The 10-year Treasury yield is spiking, hitting its highest point since March, according to Freddie Mac’s latest Primary Mortgage Market Survey.

“After dipping slightly last week, Treasury yields surged this week amidst sell-offs in the bond market,” said Len Kiefer, Freddie Mac deputy chief economist. “The 10-year Treasury yield, for instance, reached its highest point since March of last year.”

And this means mortgage interest rates could also soon spike. This paragraph from Zacks, which provides research for investors, explains why:

There is a strong correlation between mortgage interest rates and Treasury yields, according to a plot of 30-year conventional mortgages and 10-year Treasury yields using Federal Reserve Economic Data. Mortgage interest rates are higher than Treasury yields because mortgages are riskier than Treasury bonds. The risk is that some homeowners get into financial difficulty and default on their mortgage obligations. The difference, or spread, between Treasury yields and mortgages interest rates is the risk premium.

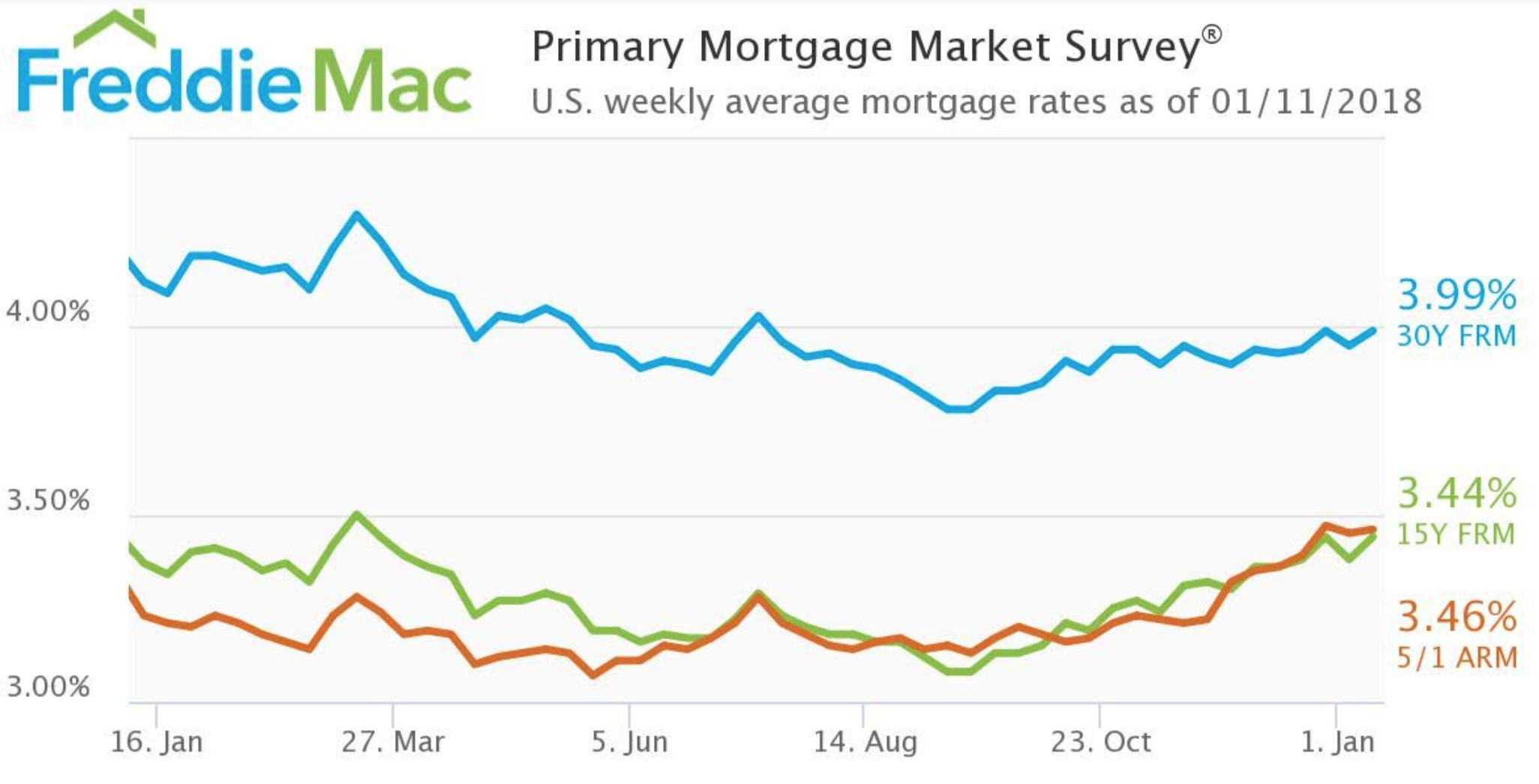

The chart below shows mortgage interest rates also increased.

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage increased to just below the 4% mark at 3.99% for the week ending January 11, 2018. This is up from last week’s 3.95% but still down from 4.12% last year.

The 15-year FRM also increased, rising from 3.38% last week and 3.37% last year to 3.44% this week.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.46% this week, up slightly from 3.45% last week and from 3.23% last year.

“Mortgage rates followed Treasury yields and ticked up modestly across the board,” Kiefer said. “The 30-year fixed-rate mortgage averaged 3.99%, up four basis points from a week ago.”