It doesn’t look like peak home-buying season judging by the latest appraisal volume numbers from a la mode, an appraisal forms software company that tracks appraisal volume throughout the country and provides its findings exclusively to HousingWire.

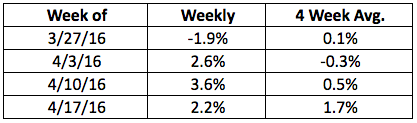

For week of April 17, the National Appraisal Volume Index grew 2.2%, down from a 3.6% rate last week.

As a result, the four-week average rose to a modest 1.7% from 0.5%, finally offsetting the significant drop at the end of March.

Click the chart for a break down of appraisal volume over the past four weeks.

Click chart to enlarge

(Source: a la mode)

“While mortgage rates are very low, it appears that the tight credit, low inventory and high home prices have stifled any momentum this spring,” said Kevin Golden, director of analytics with a la mode.

“There doesn’t seem to be anything on the horizon to change the modest growth,” said Golden. “It’s hard to tell what will happen, but the confusion seems to make for slow growth overall.”

Appraisal volume is an indicator of market strength and has some advantages over mortgage applications. Fallout is less for appraisals since they are ordered later in the mortgage process after credit worthiness is determined and there are few multiple-orders.

a la mode captures 50% of the appraiser market – more than 6 million appraisals per year since the fourth quarter of 2006.