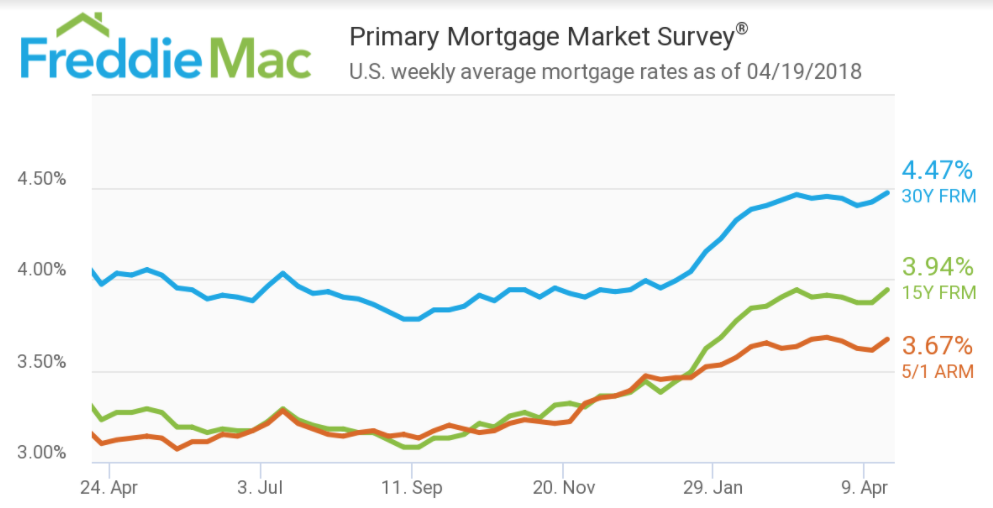

Mortgage rates soared this week to their highest level since 2014, according to Freddie Mac’s weekly Primary Mortgage Market Survey.

“Following Treasuries, mortgage rates soared,” said Len Kiefer, Freddie Mac deputy chief economist. “The U.S. weekly average 30-year fixed mortgage rate rose five basis points to 4.47% in this week’s survey, its highest level since January of 2014 and the largest weekly increase since February of this year.”

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage increased to 4.47% for the week ending April 19, 2018. This is up from last week’s 4.42% and from 3.97% last year.

The 15-year FRM also increased, rising from 3.87% last week to 3.94%. This is up from 3.23% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased from 3.61% last week and 3.1% last year to 3.67%.

“Treasury yields rose ahead of the release of the Fed’s Beige Book and speeches from New York Fed President William Dudley and Fed Governor Randal Quarles,” Kiefer said. “According to the Beige Book, economic activity in March and early April continued to expand at a moderate pace, however there is concern from various industries surrounding tariffs.”