Late last week, Freddie Mac announced it would be extending its appraisal-free mortgage program to purchase loans starting September 1, 2017.That same day, Fannie Mae also announced their appraisal-free purchase mortgage, offering its product effective immediately.

But what does that mean exactly? Who qualifies? Are the GSEs moving to take appraisers out of the home buying process?

At HousingWire, we set to work to find answers to these questions and more. Here is everything you need to know about the new programs.

For starters, why move to the purchase market to begin with? And how many Fannie and Freddie financed loans will qualify?

Both GSEs already had a program in place for appraisal free refinances. Freddie Mac began their program earlier this summer, while Fannie Mae began offering appraisal-free mortgages on some of its refinances through its Day 1 Certainty program back in 2016.

The answer from both companies was the same: After rising interest rates shifted the market from a refi market and more to purchase, the GSEs extended their programs to meet the needs of the shifting market.

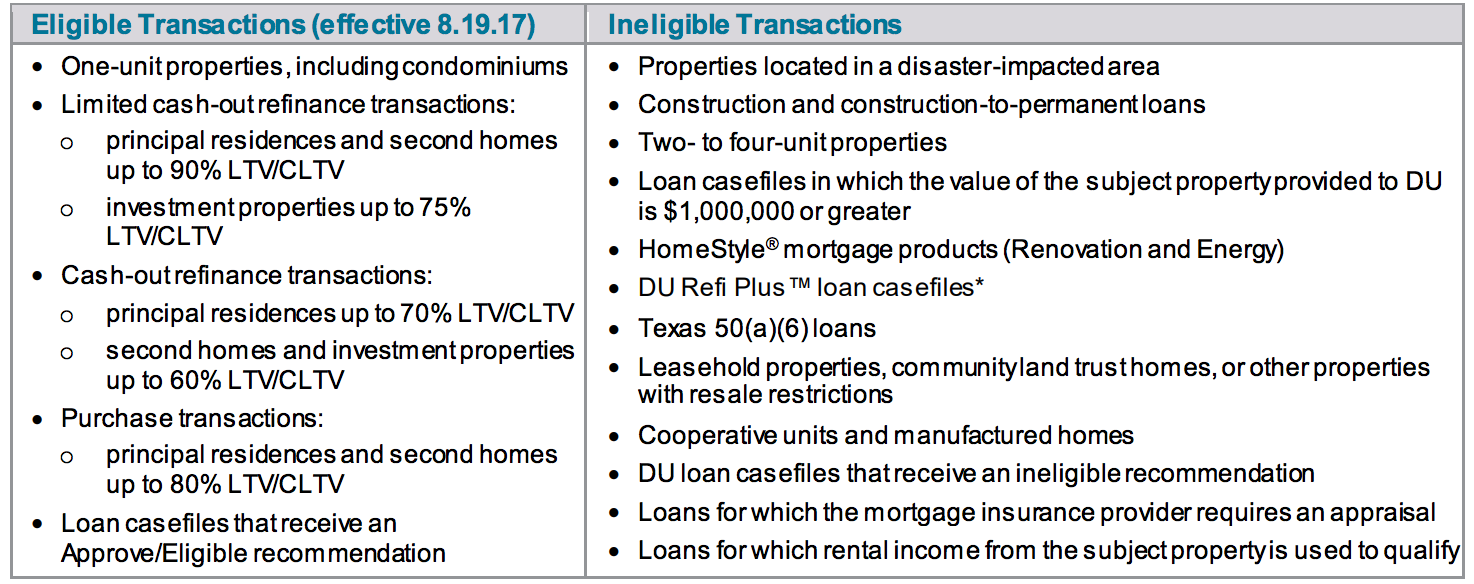

Who qualifies? Zach Dawson, Fannie Mae director of collateral policy, listed several eligibility criteria for Fannie’s Property Inspection Waiver program. Some requirements include the purchase loan having 80% or lower loan-to-value ratio, being single-family and condo properties, primary occupancy and second homes and only when Fannie already has a prior appraisal in electronic format that has been analyzed by Collateral Underwriter.

The chart below shows some eligibility requirements for PIW:

Click to Enlarge

(Source: Fannie Mae)

Freddie also listed several requirements for its Automated Collateral Evaluation including being 80% or lower LTV, a single-family residence, a one-unit dwelling and the borrower’s primary residence.

Andy Higginbotham, Freddie Mac senior vice president of strategic delivery and operations of single-family business, explained that unlike Fannie’s requirements, Freddie ACE loans did not need to have a prior appraisal in the system.

“We’re leveraging previous data around appraisals so we do have those records out there, but it doesn’t have to be exactly that one, and then we look at other sources of data that will also give us additional sources of information so that we get very comfortable with what that value assumption is going to be whether we agree with it or whether we don’t,” Higginbotham told HousingWire. “We don’t have that restriction, and that, frankly, opens up the window to a broader population of eligibility.”

When analyzing the requirements, Dawson explained that it does not expect more than 5% of purchase loans will be eligible for Fannie’s PIW program. Higginbotham said it is too soon to tell how many purchase loans will be eligible for Freddie’s ACE program, but concurs the majority will still need a traditional appraiser.

While neither GSE is currently making plans to expand the program to more borrowers, they also did not deny the possibility.

“Never say never, but I think what we want to do is evaluate what we have over the next few months and make sure that we’re comfortable with the result that we’re getting back and that the process works really well for the lender and the borrower,” Higginbotham said.

And Fannie Mae’s response was similar, ensuring its dedication to continue to improve the mortgage origination process, but still unsure about opening the door to more PIW loans.

“Fannie Mae is going to continue to innovate and continue to lead the market in the area,” Dawson said. “I can’t say definitively yes or no this will or will not expand. Fannie Mae is very committed to driving responsible innovation in the collateral space and trying to modernize the mortgage origination process.”

The GSEs explained a traditional appraisal is still very important to the mortgage origination process, and that job won’t be going away anytime soon.

“I think we’ll constantly be looking at ways to improve the model and to drive that percentage up as much as we can, but I don’t think ever we’ll see anything but the vast majority of the loans still needing that traditional appraisal,” Higginbotham told HousingWire.

He explained that by automating some of the simpler mortgages, appraisals will be able to focus on the ones that need more expertise, saying, “They’ll still have that opportunity for as long as I can see in the future.”