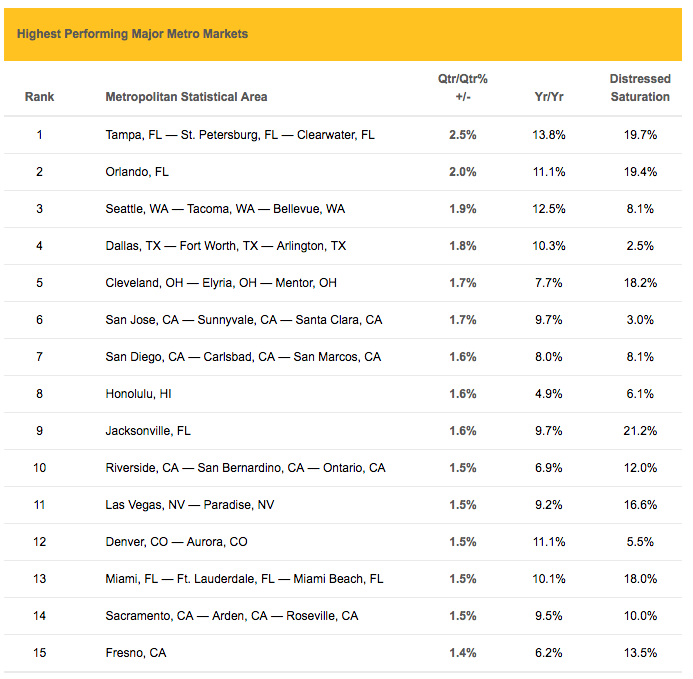

While home prices only increased a meager 1.3% in the first quarter of 2016, it’s added onto a long string of increases; 19 consecutive quarterly price increases to be exact.

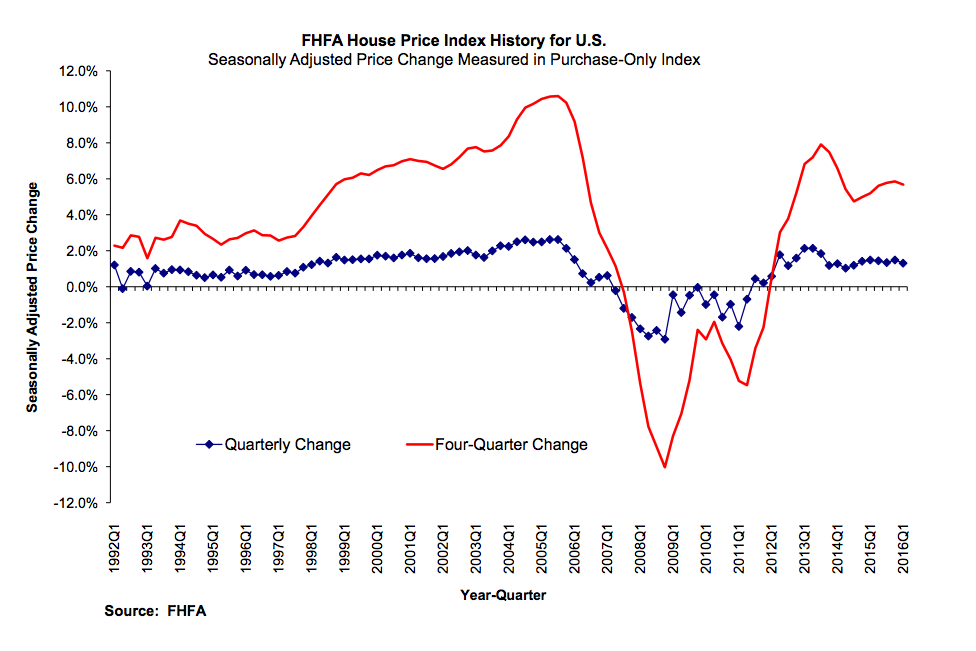

According to the Federal Housing Finance Agency House Price Index, this chart shows the seasonally adjusted and unadjusted monthly appreciation rates.

Click to enlarge

(Source: FHFA)

From first quarter 2015 to first quarter 2016, house prices rose 5.7%, marking the fourth consecutive year in which prices grew more than 5%.

The FHFA added that its seasonally adjusted monthly index for March was up 0.7% from February.

This chart shows the FHFA’s house price index history for the U.S.

Click to enlarge

(Source: FHFA)

"While the overall appreciation rate was robust in the first quarter, home price appreciation was somewhat less widespread than in recent quarters," said FHFA Supervisory Economist Andrew Leventis.

"Twelve states and the District of Columbia saw price declines in the quarter—the most areas to see price depreciation since the fourth quarter of 2013. Although most declines were modest, such declines are notable given the pervasive and extraordinary appreciation we have been observing for many years,” added Leventis.

The FHFA said the HPI is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac.