National Association of Home Builders’ CEO Jerry Howard tells Bloomberg’s Vonnie Quinn, that the high end and low end markets are facing a variety of situations negatively affecting homebuyers, according to USA Today.

“At the higher end of the market, Vonnie, you’re seeing a situation where those buyers are concerned about the overall health of stock market, and their investments in general,” said Howard.

“At the low end of the market, household formations that are just coming into play post recession, are forcing a lot of people into the rental market,” added Howard.

In Trulia’s recent report, it states that America is experiencing a housing shortage.

This little tidbit lead one Gawker author to call homebuilders 'a-holes' (caution: NSFW language).

But there's more to it, as it turns out.

Not only are there fewer homes available to buyers of all income levels, those just starting out or making their first foray into home ownership are worse off than they’ve been in years. There are fewer homes available, an even if they can find a home, it’s likely to be more expensive.

Tight inventory and low affordability are still major obstacles first time homebuyers are facing this spring homebuying season, according to a recent report from online real estate site, Trulia.

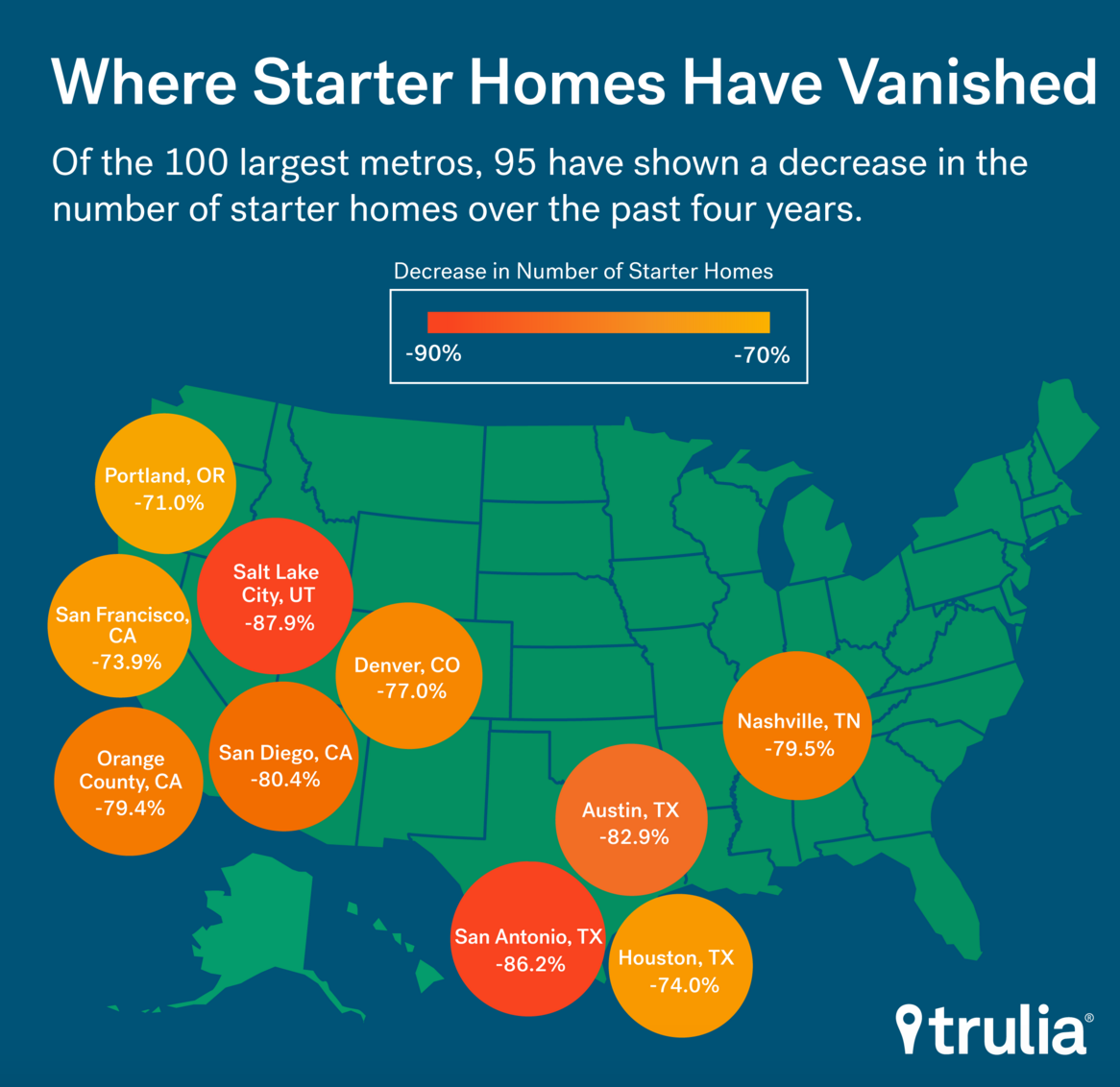

The report states that across the 100 largest metros, 95 have shown a decrease in the number of starter homes over the past four years. Of the 10 metros that have seen the largest drop, all are in the West and South. The number of starter homes in Salt Lake City has dropped the most, from 1,243 to just 151 – an 88% drop in four years.

Click to enlarge

(Source: Trulia)

"If inventory continues to shrink throughout the spring house hunting season, buyers will likely be faced with more bidding wars and offers above the seller's asking price,” said Ralph McLaughlin, Trulia’s chief economist and the author of the study.

“Meanwhile, sellers will be better positioned to sell their homes than in years past, but may have difficulty finding another home to buy," McLaughlin added.

According to USA Today:

In January, there was a four-month supply of existing homes for sale in the USA, well below a healthy six-month inventory, according to the National Association of Realtors. That drove up the median home price by 8.2% the past year, the biggest jump since last April.

The shortage is also helping constrain existing home sales, which totaled 5.25 million in 2015, below the 5.75 million considered normal in light of population growth, says Lawrence Yun, the Realtor group’s chief economist.

Yun says the main reason for the skimpy supply is sluggish single-family housing starts, which hit an eight-year high of 715,000 last year but remained well below a normal 1.2 million.

McLaughlin disagrees, noting that new home sales represent less than 10% of all housing sales.

Starter home affordability dropped in California after the demand of starter homes increased due to a “strong job growth.”

According to the study, faced with growing demand and tight supply, prices of all homes in California have risen sharply over the past few years. And as prices rise, homebuyers tend to follow the principles of supply and demand.

The latest existing-home sales report confirms how barren the market is as almost every sector of housing continues to suffer from the impact of barely any inventory.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, tumbled 7.1% to a seasonally adjusted annual rate of 5.08 million in February from 5.47 million in January. Despite last month's large decline, sales are still 2.2% higher than a year ago, the National Association of Realtors report stated.