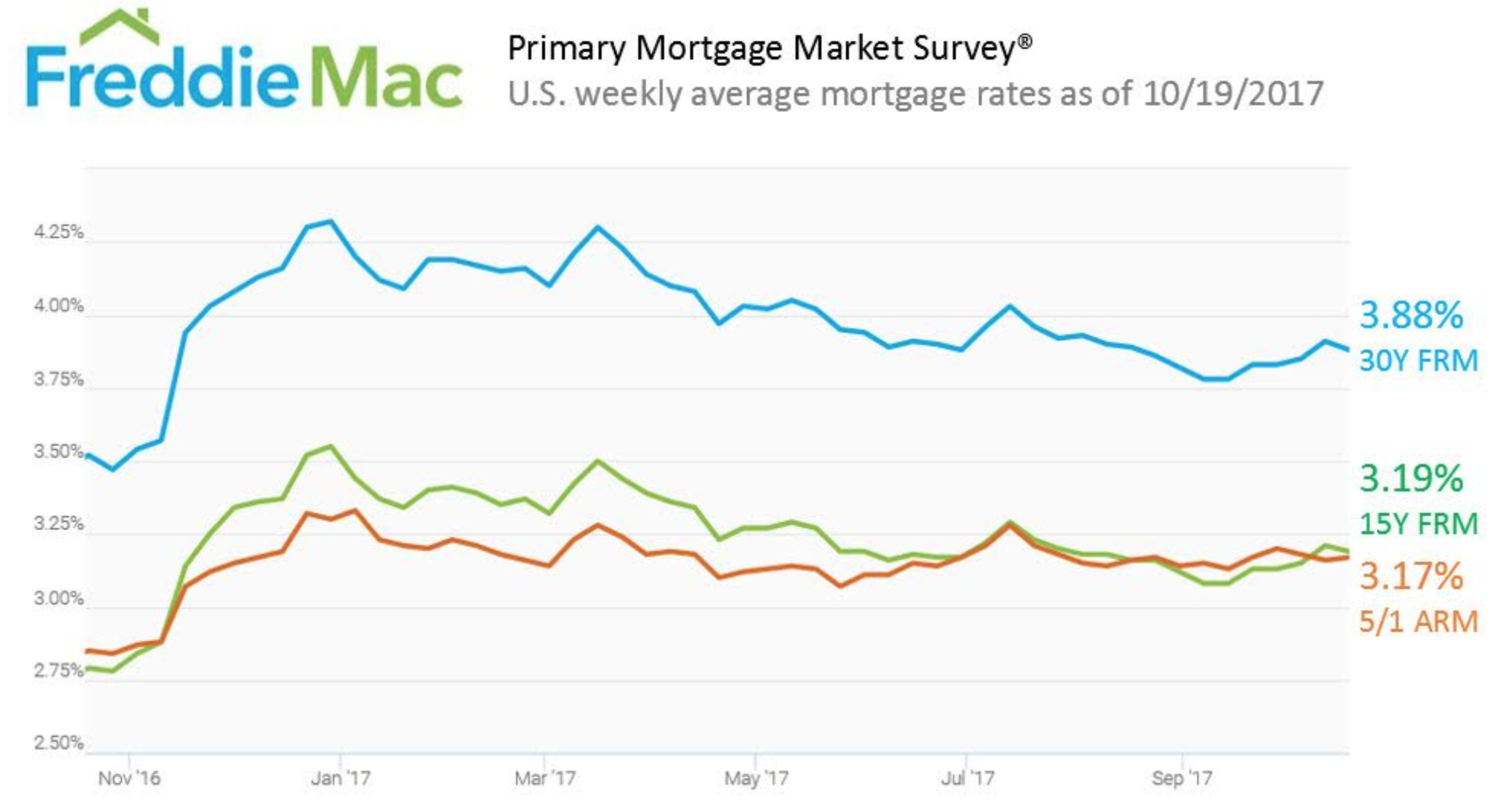

Mortgage rates fell for the first time in two weeks, falling further away from the 4% mark, according to Freddie Mac’s Primary Mortgage Market Survey.

“Rates came down slightly this week, ending a brief, two-week streak of increases,” Freddie Mac Chief Economist Sean Becketti said.

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage dropped to 3.88% for the week ending October 19, 2017. This is down from last week’s 3.91%, but up from 3.52% last year.

The 15-year FRM also decreased, falling from 3.21% last week to 3.19%. This is still up from 2.79% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage ticked up slightly, rising to 3.17%, up from 3.16% last week and 2.85% last year.

“The 10-year Treasury yield dipped six basis points, while the 30-year fixed mortgage rate fell three basis points to 3.88%,” Becketti said.