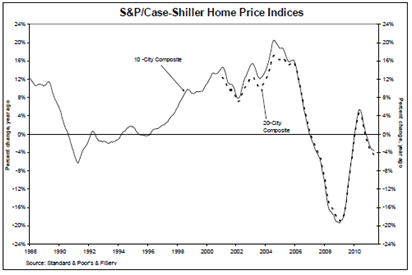

Seasonal improvement in home prices fueled the second consecutive month of increases in the S&P/Case-Schiller Home Price Indices with data through May.

The 10-city and 20-city composites increased for the month by 1.1% and 1.0% respectively with 16 of the 20 MSAs posting a positive monthly increase. Although the monthly gains marks a positive seasonal improvement, both composites are still down compared to the previous May. The 10-city composite is down 3.6% compared to last year, and the 20-city composite is down 4.5%.

“We see some seasonal improvements with May’s data,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “This is a seasonal period of stronger demand for houses, so monthly price increases are to be expected and were seen in 16 of the 20 cities. The exceptions where prices fell were Detroit, Las Vegas and Tampa. However, 19 of 20 cities saw prices drop over the last 12 months. The concern is that much of the monthly gains are only seasonal."

In additional to the uptick in home sales, the report noted that single-family housing starts increased moderately in June and have reached the same pace as a year ago. Existing home sales is trending flat in June being reported as due to contract cancelations and tight credit. Blitzer suggests that the data is pointing to a continuing "bounce-along-the-bottom" scenario that the housing market has been mired in the past two years.

We have now seen two consecutive months of generally improving prices; however, we might have a long way to go before we see a real recovery," Blitzer said. "Sustained increases in home prices over several months and better annual results need to be seen before we can confirm real estate market recovery.”