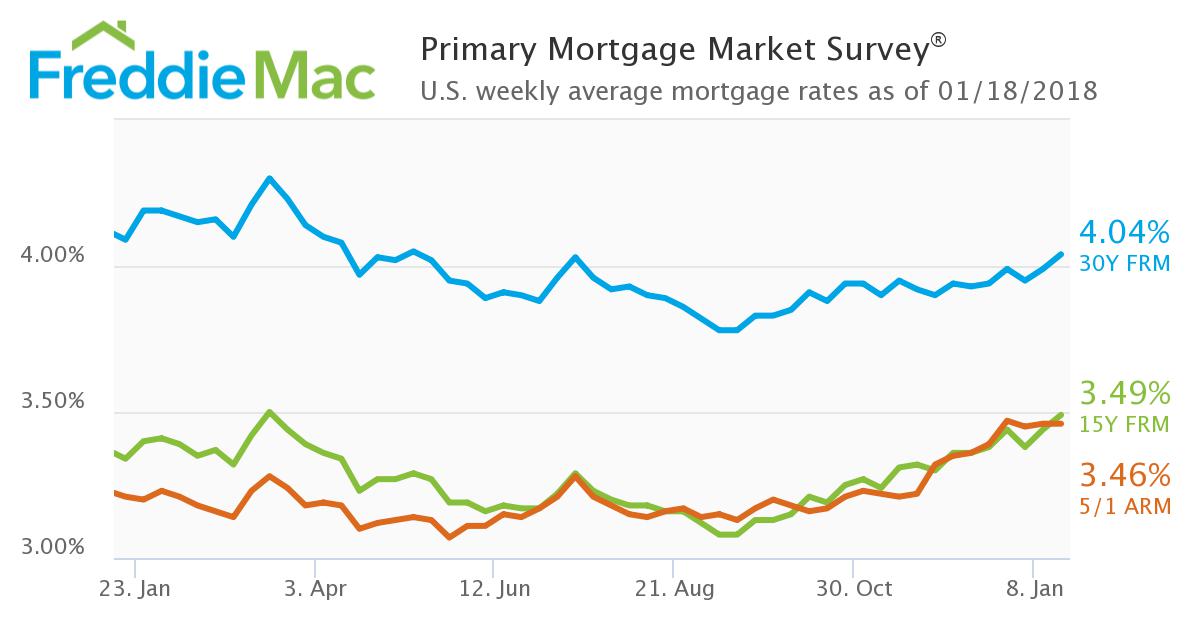

Mortgage rates continued rising in the last week, eventually breaching 4% for the first time since last summer, according to Freddie Mac’s latest Primary Mortgage Market Survey.

Freddie Mac’s report, which was released Thursday morning, shows that the 30-year fixed-rate mortgage rose to an average of 4.04% for the week ending Jan. 18, 2018.

That continued a recent trend of mortgage rates climbing. Last week, the 30-year mortgage checked in at 3.99%.

In fact, this week’s average of 4.04% was the first time that benchmark interest rate broke 4% since July 2017. Interest rates are also the highest they’ve been since May 2017. A year ago at this time, interest rates averaged 4.09%.

(Click to enlarge. Image courtesy of Freddie Mac)

Last week, Zacks, which provides research for investors, predicted that interest rates would climb due to the rise in Treasury yields, and that's just what happened. Here’s Zack’s explanation of the relationship between Treasury yields and mortgage rates:

There is a strong correlation between mortgage interest rates and Treasury yields, according to a plot of 30-year conventional mortgages and 10-year Treasury yields using Federal Reserve Economic Data. Mortgage interest rates are higher than Treasury yields because mortgages are riskier than Treasury bonds. The risk is that some homeowners get into financial difficulty and default on their mortgage obligations. The difference, or spread, between Treasury yields and mortgages interest rates is the risk premium.

So, as Treasury yields rise, so do mortgage rates.

And as Freddie Mac Deputy Chief Economist Len Kiefer explains, interest rates may not fall back below 4% for some time, if at all.

“Some may be wondering if this is the last time we'll see a three handle on the 30-year mortgage rate,” Kiefer said. “Never say never, but inflation is firming, the Federal Reserve’s Beige Book indicates broad-based economic growth and labor markets are tightening. This means upward pressure on long-term rates, like the 30-year fixed-rate mortgage, is building.”

Additionally, Freddie Mac’s report showed that the 15-year FRM averaged 3.49%, up from last week when it averaged 3.44%. A year ago at this time, the 15-year FRM averaged 3.34%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.46% this week, unchanged from last week. A year ago at this time, the 5-year ARM averaged 3.21%.