Supply shortages and rising home prices caused pending home sales to fall in May for the third consecutive month, according to the latest report from the National Association of Realtors.

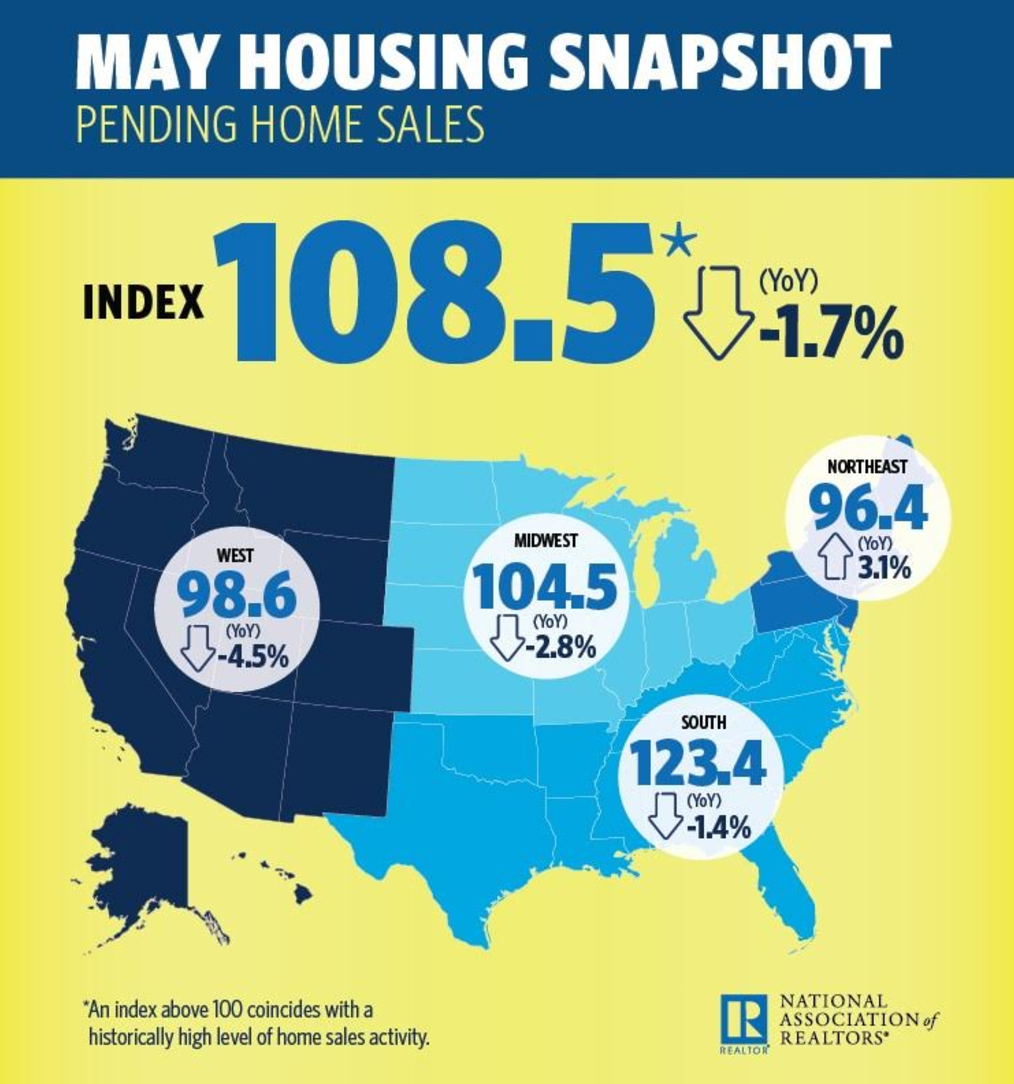

The Pending Home Sales Index, a forward-looking indicator based on contract signings, fell 0.8% to 108.5 in May, down from a downwardly revised 109.4 in April. This marks a decrease of 1.7% from last year, marking the second consecutive annual decline.

The chart below breaks down the increase by geography. While the South saw an annual decrease in May, its pending home sales are still significantly higher than other regions of the U.S.

Click to Enlarge

(Source: NAR)

“Monthly closings have recently been oscillating back and forth, but this third consecutive decline in contract activity implies a possible topping off in sales,” NAR Chief Economist Lawrence Yun said.

“Buyer interest is solid, but there is just not enough supply to satisfy demand,” Yun said. “Prospective buyers are being sidelined by both limited choices and home prices that are climbing too fast.”

The housing shortages are most sever in lower price ranges and entry-level homes, Yun explained. Sales of homes under $100,000 decreased 7.2% from last year, and sales of homes priced between $100,000 and $200,000 is up just 2% from last year.

However, on the other end of the spectrum, sales of homes priced between $750,000 and $1 million surged 26% and sales of those priced at over $1 million increased even more at 29.1%.

NAR’s Housing Opportunities and Market Experience survey, released Monday, showed less renters think now is a good time to buy a home.

“The lack of listings in the affordable price range are creating lopsided conditions in many areas where investors and repeat buyers with larger down payments are making up a bulk of the sales activity,” Yun said.

“Meanwhile, many prospective first-time buyers can’t catch a break,” he said. “Prices are going up and there’s intense competition for the homes they’re financially able to purchase.”

NAR predicts existing home sales will come in at about 5.63 million this year, an increase of 3.2% from 2016’s 5.45 million. It forecasts the national median existing-home price will increase about 5% this year.

“A much higher share of homeowners compared to a year ago think now is a good time to sell, but until they do, sales will likely stay flat and low inventory will keep price growth moving swiftly,” Yun said.