Where are we in the credit cycle? Are there more “bubbles” (bonds, subprime auto, student loans) lurking out there? How will credit markets react to the upcoming election? Has the pendulum swung too far when it comes to mortgage underwriting? Are debt preferences really changing? Is the regulatory environment too strict, not strict enough, or just what we deserve?

These were some of the questions raised and answered during the opening session and the first day at the ABS East Conference that began this week in Miami.

Steve Eisman, the angry money manager from “The Big Short”, was at this year’s conference. This time not as the angry heckler, but as the opening keynote speaker.

Eisman reminded the packed ballroom how, in his opinion, greed, leverage and porous underwriting standards led to the mortgage meltdown. The reaction to this crisis, he said, has led to a new paradigm in mortgage lending, which currently may be too restrictive in terms of underwriting and may take up to 10 years to “workout the kinks.”

While he expressed concern about the high levels of leverage in European banks, he didn’t feel that student debt and/or subprime auto loans were as potentially dangerous as the housing/mortgage bubble.

When asked whether all the new post-mortgage crisis regulations were fair, he responded (in a fashion that would have made Steve Carell proud): “Tough [expletive], you blew up the planet! Shut up and move on!”

As they say in show business, Eisman was a tough act to follow.

The show must go on

But the next morning, a group of intrepid economists (including yours truly) tried. Led by Bob Behal (Vanguard Group), our panel included Beth Ann Bovino (S&P Global Ratings), Christopher Flanagan (Bank of America Merrill Lynch), Andrew Jennings (FICO) and Michael McDonough (Bloomberg).

We were charged with taking a broad look at a wide spectrum of credit markets and trying to predict how they’d react to interest rate hikes, the upcoming election, demographic trends and potential credit problems.

Here are some of the macro highlights:

- Interest rates: The consensus seemed to be that the Federal Reserve could raise interest rates (though probably not until December) without significantly disrupting the markets. However, if it appeared that the Fed would tighten more aggressively, watch out.

- Global headwinds: Flanagan didn’t see a bond bubble. Instead, he pointed to permanent, long-term changes in the global economy, including the aging global population which could be a drag on economic growth. He noted that by 2050, 37% of Japan’s population will be 65-plus (by contrast only 21% of the U.S. population will be that age by then.)

- Warning lights: While the subprime auto market looks benign at the macro level, when you drill down by credit score and product selection, a different picture emerged, said Jennings. Weaker credits are adversely selecting longer duration products and are defaulting at high rates.

- “The kids” are ok: Are Millennials really that different? Or do they just seem that way to the older generation? Bovino noted that 50-plus years ago, the musical “Bye Bye Birdie” asked: “What’s the matter with kids today?” From a mortgage perspective, Millennials have come of age at a very challenging period. The most educated cohort of all time has been challenged in good paying jobs (on average it has taken them four years longer to reach the median wage level than their predecessors, Jennings noted) and the Great Recession has set them back as well. In 2005, 5% of 18-24 year olds had a mortgage. By 2015 that number had fallen 60% to 2.1%.

- The election ‘trade’: McDonough shared the results of the latest University of Michigan poll that predicted who would be the winner of the next election (spoiler alert: it was Hillary Clinton.) None of the panelists predicted a violent economic reaction, a la Brexit, if the survey was wrong. According to McDonough, the logical financial play in the event of a Trump win, would be to short the “peso,” but so far, at least, this isn’t a crowd trade on the futures market.

Top 10 lists

As the group’s housing economist, it fell to me to tackle the questions: How tight is underwriting? And what’s happening within the origination market?

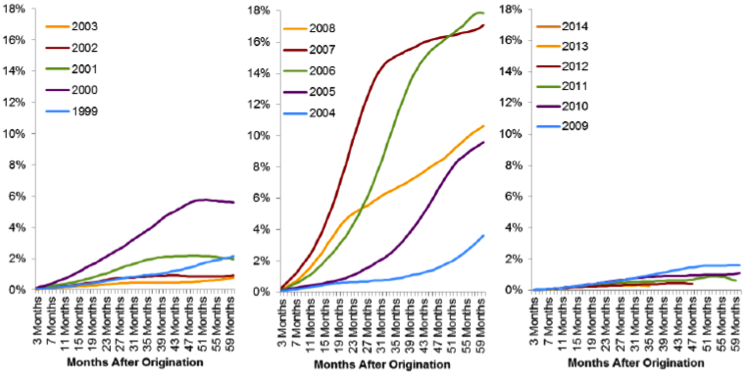

To answer the first question, we went back and looked at default rates (defined as 90-or-more days late or in foreclosure proceedings) for seasoned loans of various vintages.

At their five-year point, loans originated post-2009 currently have exceptionally low defaults. Defaults are even lower than 15 years ago, before underwriting standards loosened during the housing boom—underwriting is tighter now.

Serious delinquency rate by origination cohort

Click to enlarge

(Source: CoreLogic True Standings; the serious delinquency rate is the percent of loans outstanding that are 90-or-more days delinquent or in foreclosure proceedings.)

My fellow panelist, Jennings, agreed: “Mortgage quality doesn’t get any better than it is now.”

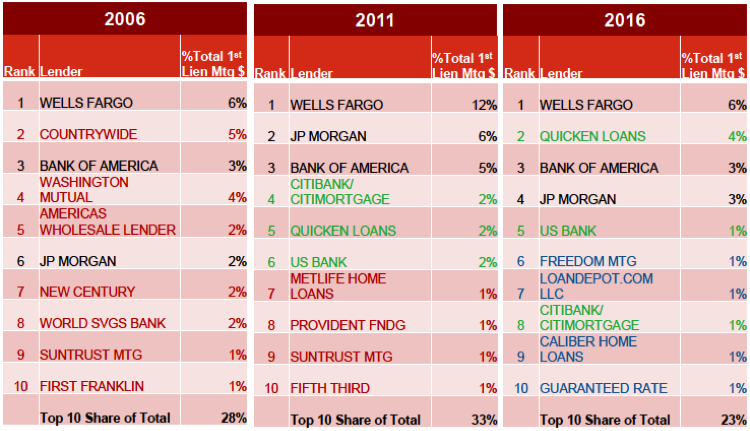

Another observation that I shared with the audience: it’s hard to stay on top, at least when it comes to mortgage origination.

Over the past 10 years, the makeup and the market share concentration of the top 10 lenders has been a moving target. Looking at the top 10 circa 2006, 2011 and 2016, only three companies have been in all three lists: Wells Fargo, JPMorgan and Bank of America. Some of the companies were casualties of the mortgage meltdown.

And the market share concentration of the top 10 has fluctuated, peaking in 2011 at 33% and now dipping to 23%. And in the everything-old-is-new-again spirit, non-banks originators are back and taking share. Currently, they make up 5 of the top 10.

Top 10 Lender Share

Click to enlarge

(Source: CoreLogic Marketrac as of August 2016)