM lenders might need to simply accept slightly higher fees and slightly longer turnaround times. We might need to just face the fact that the old 48-hour post-inspection turnaround is no longer a reasonable expectation.

But if lenders agree to accept this change, they should also have the right to demand a higher quality of work and a better level of service. If lenders are able to give a little, perhaps appraisers will too.

Within the appraisal industry itself, many say they hope to see changes made to the training requirements so that working appraisers are given an incentive to mentor trainees. Some also say the FHA should ask Congress to pass legislation allowing licensed—not just certified—appraisers to work on FHA projects, thereby increasing the appraiser pool for HECM lenders. But, considering the tough regulations surrounding government-sponsored programs, others contend that such a change is unlikely.

Still, even if helpful modifications can be made, the fact remains that things are not going to drastically improve any time soon. Provided that recruitment efforts do pick up steam, it will take time to bring in a new crop of appraisers given the current two- to three-year education and training period. In the meantime, lenders are left with few options other than to begin a dialogue with the appraiser community in the hopes of supporting the industry’s evolution so that we can continue to work together to help the borrowers we serve.