For the most part, the latest tax reform will boost the average paycheck and do little to harm the housing market.

However, according to two recent expert reports, the devil is in the details.

Thomas Torgerson, co-head of Sovereign Ratings at ratings agency DBRS, said that for most households, tax reform should only have a marginal effect.

“Even in the more expensive metropolitan areas, DBRS estimates that most households with taxable income of less than $400k will see either minimal change or an increase in disposable income,” he wrote in a report today.

“Households with taxable incomes above $400k are likely to experience a decrease in disposable income, though the effects may be muted for households that are already subject to the Alternative Minimum Tax,” he added.

However, things change slightly in areas with higher than average state and local taxes, as well as the more expensive metros in the nation right now. The law caps SALT tax deductions at $10,000, so it’s possible some homeowners may need to move to more affordable areas.

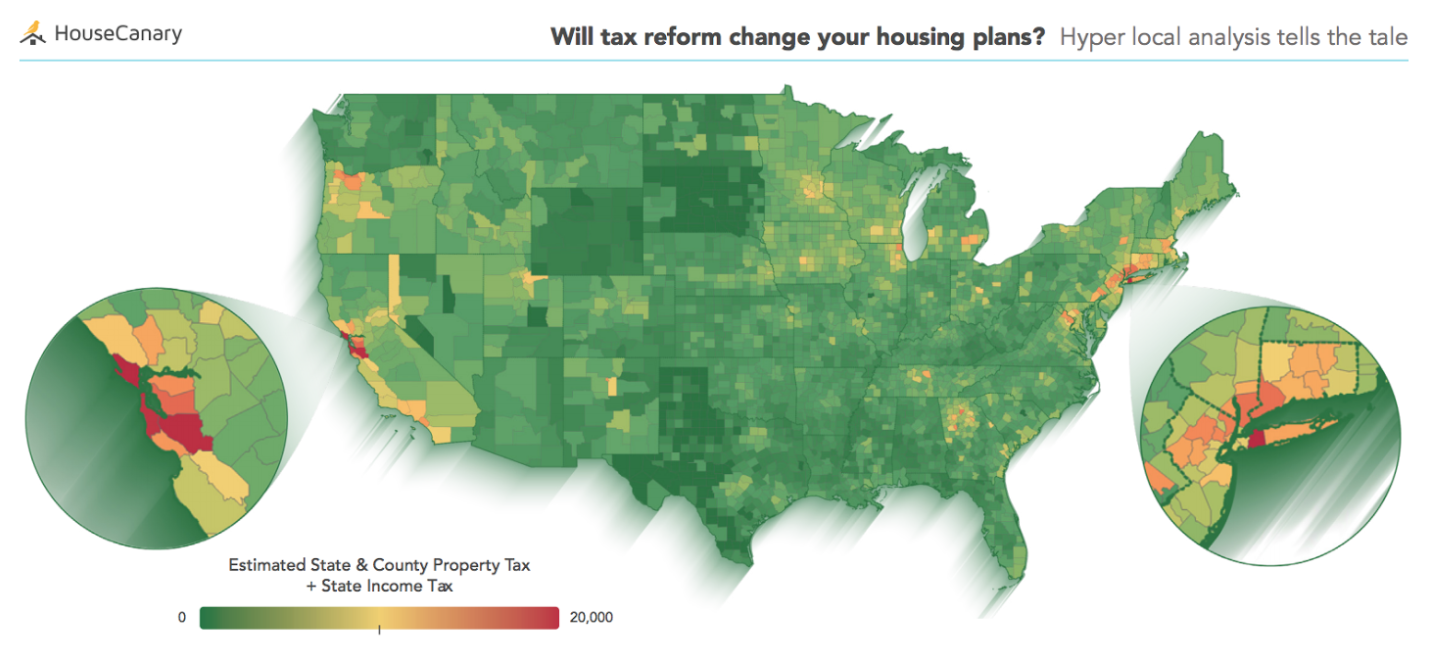

Real estate valuation and data analytics service HouseCanary will soon release the following report: “Will tax reform change your housing plans? Hyper local analysis tells the tale” And in that report, provided early for the benefit of HousingWire’s readers, analysts at HouseCanary dug through mortgages from 2017 between $750,000 to $1 million, to see how many current households would be impacted by the new tax law.

They found, overall, the average estimated household impact in the top 50 MSAs will be $1,950 per year/$162.50 per month.

“In some parts of San Francisco, arguably the most expensive market in the country right now, the median home value is more than $1 million, so it’s fair to assume that the tax bill is going to have a more substantial effect in San Francisco than in parts of the country with much lower median home values,” the report states.

“Home buyers in those markets may need to reassess their spending levels, cut corners, or opt out of the market altogether if the homes they’re reaching to buy become increasingly unaffordable. They may look to more affordable neighboring communities and opt for a longer commute in order to achieve homeownership

— and then it’s only a matter of time before prices start to spike in those neighboring communities, too.”

The areas in red show where tax reform will hit households the hardest:

“Smart buyers and investors will prioritize keeping their fingers on the pulse of neighborhoods and even block areas where they hope to own (or currently own) homes,” HouseCanary said.

According to the Torgerson DBRS report, disposable income is most likely to decline in higher income households with incomes above $400k and particularly above taxable incomes of $1 million, where lower tax rates are more than offset by the expected increase in taxable income due to the loss of SALT deductions.

“In high SALT areas, DBRS estimates the reduction in disposable income is likely to average 3% for taxable incomes between $400k and $1 million, and could exceed 7% at incomes beyond $20 million. However, housing decisions within this income segment are less likely to be constrained by a reduction in disposable income.

Moreover, many of these households are presently subject to the Alternative Minimum Tax.

If the deductibility of SALT is already effectively limited due to AMT, the changes will have less of an adverse impact on disposable income for some of these higher income households. Furthermore, many of these same households should benefit financially from corporate tax changes, either as owners of a pass-through business or simply due to gains already reflected in their stock portfolios.”

Here’s the summary of the DBRS tax reform analysis:

- Tax policy changes, even when directly tied to housing costs, affect demand for housing primarily through disposable income channels. The Tax Cuts and Jobs Act is likely to increase disposable income for the majority of U.S. taxpayers, including many taxpayers affected by the reduction in state and local tax deductibility.

- Higher income buyers may become more sensitive, at the margin, to the lack of deductibility of property taxes, particularly beyond income thresholds of $400k. However, many of these households have other assets (stocks, etc.), which may have already benefited from the expectation of lower corporate tax rates, and income constraints are sometimes a less important factor in housing purchases.

- A relative increase in the cost of homeownership could have adverse effects on housing prices in some markets. Particularly if combined with higher interest rates as a result of monetary tightening and a wider fiscal deficit, real estate prices could soften in more expensive areas.