Freddie Mac published an official list of approved eMortgage vendors to better streamline the mortgage process and to help encourage the use of digital mortgages.

Despite taking a long time to go digital, the industry is quickly evolving and growing to bring technology into the process.

The list of companies meets Freddie’s requirements for creating, signing and storing electronic promissory notes. Commonly called eNotes, they detail the repayment obligation of the borrower to the lender.

Freddie Mac explained that with the exception of eMortgages and the related eNotes, sellers don't need special approvals to use electronic documents as long as their procedures meet the requirements laid out in Freddie Mac's Seller/Servicer Guide.

However, Samuel Oliver, vice president of transformation management for the Single-Family Business, said the eNote is unique.

"The eNote is a critical document that needs to meet the 'transferable record' requirements of electronic transactions laws. In other words, it has to be a single, unique, unaltered, authoritative copy and there are special technology requirements that the mortgage industry has designed to comply with these requirements," he explained. "Whether sellers build, buy or license it, the system must facilitate the creation, signing, transfer and storage of the eNote to comply with these requirements. That's why we took the extraordinary step of publishing this list of approved vendors."

Check here for the list on Freddie Mac’s website.

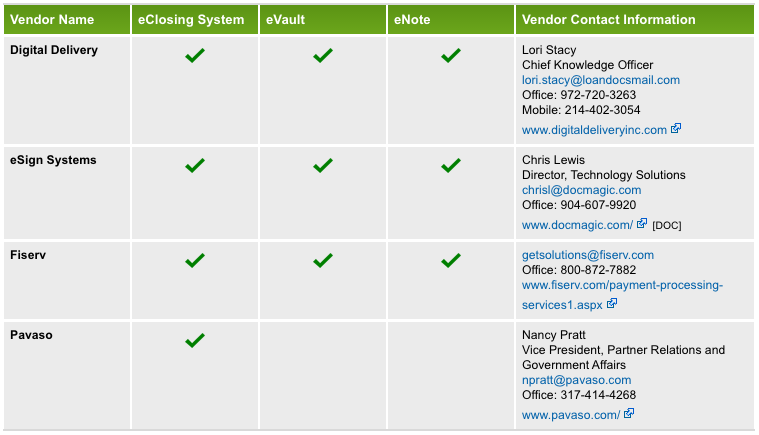

Freddie Mac noted the vendors below agreed to be included on this list. Their inclusion does not constitute an endorsement, nor does it imply a recommendation by Freddie Mac.

Click to enlarge

(source: Freddie Mac)

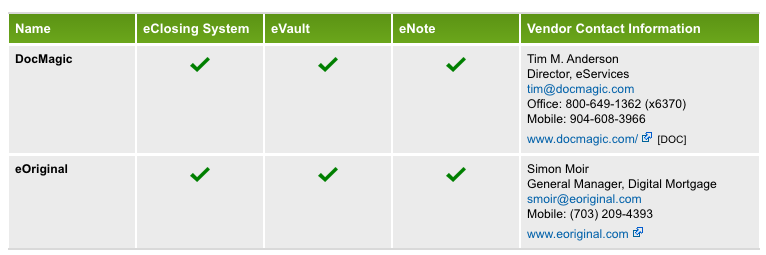

This second chart of vendors have completed the Freddie Mac “Provisional Approval” process and are/will be going through a full review process.

Click to enlarge

(source: Freddie Mac)