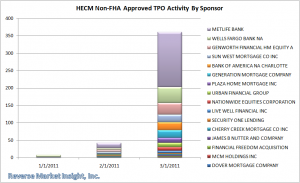

The changing landscape of the reverse mortgage industry due to new regulations is taking shape. According to the latest Wholesale Leaders Report from Reverse Market Insight (RMI), HECM originations by non-FHA third-party originators (TPOs) jumped in the last month of the first quarter.

The growth in TPO activity, however, wasn't enough to extend the growth of wholesale/broker endorsements, which fell by 0.7% in march. Direct/Retail endorsements on the other hand leaped ahead with a jump of 10.8% for the month. The total for the year so far, 409, is enough to boost the TPO category into number 20 for endorsements (RMI is not able to track these individually yet, so they are consolidated in the lender list as "Unknown").

The 7,300 loans produced in March was a 6.1% boost over February. Retail endorsements made up 4,515 of that total, with wholesale producing 2,785. After gaining ground for two consecutive months, wholesale production, March was a step back for the wholesale channel.

In the top 10, 4 lenders reached 12 month highs in March that corresponded with the industry crossing over into positive year-over-year growth, as well.

Industry behemoth Wells Fargo saw their market share jump to 31.9% in March compared to their 12 month average of 26.4%. Sun West crept back into the top 10 for the first time since November. Thus far this year, Urban is the only top 10 lender to see positive growth in the wholesale channel at 2.9%