Millennials continue to surge into the housing market, their demand rising unchecked by rising home prices or increasing mortgage rates.

Ellie Mae’s Millennial Tracker showed these first-time homebuyers saw a jump of more than .5 percentage points from their mortgage rates last year, yet they continue to buy homes.

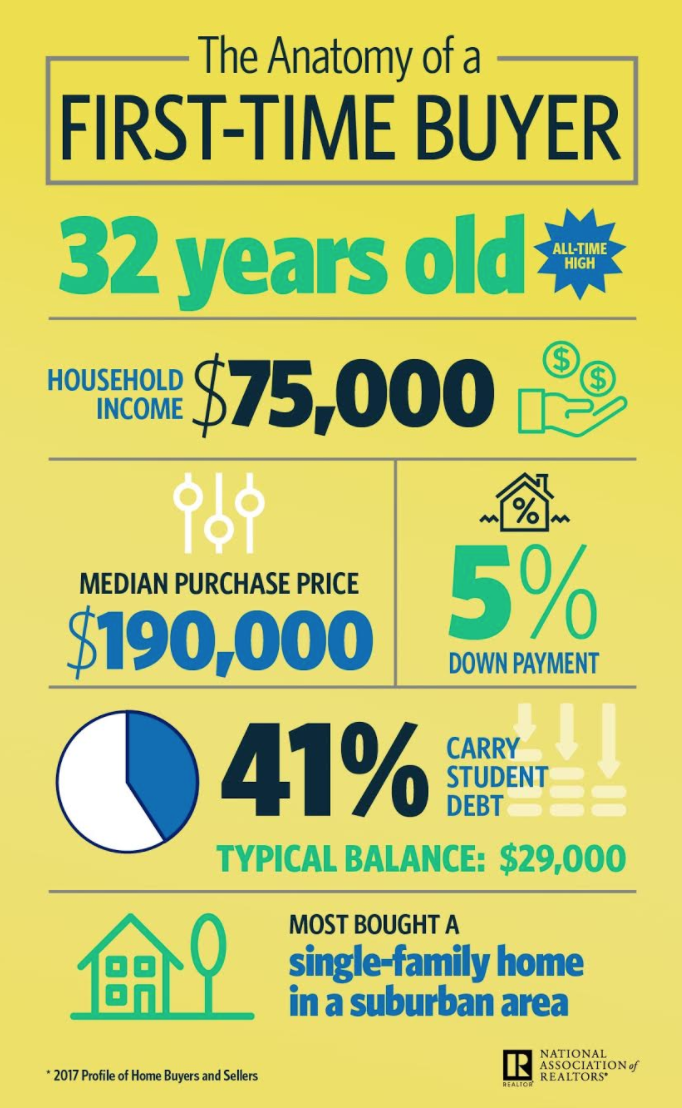

Now, a new infographic from the National Association of Realtors shows exactly what these younger homebuyers look like, and what they want. NAR pointed out Millennial homebuyers faced various obstacles in their path to homeownership including higher rents and home prices, tight inventory conditions and repaying student loan debt.

These impediments continue to hold first time homebuyers at just 34% of all market transactions, down from the historical average of 39% since NAR’s Profile of Home Buyers and Sellers survey began in 1981.

However, despite these obstacles, demand for starter homes remains strong. These are some of the characteristics of a successful first-time buyer.

Their average age is 32 years old, and they earn a household income of $75,000. The average home purchased costs $190,000, for which they usually put in a 5% down payment. The average amount of student loan debt per homebuyer is $29,000.

NAR explained these homebuyers are typically looking for a single-family home to purchase in a suburban area.

A recent report from Ellie Mae showed the most popular metropolitan area for homes purchased by Millennial buyers was Mount Vernon, Illinois. Other popular Midwestern cities included Hutchinson, Kansas, New Philadelphia-Dover, Ohio, Defiance, Ohio, Dickinson, North Dakota, Owosso, Michigan and Ashland, Ohio.