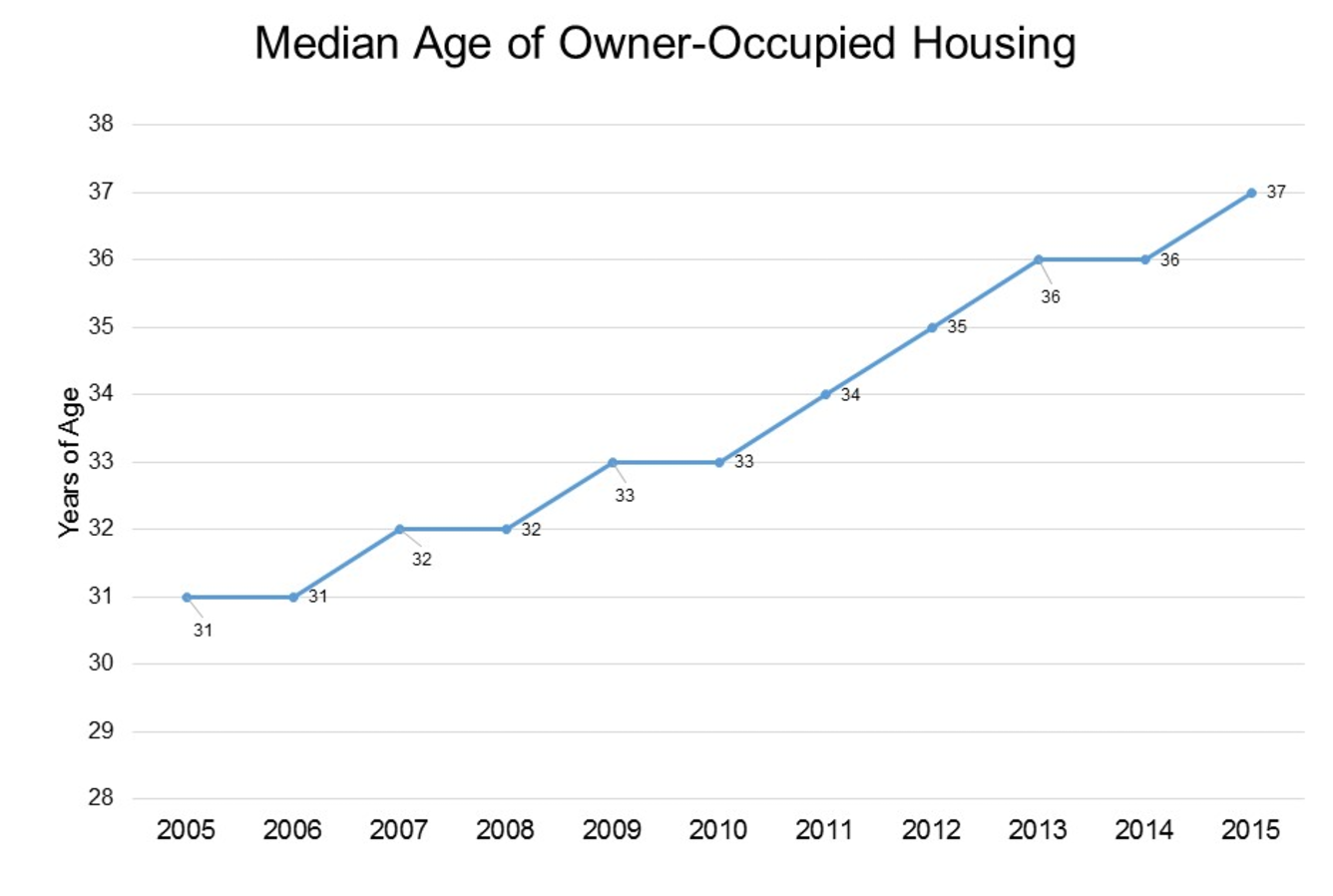

Housing stock continues to age, increasing to 37 years in 2015, up from 31 years a decade ago, according to a blog from the National Association of Home Builders.

This aging trend shows the market could be growing for remodelers as older structures normally require additional remodeling and renovations. Additionally, the aging market could bring a rising demand for new construction in the long run.

