In a hearing before the House Financial Services Subcommittee on Insurance, Housing, and Community Opportunity entitled "HUD and NeighborWorks Housing Counseling Oversight," participants pointed to the need for funding to be restored to support counseling programs.

Appearing in the first panel, Deborah Holston, Acting Deputy Assistant Secretary for Single Family Housing at HUD stated that the recent budget debate that resulted in an $88 million cut of counseling funding has put consumer protections provided by the programs at risk. In order to support the renewal of funding, she stated that HUD has been work to improve the process and oversight to ensure the funding is used more effectively.

"As part of our ongoing efforts to assess and improve this program," Holston said, "HUD has identified ways to streamline and improve the housing counseling program, deliver grant money more quickly, and restore confidence that an investment in housing counseling is a worthwhile investment of public funds."

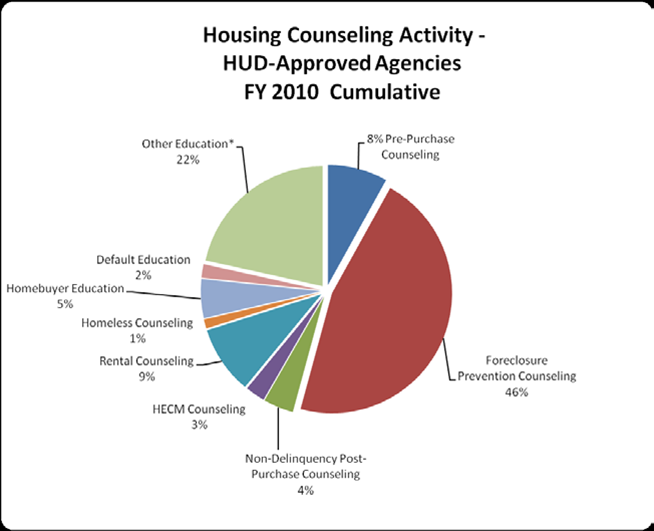

She pointed to the importance of the housing counseling programs to assist homeowners during this economic crisis, highlighting that 46% of counseling sessions have been related to foreclosure prevention. The breadth of available programs available, especially during current times, rely on support from HUD, she indicated.

In terms of HECM counseling, which has accounted for 3.6% of all counseling sessions between 2005 and 2010, Holston pointed to the importance of the HECM program to help older Americans fund their latter years and reduce the need for public assistance.

"As more Americans retire and decide to “age in place,” tapping home equity will become an increasingly popular means to fund retirement," Holston said. "Housing counselors help seniors make wise choices regarding reverse mortgages and protect seniors against unscrupulous lenders and financial advisors. HUD-approved counselors play a critical role in ensuring these services are provided to seniors at low or no cost."

Holston stated that with increased efficiency and oversight of counseling programs, especially from the creation of the new Office of Housing Counseling at HUD as required by the Dodd-Frank Act, HUD will be able ensure that funding provided is utilized effectively in providing the necessary support to counseling programs.

Appearing in the second panel, NRMLA President Peter Bell focused on the importance of HECM counseling. He pointed to the importance of including home equity in the discussion regarding the challenges faced in funding longevity. Home equity, he said, remains one of older Americans greatest assets.

Counseling has become a hallmark of the HECM program." Bell said. "It is a very effective consumer safeguard and its impact can be seen in the limited and isolated number of instances where there has been evidence of fraud or elder financial abuse within the HECM program."

With the combination of HUD mandate and the importance of the counseling to helping senior understand the HECM program, Bell stated that it is vital the the program is available to all borrowers, especially to those with limited means.

Additionally, Bell highlighted how the counseling programs designed to help HECM borrowers in technical default due to unpaid taxes and insurance to help borrowers find remedial solutions to resolve the issue.

He acknowledged that if Congress were to restore the funding, the various participants in the counseling program would need work collaboratively to make sure that the process for utilizing the funds is streamlined and implemented effectively.