Freddie Mac managed to report another profitable quarter and posted net income of $2.3 billion for the third quarter of 2016, up from net income of $993 million for the second quarter of 2016.

The government-sponsored enterprise also recorded comprehensive income of $2.3 billion for the third quarter of 2016, which is more than double the $1.1 billion recorded for the second quarter of 2016.

This is significantly up from the rough start to 2016. Freddie Mac reported a $354 million net loss in the first quarter, which was drastically down from its $2.2 billion net income recorded in the fourth quarter of 2015. The news was a reminder of the government-sponsored enterprise’s net loss of $475 million for the third quarter of 2015, which marked its first loss in four years.

According to Freddie Mac, two market-related items primarily drove the improvement. However, this was partially offset by a shift to a provision for credit losses in the third quarter.

“Freddie Mac’s improving business fundamentals and competitiveness were strongly reflected in our results this quarter. Volumes were higher, credit quality is at its best in eight years, and legacy assets are continuing to decline,” said Donald Layton, CEO of Freddie Mac.

“Investments in technology are bearing fruit both for ourselves and our customers. In particular, due largely to our leadership in credit risk transfer, the new business we’re winning from single family and multifamily customers poses significantly less risk to taxpayers,” he continued.

“We’re continuing to improve affordability and access to credit for homebuyers and renters – the core of our community mission, often working with industry partners and community organizations,” Layton said. “We are also innovating to improve the operations of the mortgage markets, including giving our customers products and tools to make it easier and less expensive to make loans to working families.”

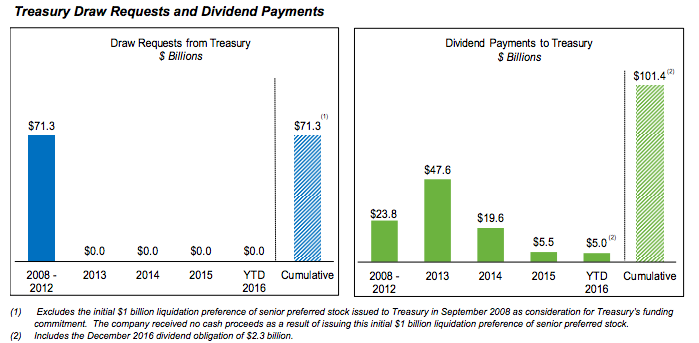

Freddie Mac’s dividend obligation to Treasury in December 2016 will be $2.3 billion, based on its net worth of $3.5 billion at Sept. 30, 2016, less the 2016 capital reserve amount of $1.2 billion.

The applicable capital reserve amount is $1.2 billion for 2016, and will be $600 million for 2017 and zero beginning on Jan. 1, 2018.

This chart shows Freddie’s Treasury draw requests and dividend payments since 2008.

Click to enlarge

(Source: Freddie Mac)