Mortgage rates fell once again this week to the lowest level in almost seven months, but remained higher than last year’s rates.

“Mixed economic data and increasing uncertainty are continuing to push rates to the lowest levels in nearly seven months,” Freddie Mac Chief Economist Sean Becketti said.

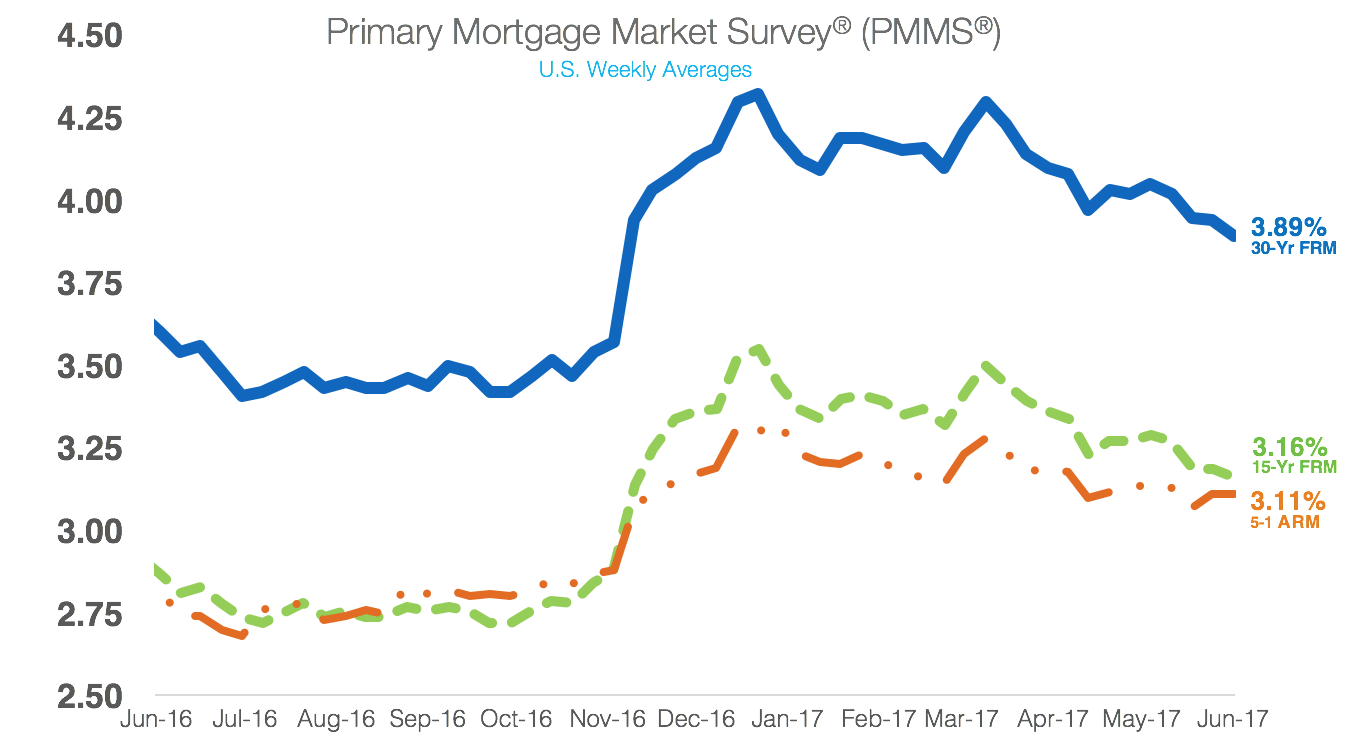

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage dropped to 3.89% for the week ending June 8, 2017. This is down from last week’s 3.94% but still up from 3.6% last year.

The 15-year FRM also decreased, falling from 3.19% last week to 3.16% this week, but it remains higher than last year’s 2.87%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage held steady at 3.11%. This is higher than last year’s 2.82%.

“The 10-year Treasury yield fell three basis points this week,” Becketti said. “The 30-year mortgage rate moved in tandem with Treasury yields, falling five basis points to 3.89%.”