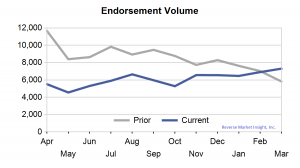

Retail endorsement volume finally crossed over into positive year-over-year growth in March, as the slow upward trend exceeded declines from March of 2010. According to the latest Retail Leaders Report from Reverse Market Insight (RMI) March endorsements, at 7,306, increased by 24.4% from March of last year when industry volume was in steep decline.

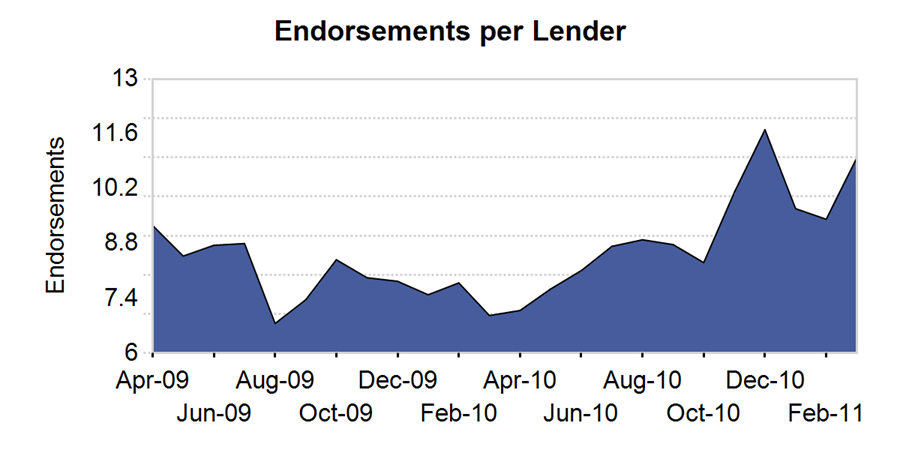

The March volume was also an increase of 5.8% over February, even while the total number of contributing lenders decreased by 9.3%. Accordingly, the average number of endorsements per lender jumped to nearly 11 units, the second highest level in the past two years.

Although 4 out of the top ten producing lenders year-to-date did decline in March, however, their overall market share increased to 60.76%. Their increase for the month also was 15.45% jump over February. MetLife Bank, One Reverse Mortgage and Generation Mortgage saw the biggest jumps in volume for March, with month-over-month increases of 53.6%, 34.92% and 32.86% respectively.

Growth also reached across geographic areas, with 8 out of 10 regions tracked by RMI showing positive growth. Of the two that did not see increases, the Northwest/Alaska was equal to the prior month and the other, the Midwest, was only 5 units lower than the previous month.

As the industry strives to sustatin positive growth momentum, it will be interesting to watch how the distribution continues to develop, especially as the impact of new requlations begins to work its way into production numbers.