The overall delinquency rate remained unchanged in December as early stage delinquencies increase by serious delinquencies fell, according to the latest Loan Performance Insights Report from CoreLogic, a property information, analytics and data-enabled solutions provider.

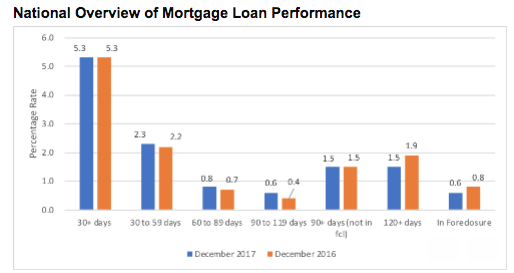

The overall delinquency rate came in at 5.3% of all mortgages in December, unchanged from December 2016.

The foreclosure inventory rate, which measures the share of mortgages in some stage of the foreclosure process, decreased to 0.6% in December. This is down 0.2 percentage points from 0.8% in December 2016. In fact, since August, the foreclosure inventory rate has held steady at 0.6%, the lowest level since June 2007 when it was also 0.6%. December’s foreclosure inventory rate was the lowest for that month in 11 years – since 2006.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market, CoreLogic explained in its report. To monitor mortgage performance comprehensively, the company examines all stages of delinquency, as well as transition rates, which indicate the percentage of mortgages moving from one stage of delinquency to the next.

The rate of early-stage delinquencies, or those that are 30 to 59 days past due, was 2.3% in December, up 0.1 percentage point from 2.2% in November and December 2016.

The share of mortgage that were 60 to 89 days past due decreased slightly, falling to 0.8%, down from 0.9% in November but up 0.7% in December 2016.

The series delinquency rate, or mortgages 90 days or more past due including loans in foreclosure, increased from last month’s 2% to 2.1% in November. However, this is down from 2.3% in December 2016, marking the lowest rate for December since 2006 when it was 1.5%.

“The wildfires in Sonoma and Napa counties began October 8 and destroyed or damaged thousands of homes,” CoreLogic Chief Economist Frank Nothaft said. “Two- and three-month delinquency rates have spiked in these two counties, more than doubling between October and December.”

“The after effects of Hurricanes Harvey, Irma and Maria continue to appear as well,” Nothaft said. “Serious delinquency rates in the Houston and Miami metropolitan areas doubled between September and year-end and quadrupled in the San Juan area of Puerto Rico.”

Click to Enlarge

(Source: CoreLogic)

The share of mortgages that transitioned from current to 30 days past due increased 0.1 percentage point from November and December 2016 to 1.1% in December, this was the highest rate for December since 2013’s 1.2%.

For comparison, in January 2007, just before the financial crisis, the current to 30-day transition rate was 1.2%. It later peaked in November 2008 at 2%.

“The effect of the wildfires and hurricanes on delinquency transition rates was all too clear in our latest analysis,” CoreLogic President and CEO Frank Martell said. “In Sonoma and Napa counties, both 30 to 60 day and 60 to 90 day delinquent transition rates in December were more than double what they had averaged the prior year.”

“Likewise, neighborhoods affected by hurricanes have seen a jump in transition rates in the months immediately following,” Martell said. “These natural disasters have stalled or reversed the decline in 30 to 119 day delinquency rates that we had seen previously.”