This chart shows the median age of owner-occupied housing over the past decade:

Click to Enlarge

(Source: NAHB)

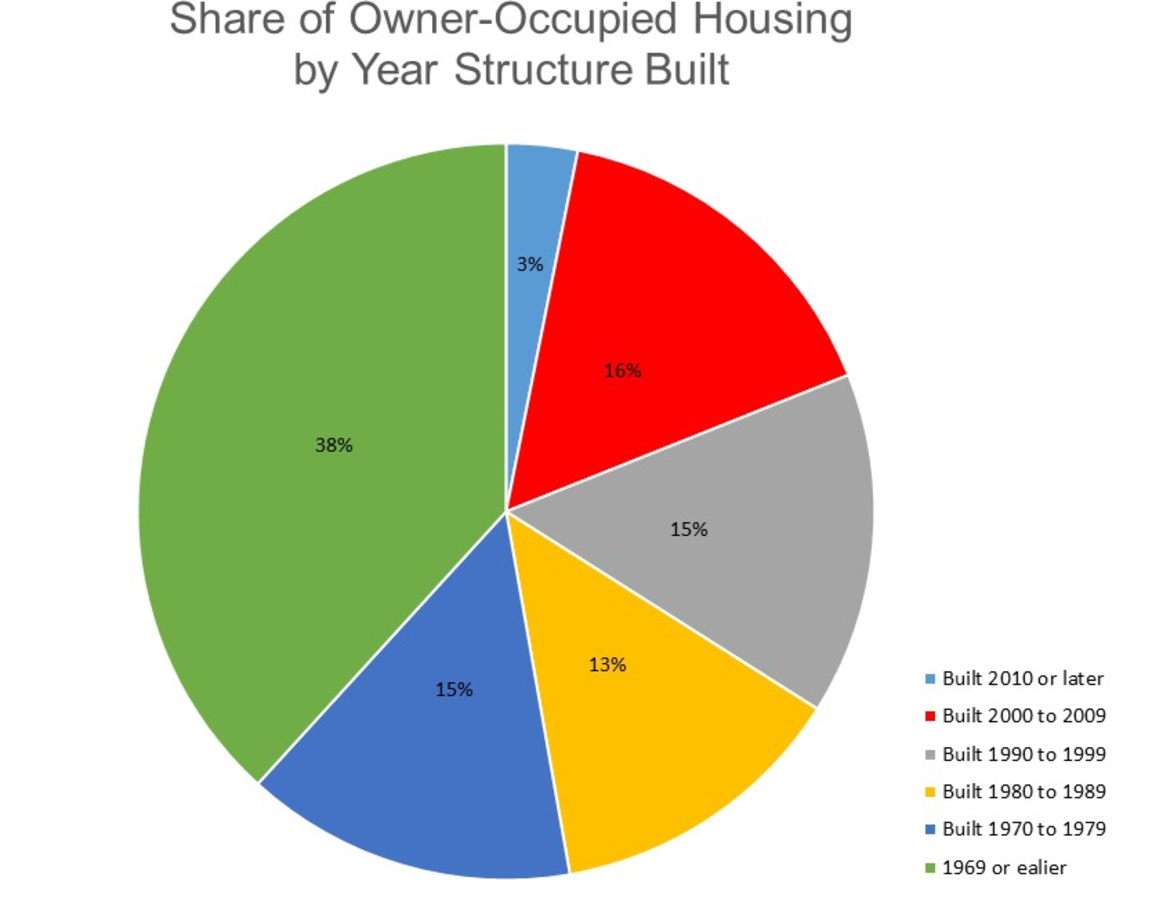

As of 2015, more than half of the owner-occupied housing stock was built before 1980, and 38% of homes were built before 1970. This chart shows the owner-occupied housing by the year the structure was built:

Click to Enlarge

(Source: NAHB)

