Following their mandate, Fannie Mae and Freddie Mac continued to offload a number of severely aged delinquent loans and REO properties in 2016, transferring credit risk to the private sector.

According to the Federal Housing Finance Agency’s report to Congress, the government-sponsored enterprises enhanced and designed programs that provide effective loss mitigation alternatives, along with REO disposition that focused on community stabilization.

While this report is designed for Congress, the FHFA released a similar comprehensive report back in March on how Fannie Mae and Freddie Mac performed in 2016, measured against the goals laid out for them in 2014.

HousngWire coverage over the past year followed the continual non-performing loan sales between the GSEs and the winners of their sales. Most recently, Fannie Mae reduced its seriously delinquent portfolio by selling a total of $581.1 million in non-performing loans.

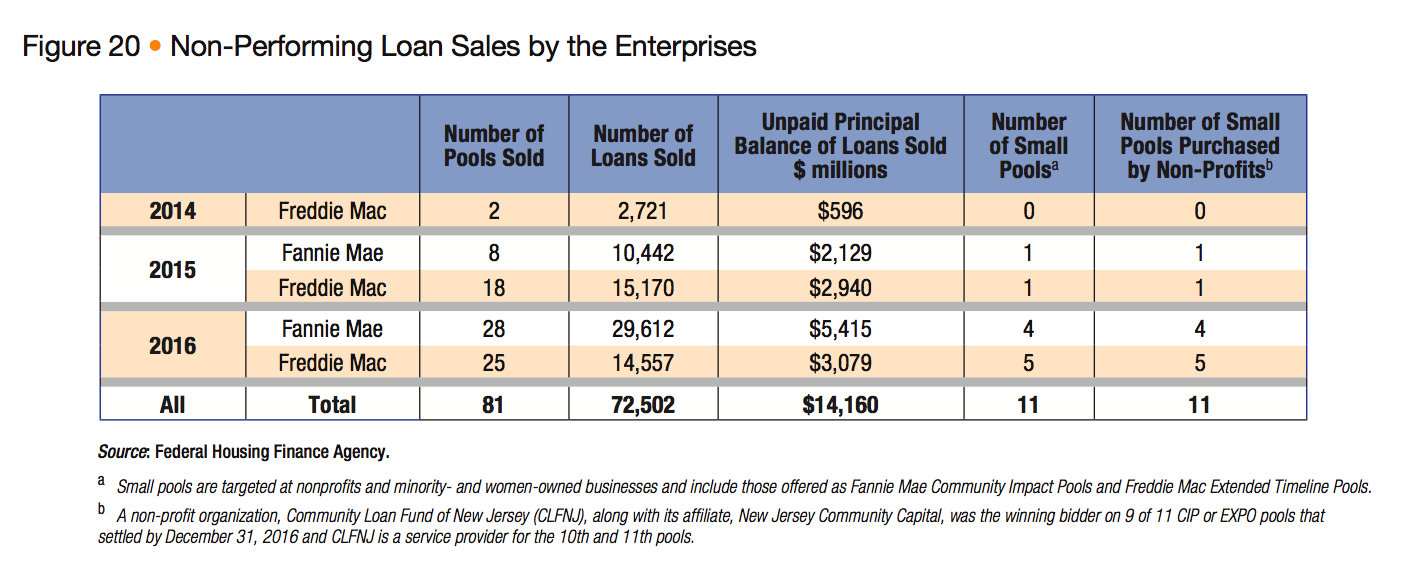

Deals, such as the one listed above, ramped up a lot in 2016, as seen in the chart below.

The chart breaks down the non-performing loan sales by the enterprises since 2014.

Click to enlarge

(Source: FHFA)

Fannie Mae and Freddie Mac reduced their combined inventories of severely aged loans by 45.2% in 2016, with a total decline of 51,663 such loans from 114,185 to 62,522.

The report added that while NPL sales mainly drove these reductions, reductions are also attributable to the utilization of special servicers; streamlined modifications; FHFA’s one-time principal reduction modification program provided in 2016; and targeted modification strategies.

Under the 2016 Scorecard, the enterprises had to provide plans for continuing NPL sales. In their plans, the GSEs addressed:

- Broad NPL sales strategy.

- Potential expansion to multi-servicer pools.

- Efforts to continue offering small pools and strengthening nonprofit access and purchase opportunities.

- Consideration for improving borrower outcomes and, where appropriate, impacts on neighborhood stabilization.

- Public reporting of loan performance post-sale.

Furthermore, the enterprises continued to reduce their inventory of REO properties by focusing their efforts on supporting owner-occupants and nonprofit purchasers. In 2016, Fannie Mae and Freddie Mae reduced their REO property inventories by 33%, with a total decline of 24,746 properties to 49,511 properties.

The GSEs also continued their efforts to strengthen existing relationships with minority-, women- and disabled-owned broker-dealers and implemented programmatic features to increase the participation of those firms when conducting NPL sales.

For example, the enterprises engaged in training and support activities with MWD-owned broker- dealers to encourage their participation in capital market transactions.