Genworth Mortgage Insurance, an operating segment of Genworth Financial, announced Wednesday it will reduce its national monthly and single premium borrower-paid mortgage insurance rates.

The company announced two rate adjustors, co-borrower and debt-to-income ratio, for the monthly borrower paid mortgage insurance plan. The new price reductions will go into effect on June 4, 2018.

“Our goal is to implement prudent pricing solutions that increase homeownership opportunities for qualified borrowers and deliver attractive returns to our shareholders,” said Rohit Gupta, Genworth Mortgage Insurance president and CEO. “Today's announcement further emphasizes our desire to address evolving affordability needs in a clear and transparent manner, and more granularly differentiate performance of the loans we insure.”

Under the new rates, loans with co-borrowers will see an approximate decrease of 18% from the current rates, while loans to borrowers with a DTI more than 45% will see a decrease of about 8% from current rates. Overall, the average borrower will see a decrease of about 10%.

“Genworth is committed to remaining competitively priced in the market and refining our pricing across key risk characteristics,” Gupta said. “Introducing these transparent rates balances these business objectives following the recent reduction to the federal tax rate and the current favorable macro-economic conditions.”

“Our new pricing maintains similar mid-teen returns, which are above our cost of capital and internal hurdle rates,” he said. “We look forward to implementing our changes in June and to continued innovation that drives our business forward.”

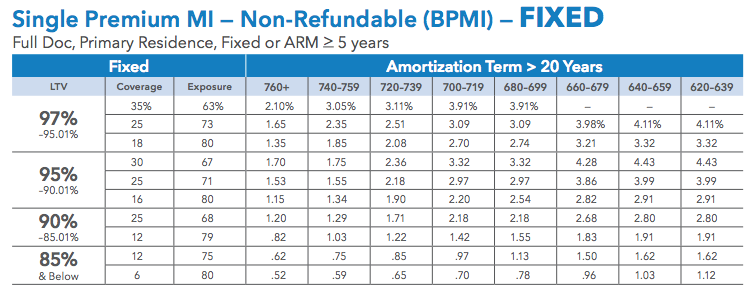

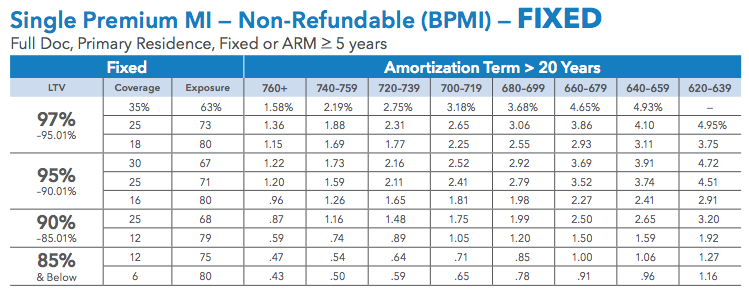

The charts below show the changes in rates for Genworth’s single premium MI for fixed loans. They compare the current rates [left] with the changed rates set to take effect June 4th [right.]

Click to Enlarge

To see charts on all Genworth’s products with their rate changes, click here.

But Genworth isn’t the first mortgage insurance company in recent weeks to announce it is cutting its borrower-paid rates. At the beginning of April, MGIC Investment Corp. announced it reduced its mortgage insurance premium rates by an average 11%.

Last year, the Federal Housing Administration announced a cut to its mortgage insurance premiums, which President Donald Trump’s administration halted on inauguration day.

Then in November, despite some thought that the FHA may reinstate the cut, the U.S. Department of Housing and Urban Development announced that premiums will not be cut, due in part to the weaker-than-expected performance of the FHA’s flagship insurance fund, the Mutual Mortgage Insurance Fund.

And now, a new analysis from the Urban Institute suggests private mortgage insurance is growing more competitive against the FHA.

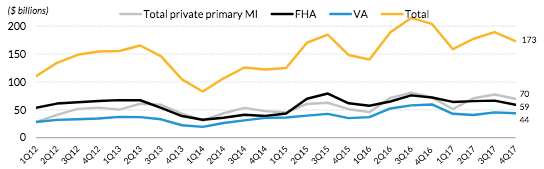

In the fourth quarter of 2017, mortgage insurance activity decreased from all sources, the FHA, VA and private mortgage insurers, dropping from $189 billion in the third quarter to $173 billion, according to the April 2018 Housing Finance at a Glance monthly chartbook from the Urban Institute. This decrease also represents a fall of 15% from the fourth quarter of 2016.

While private mortgage insurance and the FHA each decreased by $7 billion in the fourth quarter, the VA share decreased by $2 billion.

But even with these decreases, the chart below shows total private MI surpassed the FHA share of mortgage insurance at the beginning of 2017.

Click to Enlarge

(Source: Urban Institute)

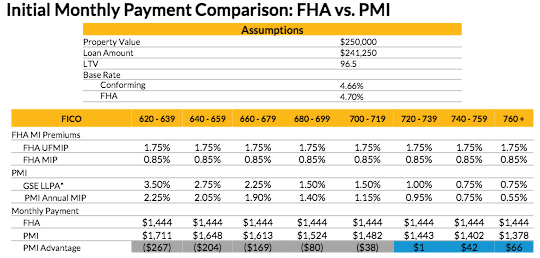

And as private mortgage insurance struggles to make itself more competitive, it is now, at times, more financially sound for buyers to choose a private mortgage insurance option, rather than going with FHA.

The chart below, which uses data from Genworth Mortgage Insurance, Ginnie Mae, MGIC and the Urban Institute, shows the breakdown of when private MI is the more affordable option. The PMI advantage highlighted in grey shows when FHA is the more affordable option, while the scenarios highlighted in blue show it is better to go with private MI.

Click to Enlarge

(Source: Urban Institute)