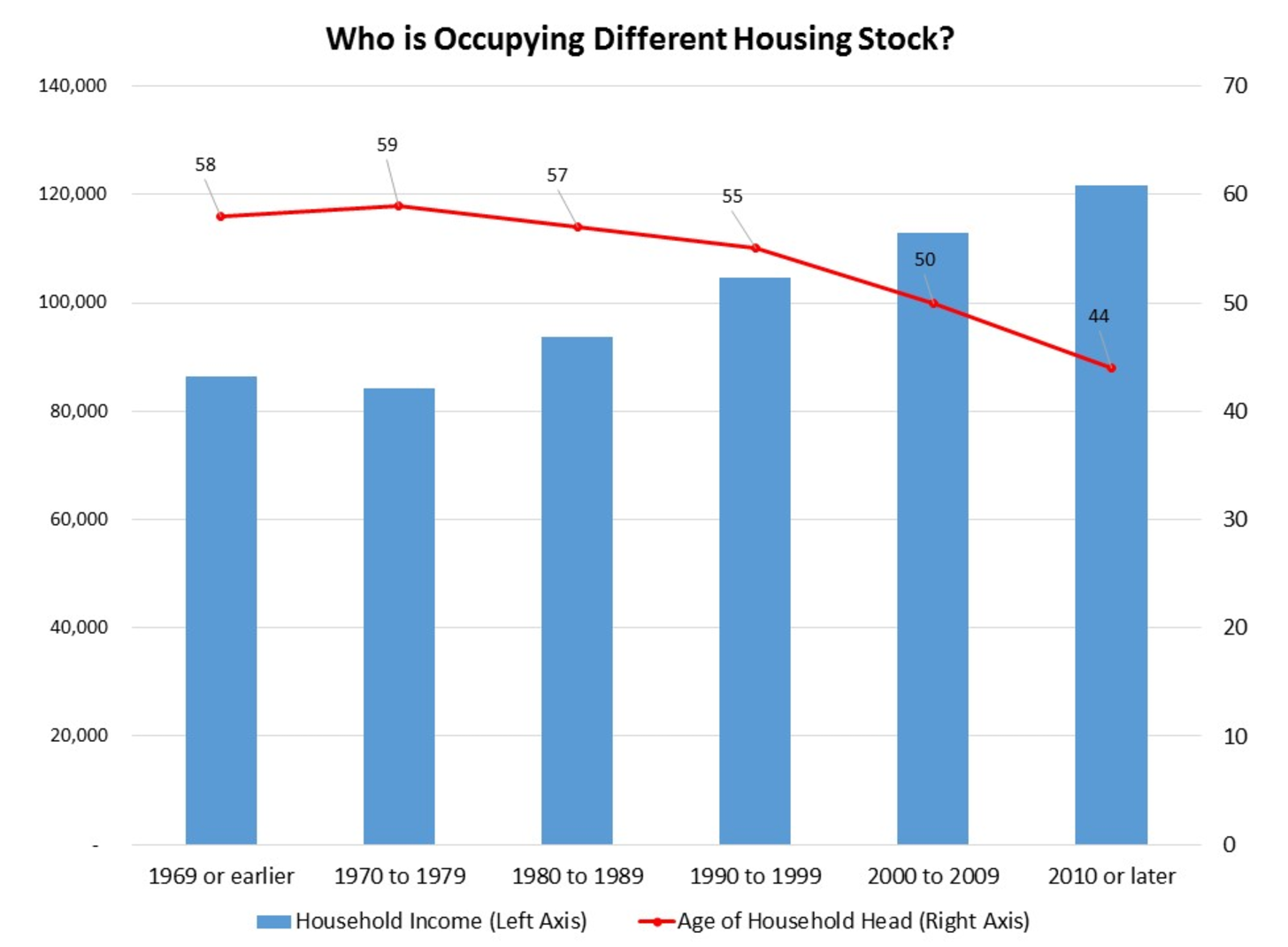

Only 3% of owner-occupied housing stock was built after 2010. And homeowners with higher family incomes tend to live in newer residential units. The average household income for owner-occupied homes built after 2010 came in at $121,577. This is up from the average income of $86,328 for those living in homes built before 1969.

And younger homeowners are also more likely to live in newer homes. Homes built after 2010 are headed by homeowners with a median age of 44 years, compared to homes built prior to 1969 which were headed by homeowners with a median age of 58.

Click to Enlarge

(Source: NAHB)

HousingWire Magazine’s June edition explains that the nation’s aging housing stock is in many cases toxic, energy inefficient and often obsolete.