Home prices increased once again in April, according to S&P Dow Jones and CoreLogic’s latest report.

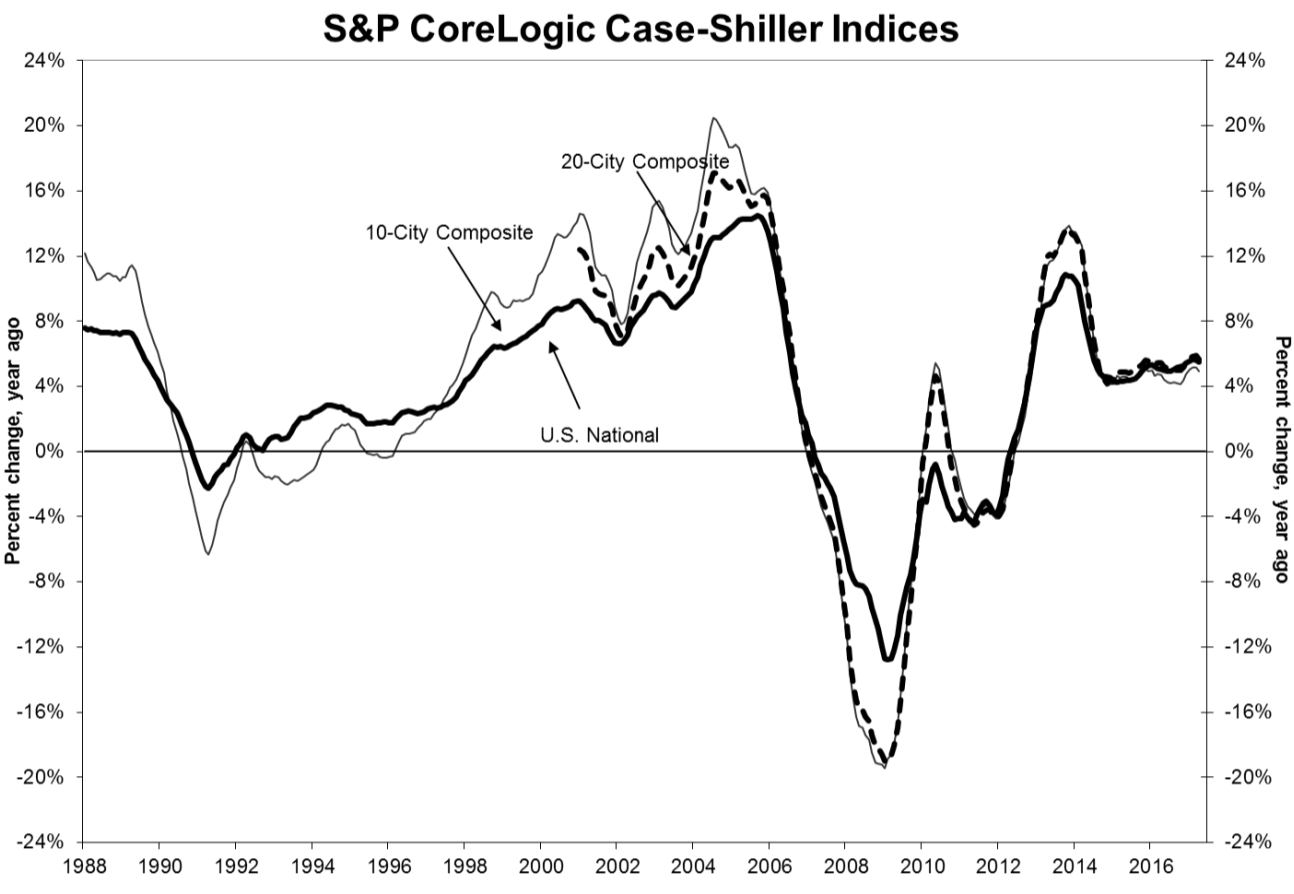

Home prices increased 5.5% in April, slightly slower than last month’s 5.6% increase, according to the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, which covers all nine U.S. Census divisions.

The 10-City Composite saw an annual increase of 4.9%, slightly less than last month’s 5.2%, while the 20-City Composite increased 5.7% annually, down from 5.9% in March.

Click to Enlarge

(Source: S&P Dow Jones, CoreLogic)

“As home prices continue rising faster than inflation, two questions are being asked: why? And, could this be a bubble?” said David Blitzer, S&P Dow Jones Indices managing director and Index Committee chairman. “Since demand is exceeding supply and financing is available, there is nothing right now to keep prices from going up.”

“The increase in real, or inflation-adjusted, home prices in the last three years shows that demand is rising,” Blitzer said. “At the same time, the supply of homes for sale has barely kept pace with demand and the inventory of new or existing homes for sale shrunk down to only a four-month supply.”

“Adding to price pressures, mortgage rates remain close to 4% and affordability is not a significant issue,” he said.

A recent report from First American Financial Corp. showed affordability reversed course in April, increasing for the first time in months. The study showed the housing market is currently 33% more affordable than the housing boom peak.

Home prices also increased monthly. Before seasonal adjustment, the National Index increased 0.9% in April while the 10-City Composite increased 0.8% and the 20-City Composite increased 0.9%. However, after seasonal adjustment, the gains were much lower at 0.2% for the National Index, 0.2% for the 10-City Composite and 0.3% for the 20-City Composite.

A full 18 of the top 20 cities reported home price increases in April before seasonal adjustment, and 13 cities reported increases after seasonal adjustment.

Seattle, Portland and Dallas saw the highest annual home prices gains in the top 20 cities, with increases of 12.9%, 9.3% and 8.4% respectively.

“The question is not if home prices can climb without any limit – they can’t,” Blitzer said. “Rather, will home price gains gently slow or will they crash and take the economy down with them? For the moment, conditions appear favorable for avoiding a crash.”

“Housing starts are trending higher and rising prices may encourage some homeowners to sell,” he continued. “Moreover, mortgage default rates are low and household debt levels are manageable. Household finances should be able to weather a fairly large price drop.”