The sluggish growth of the U.S. economy continues to be stalled by household dept, declines in home values, financial institutions protecting fragile capital adequacy and fiscal consolidation at all levels of government.

The latest Economics and Mortgage Market Analysis report from Fannie Mae forecasts slow growth to extend through 2012 as analysts continue to downgrade their outlooks for the coming months. The consensus is that the stability of the recovery remains fragile and is vulnerable to any additional shocks. Consumer spending has picked up, but inventories have not kept pace indicated doubts that the growth in spending will continue.

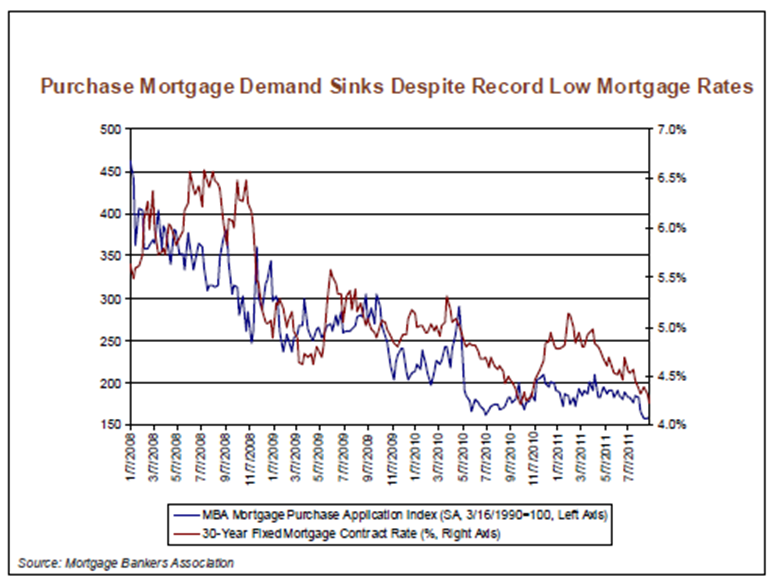

Struggling to find positive light in the housing market, the report points to continuing pressure led by subdued housing demand. With 9 percent unemployment and another 26 percent worried about their job stability, combined with weak home values and tight lending environment, the outlook for purchased mortgage demand is hovering at the lowest level since 1996.

In addition to weak purchase demand, the Mortgage Bankers Association indicated an increase in mortgage delinquencies in the second quarter of 2011. Although mortgage interest rates are expected to remain low, the weight of the overall economy appears to continue to dampen growth in the purchase market, and accordingly, appreciation of home values.