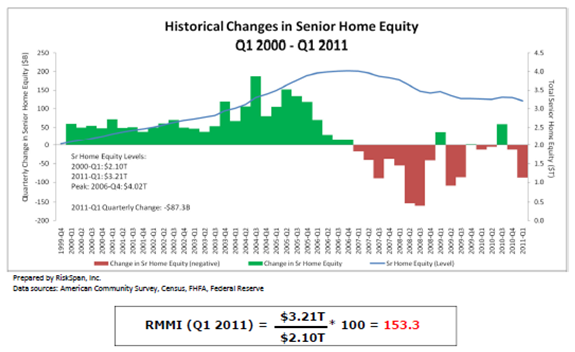

The amount of equity held in the homes of seniors held above $3 trillion in the first quarter of 2011 according to latest NRMLA/RISK SPAN Reverse Mortgage Market Index (RMMI).

The RMMI fell by 3% to $3.2 trillion in the first quarter fueled by weakening in the housing market. However, losses were mitigated by mortgage debt levels falling for the seventh consecutive quarter to the lowest levels since quarter 2 of 2007.

“This index shows that seniors continue to have significant equity in their homes, despite modest declines in home prices,” said Peter Bell, President of the National Reverse Mortgage Lenders Association. “For many seniors looking for an effective way to fund longevity, a reverse mortgage remains a helpful solution.”

The RMMI produced on a quarterly basis has tracked the amount of home equity held by seniors since Q1 2000. The first quarter tracked also serves as the base period for the index, tracking equity relative to that period.