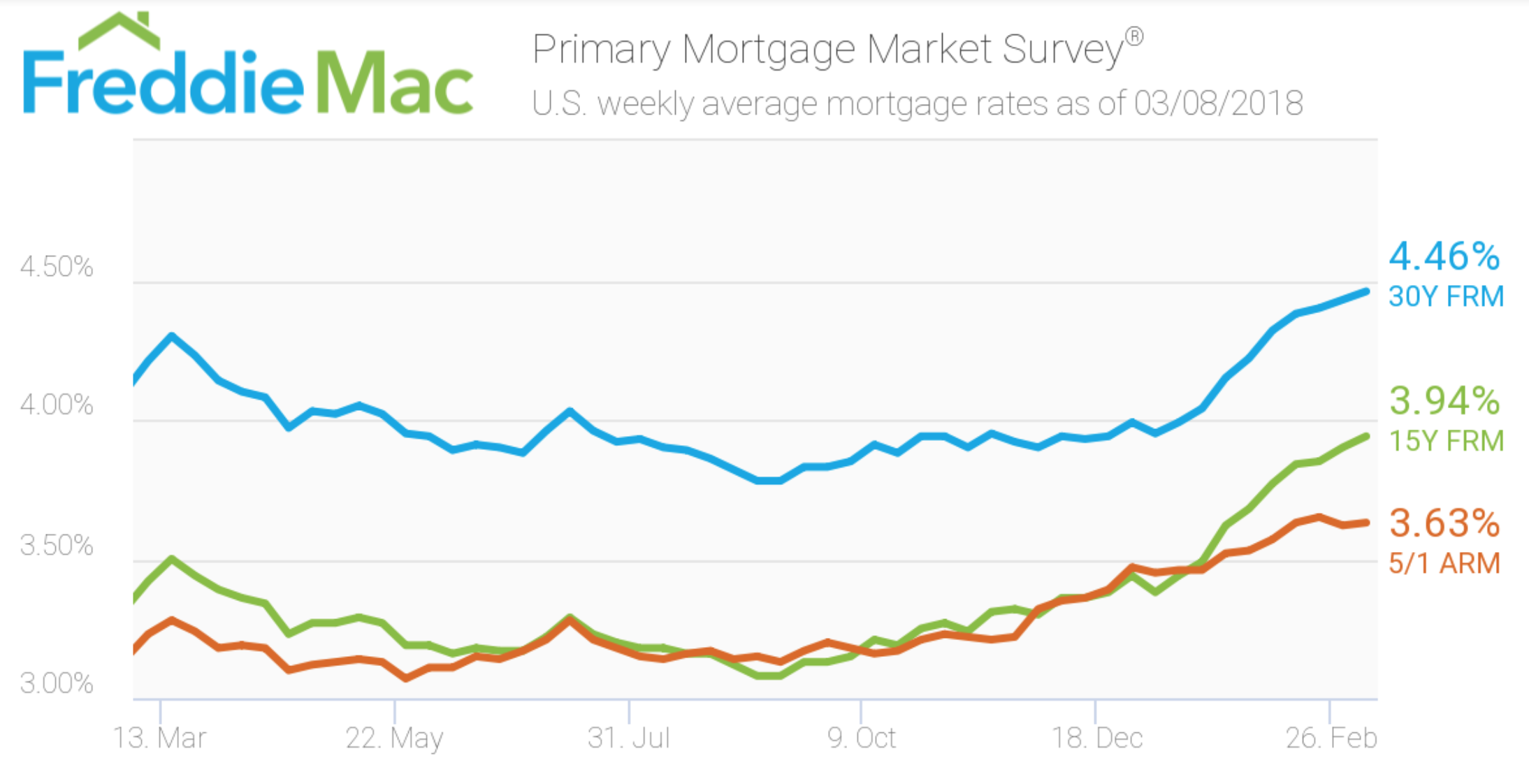

Mortgage rates increased for the ninth consecutive week, as the 30-year rate reached its highest point since 2014, according the Freddie Mac’s latest Primary Mortgage Market Survey.

“The U.S. weekly average 30-year fixed mortgage rate rose three basis points to 4.46% in this week’s survey, its highest level since January 2014,” said Len Kiefer, Freddie Mac deputy chief economist.

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage increased to 4.46% for the week ending March 8, 2018. This is up from last week’s 4.43% and from 4.21% last year.

The 15-year FRM increased from 3.9% last week and 3.42% last year to this week’s 3.94%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased to an average 3.63% this week. This is up slightly from 3.62% last week and 3.23% last year.

“The 10-year Treasury yield has been bouncing around in a narrow 15 basis point range for the last month,” Kiefer said. “While the yield on the 10-year Treasury is currently below the high of 2.95% reached two weeks ago, mortgage rates are up for the ninth consecutive week.”